United States Perfume Market Size, Share, and COVID-19 Impact Analysis, By Product (Mass and Premium), By End-user (Men, Women, and unisex), and United States Perfume Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Perfume Market Insights Forecasts to 2035

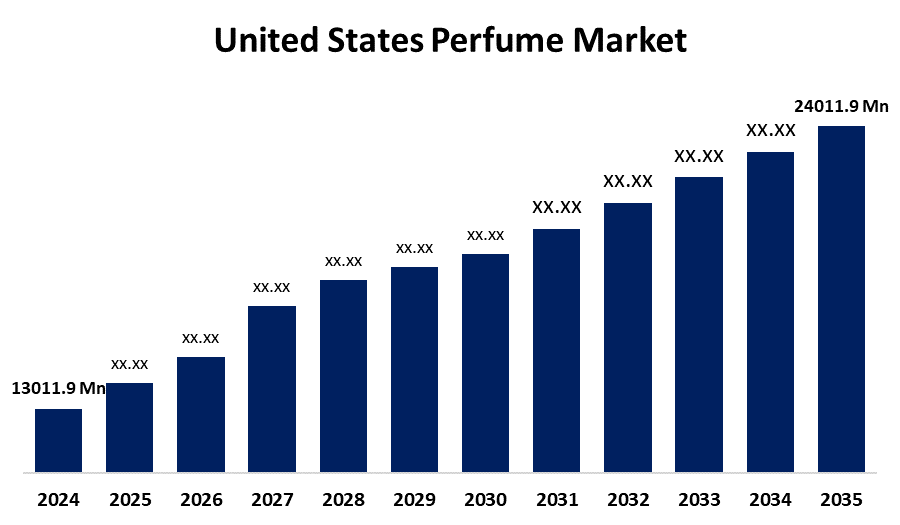

- The US Perfume Market Size Was Estimated at USD 13011.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.73% from 2025 to 2035

- The US Perfume Market Size is Expected to Reach USD 24011.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Perfume Market Size is anticipated to reach USD 24011.9 Million by 2035, growing at a CAGR of 5.73% from 2025 to 2035. The expansion of the United States' perfume market is propelled by the rising demand for expensive and exotic scents, as well as the expanding trend of personal grooming.

Market Overview

A perfume is a scented liquid containing a mixture of essential oils, aroma components, and solvents designed for body, item, or living area scent to be pleasing and complex. Perfume evolved from natural aromatic materials that were burned for their scent. In contemporary times, fragrances are manufactured by carefully blending natural and synthetic chemicals to create a scent that is balanced and long-lasting. Fragrances are typically layered, using top, middle, and base notes that are deliberately designed to develop over time to create a complex scent. Perfume is often a manifestation of someone’s preferences and style, making it a tool of self-expression, sometimes even emotional and memory-related. Perfume comes in unique bottles that are collectible items and also combines art, chemistry, and a person's sense of self to create a sensory experience. The idea of self-expression and being well-groomed is encouraging growth for the U.S. perfume industry. Customers are becoming more and more interested in being unique, even as they anticipate finding a large variety of perfumes in stores. Along with this, the ever-increasing disposable income of the US consumers supports the growth of the perfume industry. When consumers' disposable income rises, they are more willing to pay for premium and luxury fragrances. As consumers spend more on luxury and premium perfumes, the market is now introducing a variety of niche and luxury fragrances to appeal to those market segments that desire a little more uniqueness and quality.

Report Coverage

This research report categorizes the market for the United States perfume market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States perfume market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States perfume market.

United States Perfume Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13011.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.73% |

| 2035 Value Projection: | USD 24011.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 159 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product and By End-user |

| Companies covered:: | Revlon, The Estee Lauder Companies Inc. Class A, Coty Inc Class A, The Avon Company, CHANEL, LVMH Moet Hennessy-Louis Vuitton, Puig, L’Oreal Groupe, Shiseido Company Ltd., Givaudan, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States' perfume market is boosted by the consumers' higher expectations level of their health. Customers who are more aware of the unfavourable impacts of possibly dangerous synthetic compounds are more likely to be drawn to goods they believe to be safe and healthy. Natural perfumes are made with plant-sourced essential oils and plant extract fragrances, which are less likely to have certain allergic reactions and health issues than those synthetic fragrances. The concept has engaged consumers to gravitate towards the opportunity of owning natural personal care products like perfumes and fragrances. Through focused branding and marketing, the perfume industry has taken the natural trend and run with it. Natural fragrances are presented as consistent with general lifestyle trends of luxury, purity, and well-being in marketing.

Restraining Factors

The United States perfume market faces obstacles, like if products are reformulated, costs may increase if sensitivities are removed, or hypoallergenic alternatives are included. Perhaps the safe alternatives may be more expensive or less effective at creating the marketed scent profile.

Market Segmentation

The United States perfume market share is classified into product and end-user.

- The premium segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States perfume market is segmented by product into mass and premium. Among these, the premium segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven as its increase has been leisurely slower than the increase in mainstream scent products due to a more intense focus on exclusivity, quality, and personalisation. This is only furthered by manufacturers, who are also looking to add steering towards luxury products.

- The women segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-user, the United States perfume market is segmented into men, women, and unisex. Among these, the women segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled, as in contrast to males, who tend to purchase new scents just once or twice a year, women in the US may purchase them every month, and 41% of women wear perfume daily, according to a study. Women are also expected to purchase more fragrances, regardless of the expense, when fragrances form a legitimate part of their necessary hygiene requirements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States perfume market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Revlon

- The Estee Lauder Companies Inc. Class A

- Coty Inc Class A

- The Avon Company

- CHANEL

- LVMH Moet Hennessy Louis Vuitton

- Puig

- L'Oreal Groupe

- Shiseido Company Ltd.

- Givaudan

- Others

Recent Development

- In September 2022, The Estee Lauder Companies Inc. launched luxury scent collections, including eight fragrances. The launch will help the company to rival designer scents, which exist in the market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States perfume market based on the following segments:

United States Perfume Market, By Product

- Mass

- Premium

United States Perfume Market, By End-user

- Men

- Women

- unisex

Need help to buy this report?