United States Pacemakers Market Size, Share, and COVID-19 Impact Analysis, By Product (External and Implantable), By Application (Arrhythmias, Congestive Heart Failure, Bradycardia, and Others), and United States Pacemakers Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited States Pacemakers Market Insights Forecasts to 2035

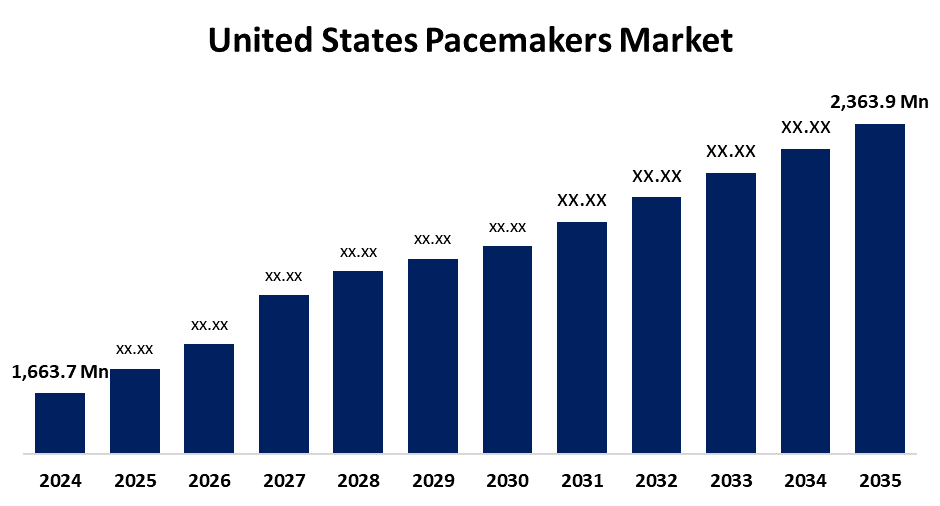

- The US Pacemakers Market Size Was Estimated at USD 1,663.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.24% from 2025 to 2035

- The US Pacemakers Market Size is Expected to Reach USD 2,363.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Pacemakers Market Size is anticipated to reach USD 2,363.9 Million by 2035, growing at a CAGR of 3.24% from 2025 to 2035. The expansion of the United States pacemakers market is propelled by the rising incidence of heart conditions, advancements in pacemaker technology, and the advantages of legal and financial structures.

Market Overview

A pacemaker is a tiny, battery-operated medical device that is placed beneath the skin close to the collarbone to control irregular heartbeats. The U.S. market is expanding due to the increased prevalence of cardiovascular diseases and advances in medical technology. A strong health system in the United States also helps to facilitate the fast adoption of innovative medical technology, like leadless pacemakers and remote monitoring devices. In February 2024, UC San Diego Health was the first healthcare system in San Diego to adopt the innovative dual-chamber leadless pacemaker technology in treating arrhythmias. The FDA approved the device in July 2023 as a less invasive method to treat irregular heartbeat. The market momentum of the above medical innovations is further propelled by other incremental innovations such as MRI-compatible devices and rechargeable pacemakers, all of which enhance the overall efficiency, effectiveness, and safety of the devices. It is also clear that these innovations are necessary to widen the spectrum of less invasive therapy options available to patients, increase battery life, and improve the Quality of Life (QoL) of patients.

Pacemakers and other heart-related technologies have been the focus of substantial SBIR/STTR funding from the National Heart, Lung, and Blood Institute (NHLBI), a division of the NIH. These awards offer up to $150K for phase I feasibility studies and more than $1 million annually for multi-year phase II and IIB "Bridge Awards," which are designed to help small enterprises develop clinically and draw in private capital.

Report Coverage

This research report categorizes the market for the United States pacemakers market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States pacemakers market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States pacemakers market.

United States Pacemakers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,663.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.24% |

| 2035 Value Projection: | USD 2,363.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 233 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Medico International Inc, ZOLL Medical Corporation, Integer Holdings Corp, Boston Scientific Corp, Abbott Laboratories, Medtronic, OSCOR Inc, Guidant Corporation, Cardiac Pacemakers, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States pacemakers market is boosted by the increase in cardiovascular diseases, and the need for pacemakers is increasing. More than four out of five cardiovascular disease (CVD) deaths are the result of strokes or heart attacks, and every third CVD death is among an adult under the age of 70. The industry is supported by innovations such as leadless pacemakers, MRI-compatible devices, and rechargeable pacemakers, which demonstrate enhancements in the overall efficiency, reliability, and safety of devices. These innovations expand options for patients with more minimally invasive treatments while increasing battery life and improving their clinical outcomes. The development of remote monitoring capabilities has increased the market opportunity, as these capabilities provide more customised care and reduce clinic visits, as they allow healthcare providers to monitor the pacemaker's functionality and heart rhythm in real-time with their patients.

Restraining Factors

The United States pacemakers market faces obstacles like investment of significant funds in clinical research, awareness of the regulatory environment, and advanced manufacturing. Such expenses can be excessive, especially for smaller companies, which may ultimately stymie access to the market and the spirit of innovation in therapeutics.

Market Segmentation

The United States pacemakers market share is classified into product and application.

- The implantable segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States pacemakers market is segmented by product into external and implantable. Among these, the implantable segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by leadless and traditional implantable pacemakers. There are three categories of traditional pacemakers, i.e, single-chamber, biventricular, and dual-chamber. Similarly, there are two types of leadless pacemakers, i.e, single-chamber and dual-chamber. Increased demand for these devices to treat heart failure and arrhythmias, in addition to ongoing clinical studies, is driving market expansion.

- The bradycardia segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States pacemakers market is segmented into arrhythmias, congestive heart failure, bradycardia, and others. Among these, the bradycardia segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by its commonality, particularly as it relates to the elderly. It can lead to fatigue, lightheadedness, and much more serious complications, and this cardiac condition causes the heart rate to be too slow. The primary treatment for bradycardia is a pacemaker, which provides patients with a repeatable method to have their heart rate corrected.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States pacemakers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Medico International Inc

- ZOLL Medical Corporation

- Integer Holdings Corp

- Boston Scientific Corp

- Abbott Laboratories

- Medtronic

- OSCOR Inc

- Guidant Corporation

- Cardiac Pacemakers, Inc.

- Others

Recent Development

- In June 2024, Abbott announced CE Mark approval for its AVEIR dual chamber (DR) leadless pacemaker, the first of its kind for dual chamber treatment of abnormal heart rhythms. This system features two small devices-AVEIR VR for the right ventricle and AVEIR AR for the right atrium-that wirelessly communicate to deliver coordinated therapy. Each device is about one-tenth the size of a traditional pacemaker, providing a new treatment option for patients with cardiovascular conditions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States pacemakers market based on the following segments:

United States Pacemakers Market, By Product

- External

- Implantable

United States Pacemakers Market, By Application

- Arrhythmias

- Congestive Heart Failure

- Bradycardia

- Others

Need help to buy this report?