United States Peptide Therapeutics Market Size, Share, and COVID-19 Impact Analysis, By Type (Branded, Generic), By Application (Metabolic & Endocrine, Cancer, Cardiovascular, Gastrointestinal), By Route of Administration (Parenteral, Oral), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies), By Synthesis Technology (Liquid-Phase Peptide Synthesis, Solid-Phase Peptide Synthesis, Hybrid Technology), and United States Peptide Therapeutics Market Insights Forecasts to 2033

Industry: HealthcareUnited States Peptide Therapeutics Market Insights Forecasts to 2033

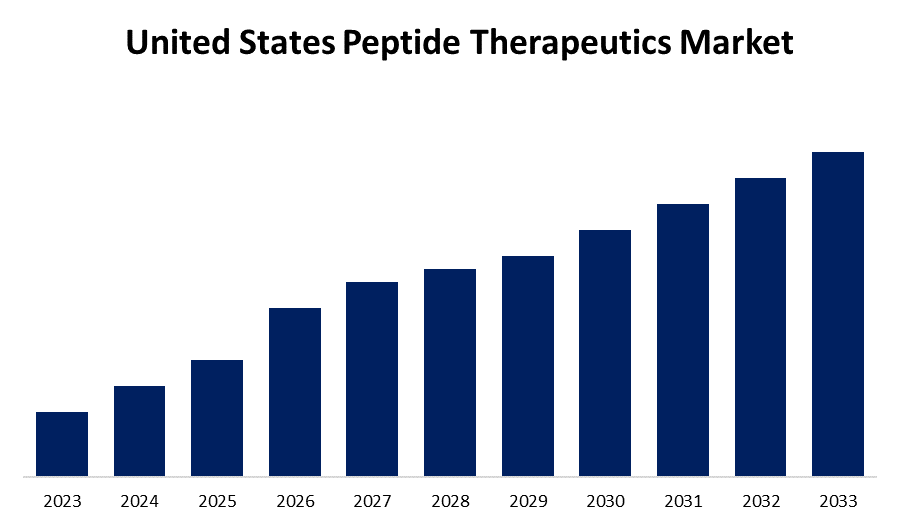

- The Market Size is Growing at a CAGR of 6.9% from 2023 to 2033.

- The United States Peptide Therapeutics Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The United States Peptide Therapeutics Market Size is Expected to Hold a Significant Share by 2033, at a CAGR of 6.9% during the forecast period 2023 to 2033.

Market Overview

Peptide therapeutics are increasingly being used to treat cancer, metabolic disorders, and hormone therapy. The industry is expected to grow further as peptide applications for diabetes, obesity, osteoarthritis, and osteoporosis become more prevalent. The development of sophisticated drug delivery methods, as well as an increase in funding in this sector, are expected to have a disruptive impact on the field of peptide-based medicine. The development of oral peptide therapeutics, which have several advantages over injectable peptide drugs, including improved patient convenience and compliance, a lower risk of infection and other injection-related complications, and the ability to reach a broader range of patients, is expected to provide lucrative market expansion opportunities. Furthermore, the development of cyclized peptides, which are more commonly produced due to their improved conformational stability, is expected to expand the market over the forecast period. The growing prevalence of chronic diseases, an increase in the geriatric patient population, and increased investments in the research and development sector by many key players and government organizations are expected to drive the United States peptide therapeutics market growth over the forecast period. Rapid technological advancements in improving automation and purity, as well as increased awareness of the growing use of peptides in the treatment of various diseases, are expected to boost the peptide therapeutics market during the forecast period.

Report Coverage

This research report categorizes the market for United States peptide therapeutics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States peptide therapeutics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States peptide therapeutics market.

