United States Over-The-Counter (OTC) Hearing Aids Market Size, Share, and COVID-19 Impact Analysis, By Product (Receiver in Canal, Completely-in-the-Canal, Earbuds), By Distribution Channel (Brick & Mortar Stores, E-commerce), By Price Band (USD 500, USD 501 – 1000, Over USD 1000), and United States Over-The-Counter (OTC) Hearing Aids Market Insights Forecasts to 2033

Industry: HealthcareUnited States Over-The-Counter (OTC) Hearing Aids Market Size Insights Forecasts to 2033

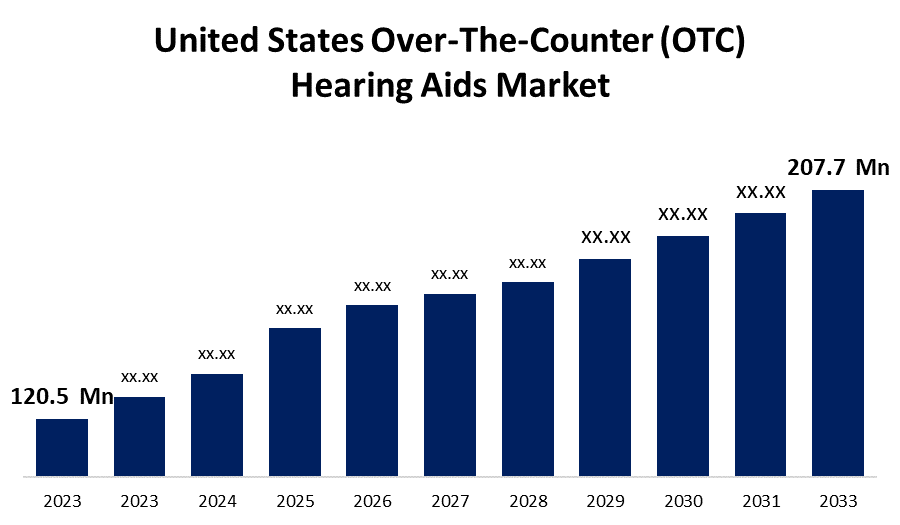

- The United States Over-The-Counter (OTC) Hearing Aids Market Size was valued at USD 120.5 Million in 2023.

- The Market Size is Growing at a CAGR of 5.6% from 2023 to 2033.

- The United States Over-The-Counter (OTC) Hearing Aids Market Size is Expected to Reach USD 207.7 Million by 2033.

Get more details on this report -

The United States Over-The-Counter (OTC) Hearing Aids Market Size is Expected to reach USD 207.7 Million by 2033, at a CAGR of 5.6% during the Forecast period 2023 to 2033.

Market Overview

Over-the-counter (OTC) hearing aids are hearing devices that can be purchased directly by consumers without requiring a prescription or professional fitting. These devices are intended to help people with mild to moderate hearing loss improve their auditory abilities and overall quality of life. OTC hearing aids are typically less expensive and more accessible than traditional hearing aids because they are available through a variety of retail channels such as pharmacies, online stores, and hearing aid specialty shops. While OTC hearing aids offer convenience and cost savings, it's important to remember that they may not be suitable for all individuals with hearing loss. Professional evaluation and fitting by a hearing healthcare professional are required to ensure optimal performance and proper device customization for the individual's specific needs. Individuals should consult with a licensed audiologist or hearing specialist before purchasing an OTC hearing aid to determine the best solution for their specific hearing needs.

Report Coverage

This research report categorizes the market for United States over-the-counter (OTC) hearing aids market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States over-the-counter (OTC) hearing aids market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States over-the-counter (OTC) hearing aids market.

