United States Pet Training Services Market Size, Share, and COVID-19 Impact Analysis, By Pet Type (Dogs, Cats, Horses, Others), By Purpose (Standard, Specific, Service), By Training Method (Virtual, Offline), and US Pet Training Services Market Insights Forecasts to 2032

Industry: Consumer GoodsUnited States Pet Training Services Market Insights Forecasts to 2032

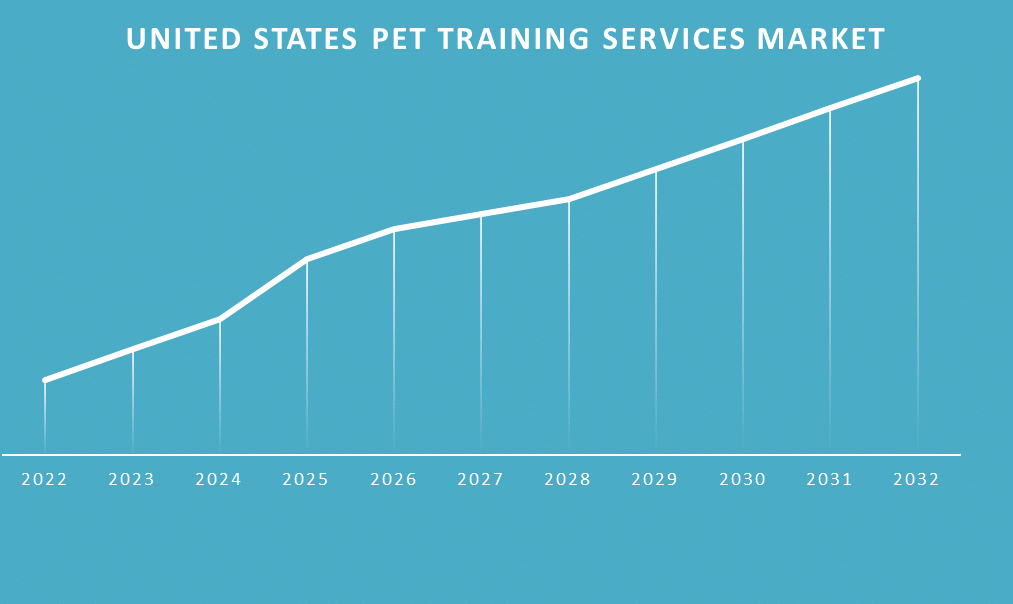

- The Market Size is Growing at a CAGR of 5.9% from 2022 to 2032.

- The United States Pet Training Services Market Size is Expected to Hold a Significant Share by 2032.

Get more details on this report -

The United States Pet Training Services Market Size is Expected to Hold a Significant Share by 2032, at a CAGR of 5.9% during the forecast period 2022 to 2032.

Market Overview

The specialized services provided to pets in order to teach them to behave in a specific manner in response to a given situation or stimuli. Training pet animals boosts their confidence, creates a stronger bond between pets and pet parents, reduces unwanted behavior in pets, increases pet sociability, and increases pet safety. Furthermore, training pets makes them functional, allowing them to perform a variety of tasks such as assisting the elderly and physically challenged people in mobility, detecting drugs, tracking bombs, and performing security tasks. These advantages are the primary reasons that pet owners in United States are increasing their demand for pet training services. The rising popularity of United States pet training service providers among pet owners is expected to drive the growth of the U.S. pet training services industry during the forecast period.

Report Coverage

This research report categorizes the market for the United States pet training services market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States pet training services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States pet training services market.

United States Pet Training Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.9% |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Pet Type, By Purpose, By Training Methods |

| Companies covered:: | PetSmart, Wag Labs, CAMP BOW WOW, Petco, Best Friends, Dog Gone Fun, Noble Beast Pet Services, Starmark Academy, Bark Buster, National K-9 Learning Center, K9 GTA, olice Services Dogs, Dog Trainer College, US K9 Academy, Precision Horse Training, and Other Key Vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The number of nuclear families is rapidly increasing owing to rapid urbanization. Other factors such as rising employment, increased female labor-force participation, rising disposable income, and increased awareness of the health benefits of owning companion pets are all driving the United States pet adoption rate. With the increasing adoption of pets comes the trend of pet humanization, which is expected to boost the United States pet training services market growth in the over the forecast period.

Restraining Factors

The growing awareness and adoption of electronic pet training products among pet owners may limit demand for pet training services in United States. Furthermore, numerous videos on pet training methods are available for free on various digital platforms, which may reduce demand for expensive pet training products which is reducing the United States pet training services market growth during the forecast period.

Market Segment

- In 2022, the dog segment is expected to hold the largest share of the United States pet training services market during the forecast period.

Based on the pet type, the United States pet training services market is classified into dogs, cats, horses, and others. Among these, the dog segment is expected to hold the largest share of the United States pet training services market during the forecast period. Dogs are trained to perform a wide range of tasks, including guarding, drug and explosive detection, search and rescue, and assisting the disabled. Training boosts confidence, provides mental stimulation, and fosters a strong bond between humans and dogs. The growing popularity of dogs as pets, as well as the growing desire among dog owners to train their pets for various functional benefits, has resulted in significant growth of the dogs’ segment in the United States pet training services market during the forecast period.

- In 2022, specific segment accounted for the largest revenue share over the forecast period.

Based on the purpose, the United States pet training services market is segmented into standard, specific, and service. Among these, the specific segment has the largest revenue share over the forecast period. The segment is expanding as a result of the increased deployment of dogs within special forces to streamline some specific tasks for personnel. There are various dogs dressed in army and military wigs. Sniffer dogs, for example, are trained by special forces to detect and locate drugs and other illegal substances.

- In 2022, the offline segment accounted for the largest revenue share over the forecast period.

Based on the training method, the United States pet training services market is segmented into virtual and offline. Among these, the offline segment has the largest revenue share over the forecast period. The ease of operation provided by the offline training approach has contributed to the segmental growth over the forecast period. Offline training allows the trainer to use more gestures with the pet, resulting in more effective training. Furthermore, it is one of the most traditional methods of training animals, which has kept it in use for a long time.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States pet training services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PetSmart

- Wag Labs

- CAMP BOW WOW

- Petco

- Best Friends

- Dog Gone Fun

- Noble Beast Pet Services

- Starmark Academy

- Bark Buster

- National K-9 Learning Center

- K9 GTA

- olice Services Dogs

- Dog Trainer College

- US K9 Academy

- Precision Horse Training

- Sit n’ Stay

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2022, Wag! Neighborhood Network was launched by Wag Labs. With a few taps, pet parents can book any pet caregiver directly.

- In February 2022, Petco Health and Wellness Company Inc. has partnered with Rover (an online industry marketplace for pet services) to provide pet boarding, sitting, and dog walking services to Petco customers.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the United States pet training services market based on the below-mentioned segments:

United States Pet Training Services Market, By Pet Type

- Dogs

- Cats

- Horses

- Others

United States Pet Training Services Market, By Purpose

- Standard

- Specific

- Service

United States Pet Training Services Market, By Training method

- Virtual

- Offline

Need help to buy this report?