United States Palladium Market Size, Share, and COVID-19 Impact Analysis, By Source (Mined and Recycled), By End-use Industry (Automotive, Electronics, Chemical & Petroleum, and Others), and United States Palladium Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUnited States Palladium Market Insights Forecasts to 2035

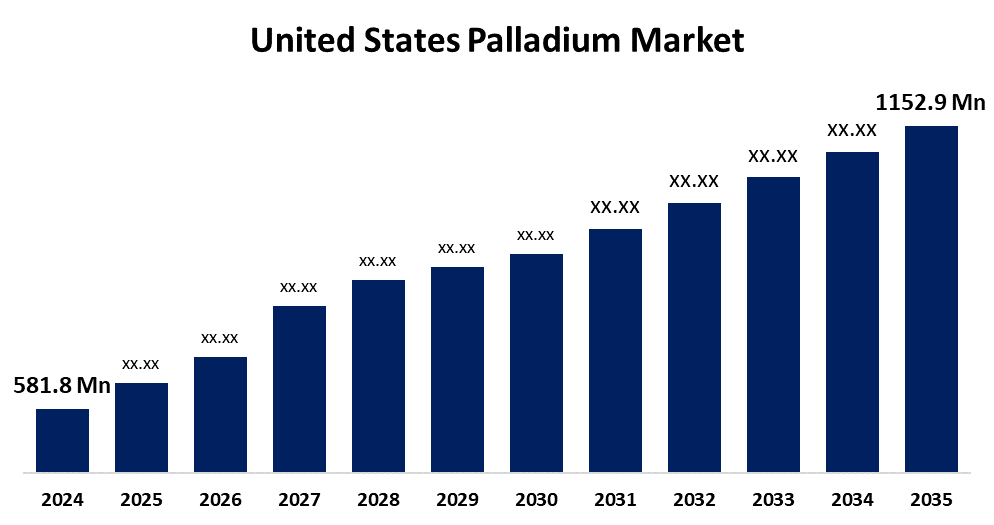

- The US Palladium Market Size Was Estimated at USD 581.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.41% from 2025 to 2035

- The US Palladium Market Size is Expected to Reach USD 1152.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Palladium Market Size is anticipated to Reach USD 1152.9 Million by 2035, Growing at a CAGR of 6.41% from 2025 to 2035. The expansion of the United States palladium market is propelled by rising demand for automobiles and more stringent car emission regulations.

Market Overview

Palladium is a platinum-group metal that is ductile, shiny, and silver-white. To cut air pollution, governments are enacting stricter laws with regard to automobile emissions. Higher amounts of palladium are required to manufacture better catalytic converters according to these restrictions. As expected, an increase in long-term demand for palladium due to its continual demand for cleaner air. Palladium is being used to plate electronic parts and is a part of multi-layer ceramic capacitors (MLCCs) because of its high conductivity and stable oxidation and corrosion resistance. Palladiums continuous technological development and its requirement for miniaturized electronics, as well as its increased use in consumer electronics, may help stabilize and increase long-term demand. Palladium is also a hydrogen storage medium and a hydrogen purifier. In response to sustainability concerns associated with electric vehicles, hybrid vehicles combine the best aspects of both petrol and electric engines. Hybrid vehicles can certainly reduce the issues often associated with running a purely electric vehicle while reducing the dependence on electricity and lithium-ion batteries. Hybrid vehicles may represent some of the best opportunities in the automobile market as they can potentially provide higher fuel economy with lower emissions.

Report Coverage

This research report categorizes the market for the United States palladium market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States palladium market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States palladium market.

United States Palladium Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 581.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.41% |

| 2035 Value Projection: | USD 1152.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Source, By End-use Industry |

| Companies covered:: | New Age Eats, Materion Corporation, Garfield Refining Company, Umicore Precious Metals USA, Inc., Johnson Matthey, Sims Recycling Solutions, PX Group, Inc., Hensel Recycling Group, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States palladium market is boosted by the increasing amount of platinum group metals used. Tighter carbon pollution standards are the main driver behind catalytic usage per vehicle and per auto catalyst. A new car testing method has also been introduced to assess emissions, the harmonised light vehicle test procedure. The proposed test regime utilizes slightly longer and further distances. The test regime requires far more rigorous testing. Also, the weight of the vehicle is heavier, the acceleration must be quicker, and it must be tested at different temperatures and altitudes.

Restraining Factors

The United States palladium market faces obstacles like the high price volatility that undermines producer confidence and financial planning. Recycling is still a restricted option because refining used catalysts is expensive, technically challenging, and unfeasible for many smaller businesses, which restricts the expansion of secondary supplies.

Market Segmentation

The United States palladium market share is classified into source and end-use industry.

- The recycled segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States palladium market is segmented by source into mined and recycled. Among these, the recycled segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because the need for recycled goods has grown as a result of the push for a circular economy. The segments growth has also been aided by rising demand for green hydrogen and increased environmental consciousness. Recycling increases demand since it lowers overall costs and carbon emissions.

- The automotive segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use industry, the United States palladium market is segmented into automotive, electronics, chemical & petroleum, and others. Among these, the automotive segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because the metals in the platinum group are the best converters. In order to lower carbon emissions, it is widely employed in petrol and hybrid vehicle exhaust fumes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States palladium market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- New Age Eats

- Materion Corporation

- Garfield Refining Company

- Umicore Precious Metals USA, Inc.

- Johnson Matthey

- Sims Recycling Solutions

- PX Group, Inc.

- Hensel Recycling Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States palladium market based on the following segments:

United States Palladium Market, By Source

- Mined

- Recycled

United States Palladium Market, By End-use Industry

- Automotive

- Electronics

- Chemical & Petroleum

- Others

Need help to buy this report?