United States Pea Protein Market Size, Share, and COVID-19 Impact Analysis, By Source (Yellow Split Peas and Others), By Product (Textured, Hydrolysates, Isolates, and Concentrates), By Form (Wet and Dry), By Application (Personal Care & Cosmetics, Food & Beverages, Animal Feed, and Others), and US Pea Protein Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUSA Pea Protein Market Insights Forecasts to 2035

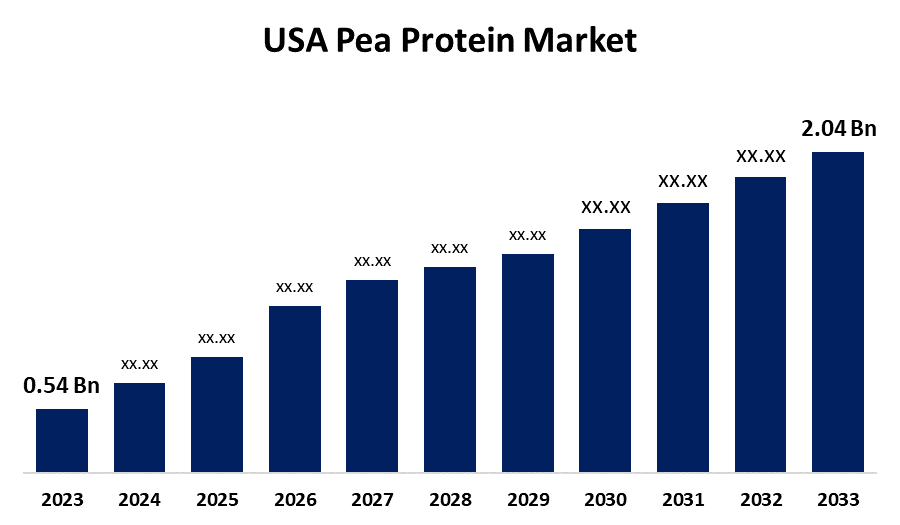

- The US Pea Protein Market Size was Estimated at USD 0.54 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.84% from 2025 to 2035

- The USA Pea Protein Market Size is Expected to reach USD 2.04 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Pea Protein Market Size is anticipated to reach USD 2.04 Billion by 2035, Growing at a CAGR of 12.84% from 2025 to 2035. The rising need for nutritional supplements made from pea protein, an upsurge in the demand for pea protein in the food and beverages sectors, and growing awareness of its health benefits.

Market Overview

The production, distribution, and use of pea protein, a plant-based protein made from yellow peas, are the main focuses of the expanding US pea protein market, which is being driven by the growing demand for plant-based nutrition, sustainability, and vegan and vegetarian diets. Peas' economic viability has led to their widespread use as a source of fiber, protein, and carbohydrates. Pea proteins, which are derived from 20% to 30% of pea seeds, provide high-quality, nutritious protein that has health benefits because of their high nutritional content, high yield, lower allergenicity, and improved digestion. The market is driven by busy lifestyles and growing consumer awareness of the importance of eating a healthy diet. Pea protein offers a plant-based substitute that satisfies sustainability and health concerns. Veganism is becoming a popular lifestyle choice for environmental, health, and ethical reasons. Online shopping and additional shelf space in physical stores are making pea protein products more widely available. Additionally, it is becoming more popular in a number of culinary categories, such as baked products, beverages, plant-based meat substitutes, and nutritional supplements. Pea protein's market position is strengthened by its possible therapeutic uses in the treatment of illnesses like diabetes, heart disease, and kidney disorders.

Report Coverage

This research report categorizes the market for the US pea protein market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US pea protein market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US pea protein market.

United States Pea Protein Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 0.54 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 12.84% |

| 2035 Value Projection: | USD 2.04 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Source, By Product, By Form, and COVID-19 Impact Analysis |

| Companies covered:: | Ingredion, Burcon NutraScience Corporation, Sotexpro, Burcon NutraScience Corporation, DuPont, The Scoular Company, Axiom Foods, Inc., PURIS, Emsland Group, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The movement towards plant-based diets is motivated by ethical considerations, health advantages from consuming less meat, and environmental concerns, which accelerates the growth of the market. People are choosing plant-based proteins like pea protein because of research that links eating a lot of meat to chronic illnesses. People with dietary restrictions or those looking to increase their nutritional intake might benefit from pea protein's great nutritional profile and lack of typical allergies. The demand for premium protein sources has surged as a result of the wellness community's emphasis on protein as a macronutrient. Using less water, land, and energy, pea protein has a smaller environmental impact than proteins generated from animals. As consumers become more conscious of the effects on the environment, businesses are finding sustainable ingredients to satisfy consumer demand and corporate sustainability goals, which is propelling market expansion.

Restraining Factors

Price sensitivity, taste and texture issues, supply chain limitations, competition from other plant proteins, including soy, rice, and hemp protein, and labeling and regulatory concerns may hinder the growth of the market.

Market Segmentation

The USA pea protein market share is classified into source, product, form, and application.

- The yellow split peas segment held the largest share of 73.11% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US pea protein market is segmented by source into others and yellow split peas. Among these, the yellow split peas segment held the largest share of 73.11% in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the major source of the pea proteins, a rich source of fibers and essential nutrients, which maintains cardiac health, versatility, and improves overall health.

- The isolates segment accounted for the largest market share of 47.82% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US pea protein market is segmented by product into textured, hydrolysates, isolates, and concentrates. Among these, the isolates segment accounted for the largest market share of 47.82% in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by a good source of fiber, which improves overall health, reduces inflammation, and minimizes the risk of cancer.

- The dry segment accounted for the largest share of 66.15% in 2024 and is predicted to grow at a significant CAGR during the forecast period.

The US pea protein market is segmented by form into wet and dry. Among these, the dry segment accounted for the largest share of 66.15% in 2024 and is predicted to grow at a significant CAGR during the forecast period. This is owing to the dry milling and air classification methods of producing pea protein that minimize water and electricity use while maintaining the natural functionality of the protein components.

- The food & beverages segment accounted for the largest share of 37.49% in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US pea protein market is segmented by application into personal care & cosmetics, food & beverages, animal feed, and others. Among these, the food & beverages segment accounted for the largest share of 37.49% in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is attributed to the growing awareness of a healthy lifestyle, the growing need for nutritional supplements, the growing demand for pea proteins from vegetarian people, and their use in various dairy products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US pea protein market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ingredion

- Burcon NutraScience Corporation

- Sotexpro

- Burcon NutraScience Corporation

- DuPont

- The Scoular Company

- Axiom Foods, Inc.

- PURIS

- Emsland Group

- Others

Recent Developments:

- In July 2024, Ingredion Incorporated launched VITESSENCE® Pea 100 HD, a pea protein fortification solution for cold-pressed bars in the U.S. and Canada. This product maintains the softness of the bars, offers preferred texture and sensory attributes, and adds nutritional value to boost consumer preference, as texture and taste.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US pea protein market based on the below-mentioned segments:

US Pea Protein Market, By Source

- Yellow Split Peas

- Others

US Pea Protein Market, By Product

- Textured

- Hydrolysates

- Isolates

- Concentrates

US Pea Protein Market, By Form

- Wet

- Dry

US Pea Protein Market, By Application

- Personal Care & Cosmetics

- Food & Beverages

- Animal Feed

- Others

Need help to buy this report?