United States Pates Market Size, Share, and COVID-19 Impact Analysis, By Product (Chicken, Duck, Fish, and Others), By Distribution Channel (Supermarkets & Hypermarkets, Online, Specialty stores, and Others), and United States Pates Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Pates Market Insights Forecasts to 2035

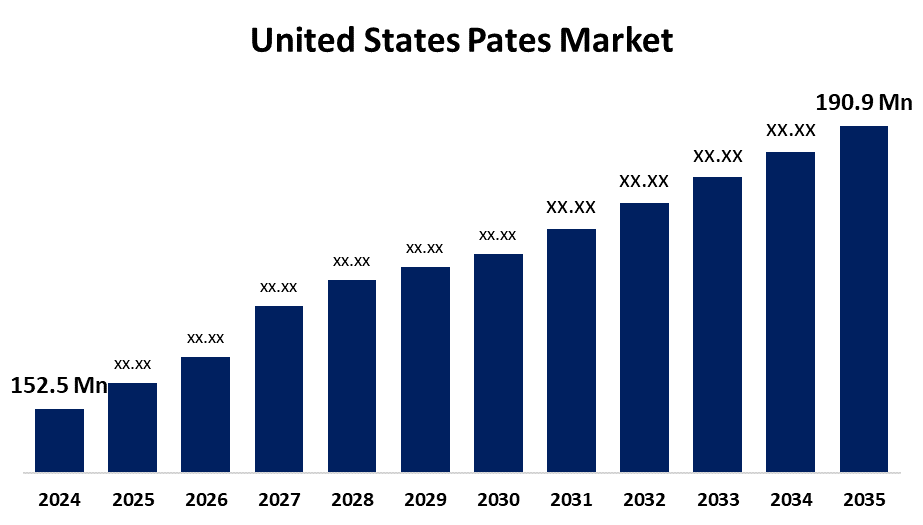

- The US Pates Market Size Was Estimated at USD 152.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.06% from 2025 to 2035

- The US Pates Market Size is Expected to Reach USD 190.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Pates Market is anticipated to reach USD 190.9 million by 2035, growing at a CAGR of 2.06% from 2025 to 2035. The expansion of the United States Pates market is propelled by the rise in culinary popularity. Pates, savoury spreads created from finely chopped or pureed seasoned meat, have made their way onto menus as customers experiment with a variety of culinary experiences.

Market Overview

Pate is a traditional cuisine-based dish that is usually created using forcemeat, which is a finely ground mixture of meats such as pork, chicken, game, or fish together with fat, spices, herbs, wine, or brandy. Several key factors are driving growth in the pate market in the United States as the consumption of high-quality pates has been stimulated by customers' growing appetite for gourmet and avant-garde food. This increasing demand drives creativity in pate flavours and mixes and catering to a broad range of palates. There is also an increasing demand for pates made with certified, premium, organic ingredients, as health-conscious eating habits are becoming more commonplace because consumers are more educated. Two important factors that have led to growth in the pate market are the convenience of many products being available through specialty retailers and online, and the increasing demand for convenient food options and ready-to-eat pates associated with the busy lifestyles of consumers. In addition, the ever-expanding food service sector, including restaurants and caterers, has played a major role in the expansion of the pates market. Many professional chefs and culinary experts are constantly experimenting with unique and premium pates and highlighting them in their culinary creations, which has led to increased demand for these unique and premium pates from restaurants and catering services.

Report Coverage

This research report categorizes the market for the United States pates market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States pates market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States pates market.

United States Pates Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 152.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.06% |

| 2035 Value Projection: | USD 190.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 123 |

| Segments covered: | By Product, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Kinsale Capital Group Inc, Terroirs d Antan, MyPanier, Inc., Army Brand, Despana Brand Foods, Hormel Foods Corporation, Murrays Cheese, Rougie USA, Henaff, Despana Brand Foods, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States pates market is boosted because more people are consuming high-quality meat products, including chicken liver, duck liver, smoked fish, and vegetarian options. Consumer habits have evolved within the food market to support end users who live hectic lifestyles by choosing convenience and fast food. E-commerce has been a major facilitator of this market development by providing a wide array of products from various brands and sources. The proliferation of e-commerce businesses, stimulated by smartphone accessibility, has allowed sales of pates and other ready-to-eat foods to grow exponentially.

Restraining Factors

The United States pates market faces obstacles like the food safety regulations. These regulations require producers to invest in insurance, fire safety, business operations review, licenses, permits, and mandated food safety training. Regulatory compliance is all about limiting the end user's exposure to contaminated food.

Market Segmentation

The United States pates market share is classified into product and distribution channel.

- The chicken segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States pates market is segmented by product into chicken, duck, fish, and others. Among these, the chicken segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the cost and convenience of this are nearly responsible. Chicken meat provides a readily available product that can also be prepared for various recipes. In addition, chicken is lean, low-fat, and almost always has some protein. Chicken meat has in its favour a combination of taste, and is healthy for the health-conscious population.

- The supermarkets & hypermarkets segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the United States pates market is segmented into supermarkets & hypermarkets, online, specialty stores, and others. Among these, the supermarkets & hypermarkets segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by urbanisation and increasing disposable incomes of consumer demand for a variety of food items, including pates. Supermarkets & hypermarkets have a wider range of selection, enhancing brand awareness and a more comfortable purchase experience than traditional food stores. This helps to facilitate the growth of the pet market, as they address premium gourmet products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States pates market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kinsale Capital Group Inc

- Terroirs d Antan

- MyPanier, Inc.

- Army Brand

- Despana Brand Foods

- Hormel Foods Corporation

- Murrays Cheese

- Rougie USA

- Henaff

- Despana Brand Foods

- Others

Recent Development

- In January 2024, Raydia Food Group acquired B & B foods distributors; Moe Alkemade and Scott Isles Discuss.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States pates market based on the following segments:

United States Pates Market, By Product

- Chicken

- Duck

- Fish

- Others

United States Pates Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online

- Specialty stores

- Others

Need help to buy this report?