United States Peptide Therapeutics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.9% |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, By Route of Administration, By Distribution Channel, By Synthesis Technology and COVID-19 Impact Analysis. |

| Companies covered:: | Pfizer, Inc., Amgen, Inc., Eli Lilly and Company, Sanofi, AstraZeneca plc, AbbVie, GlaxoSmithKline plc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing prevalence of acute and chronic diseases, along with the rising access to medical facilities, represents one of the leading factors positively influencing the demand for peptides to develop innovative therapies. Moreover, peptide therapies are used in cosmeceutical surgeries to slow down the process of skin aging. This, coupled with the increasing consciousness among individuals about physical appearance and the desire to retain young and healthy skin, is driving the adoption of cosmetic surgeries and peptide therapeutics in the United States. Additionally, with the introduction of novel synthetic strategies that reduce injection frequency and improve stability and other physical properties, peptide therapeutics are widely being used in injections for diabetic patients. This, in confluence with the increasing incidence of diabetes and the growing preference for quick and precise treatment methods, is influencing the use of peptide therapeutics over oral medications. Furthermore, the emerging trend of personalized and targeted treatments is catalyzing the demand for multifunctional peptide-based materials. This, along with the rising funding to develop novel peptide therapeutics for treating autoimmune and inflammatory diseases, is driving the United States peptide therapeutics market growth.

Restraining Factors

Obtaining regulatory approval for new peptide therapeutics requires rigorous testing and evaluation processes. These regulatory hurdles can significantly delay the introduction of new drugs, raising development costs and limiting the market entry of innovative treatments. Adhering to these regulations and obtaining the necessary approvals can be time-consuming and expensive, hampering market growth during the forecast period.

Market Segment

- In 2023, the branded segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States peptide therapeutics market is segmented into branded and generic. Among these, the branded segment has the largest revenue share over the forecast period. There are several factors that contribute to the segment's dominance, including a higher number of prescriptions for branded drugs, the perceived quality and efficacy of branded peptide therapeutics in comparison to generics, patient preferences for branded products, and insurance coverage.

- In 2023, the metabolic & endocrine segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States peptide therapeutics market is segmented into metabolic & endocrine, cancer, cardiovascular, and gastrointestinal. Among these, the metabolic & endocrine segment has the largest revenue share over the forecast period. Diabetes, obesity, and lipid metabolism disorders all contribute to a significant disease burden. The market's expansion is primarily driven by the increasing prevalence of these conditions. In the United States, the obesity epidemic has fueled efforts to develop effective treatments for obesity-related metabolic disorders. Peptide therapeutics aimed at appetite control and weight management are being developed to address this growing health issue.

- In 2023, the hospital pharmacies segment accounted for the largest revenue share over the forecast period.

Based on the distribution channel, the United States peptide therapeutics market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, the hospital pharmacies segment has the largest revenue share over the forecast period. Hospital pharmacies usually keep a well-stocked supply of essential medications, including peptide drugs. This immediate availability is critical in a hospital setting, where timely medication administration is frequently required for patient care. Hospital pharmacies work closely with physicians, including specialized care teams, to optimize the use of peptide treatment options and provide guidance on dosage, administration, and monitoring.

- In 2023, the liquid-phase peptide synthesis segment accounted for the largest revenue share over the forecast period.

Based on the synthesis technology, the United States peptide therapeutics market is segmented into liquid-phase peptide synthesis, solid-phase peptide synthesis, and hybrid technology. Among these, the liquid-phase peptide synthesis segment has the largest revenue share over the forecast period. Automation has greatly improved the efficiency, precision, and repeatability of liquid-phase peptide synthesis (LPPS). Automated peptide synthesizers are becoming more sophisticated, allowing for high-volume peptide production in research, development, and commercial manufacturing. Furthermore, downsizing LPPS processes reduces the use of reagents and solvents, making the process more environmentally friendly and cost-effective.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States peptide therapeutics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer, Inc.

- Amgen, Inc.

- Eli Lilly and Company

- Sanofi

- AstraZeneca plc

- AbbVie

- GlaxoSmithKline plc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2023, Eli Lilly acquired Dice Therapeutics to expand its treatment portfolio for immune-related diseases, which includes peptide production. This acquisition will help to expand the peptide and polypeptide therapeutics portfolio.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States peptide therapeutics market based on the below-mentioned segments:

United States Peptide Therapeutics Market, By Type

- Branded

- Generic

United States Peptide Therapeutics Market, By Application

- Metabolic

- Cancer

- Cardiovascular

- Gastrointestinal

United States Peptide Therapeutics Market, By Distribution Channel

- Hospital

- Retail

- Online Pharmacies

United States Peptide Therapeutics Market, By Synthesis Technology

- Liquid-Phase Peptide Synthesis

- Solid-Phase Peptide Synthesis

- Hybrid Technology

Need help to buy this report?