United States Over-The-Counter (OTC) Hearing Aids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 120.5 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.6% |

| 2033 Value Projection: | USD 207.7 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Distribution Channel, By Price Band, and COVID-19 Impact Analysis |

| Companies covered:: | Lucid Hearing, Sonova Holding AG, SoundWave Hearing, LLC, WS Audiology Denmark A/S, Bose Corporation, MD Hearing, Eargo Inc., Xiamen Melosound Technology Co., GN Hearing A/S (GN Group), Starkey, Neuheara Limited, Others, and |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Every year, the prevalence of hearing loss in the United States increases significantly. One of the major factors driving the growth of the hearing aids market in the United States is the increasing demand for low-cost devices to manage auditory loss among patients. Hearing loss is a public health concern that has a significant impact on quality of life and increases the disease burden. Hearing loss has a significant impact on a person's life, which is exacerbated by discrimination and negative social attitudes toward those who suffer from it. Untreated hearing loss has a severe financial impact on health, education, and societal productivity. Along with this, the improving reimbursement scenario in the United States for hearing implants as a result of rising government and market initiatives is another major factor driving market growth. Several regulatory changes have been implemented in the United States to provide auditory loss assistance products to patients suffering from this condition.

Restraining Factors

The high cost of these products is a major barrier to market growth. Despite being classified as a prescription product, most insurance companies do not cover the cost of these devices. Only a few states cover the cost of these implants for children. The majority of the population has to pay for their own examinations, devices, and services to fit and maintain them. The low adoption of these devices among patients owing to a lack of favorable reimbursement policies.

Market Segment

- In 2023, the receiver in canal (RIC) segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States over-the-counter (OTC) Hearing Aids market is segmented into receiver in canal (RIC), completely-in-the-canal, and earbuds. Among these, the receiver in canal (RIC) segment has the largest revenue share over the forecast period. The RIC segment's high growth rate is attributed to its combination of technological advancement, discreet design, customization, and connectivity. Thus, features like digital processing and wireless options not only improve sound quality but also significantly increase user convenience. Furthermore, demand from an aging population base for comfortable and effective solutions boosts the segment's popularity, while market competition and innovation drive rapid growth of the segment.

- In 2023, the brick & mortar stores segment accounted for the largest revenue share over the forecast period.

Based on the distribution channel, the United States over-the-counter (OTC) hearing aids market is segmented into brick & mortar stores, and e-commerce. Among these, the brick & mortar stores segment has the largest revenue share over the forecast period. Physical retail locations, such as pharmacies, retail chains, and specialized hearing aid centers, are reliable and familiar options for those in need of hearing aids. Their in-person consultations with hearing professionals, the ability to try out and demonstrate hearing aids, immediate availability, and accessible customer support services are critical to their success. Furthermore, the widespread presence of these stores across the country provides easy access for a wide range of consumers looking for hearing aid solutions.

- In 2023, the USD 501 – 1000 segment accounted for the largest revenue share over the forecast period.

Based on the price band, the United States over-the-counter (OTC) hearing aids market is segmented into USD 500, USD 501 – 1000, and over USD 1000. Among these, the USD 501 – 1000 segment has the largest revenue share over the forecast period. This segmental growth is attributed to its ability to strike a balance between affordability and advanced features, making it an appealing option for people with mild to moderate hearing loss. Devices in this price range are perceived to provide a balance of quality and modern technology, such as improved sound quality, comfort, and customization options.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States over-the-counter (OTC) hearing aids market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lucid Hearing

- Sonova Holding AG

- SoundWave Hearing, LLC

- WS Audiology Denmark A/S

- Bose Corporation

- MD Hearing

- Eargo Inc.

- Xiamen Melosound Technology Co.

- GN Hearing A/S (GN Group)

- Starkey

- Neuheara Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2022, NationsBenefits, a leading provider of supplemental benefits and healthcare plans, has formed a strategic partnership with Eargo, Inc. This collaboration allowed NationsBenefits health plan members to use their plan benefits for Eargo's over-the-counter (OTC) hearing aids. This collaboration increased Eargo's visibility, which could boost sales and improve the company's growth and market presence.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States over-the-counter (OTC) hearing aids market based on the below-mentioned segments:

United States Over-The-Counter (OTC) Hearing Aids Market, By Product

- Receiver in Canal

- Completely-in-the-Canal

- Earbuds

United States Over-The-Counter (OTC) Hearing Aids Market, By Distribution Channel

- Brick & Mortar Stores

- E-commerce

United States Over-The-Counter (OTC) Hearing Aids Market, By Price Band

- USD 500

- USD 501 – 1000

- Over USD 1000

Need help to buy this report?