United States Osmometers Market Size, Share, and COVID-19 Impact Analysis, By Type (Freezing Point Osmometers, Vapour Pressure Osmometers, and Membrane Osmometers), By Sampling Capacity (Single-Sample and Multi-Sample), and United States Osmometers Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Osmometers Market Insights Forecasts to 2035

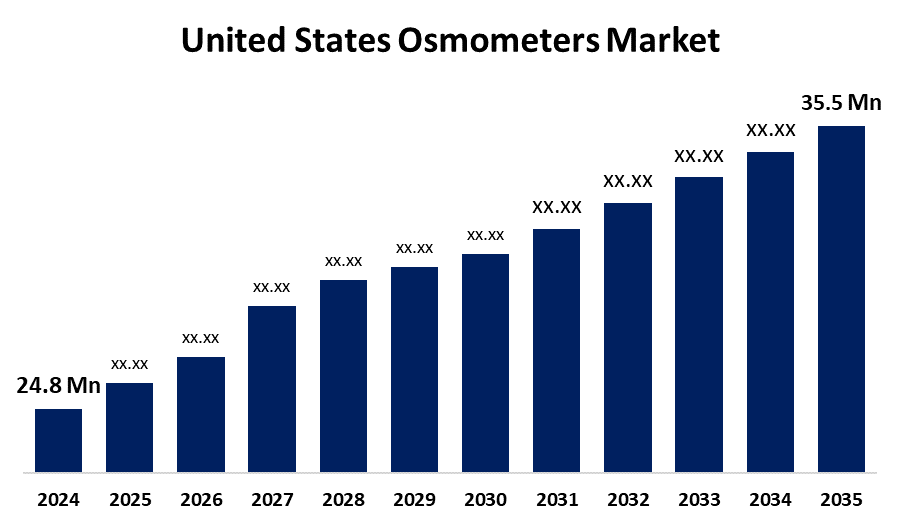

- The US Osmometers Market Size Was Estimated at USD 24.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.31% from 2025 to 2035

- The US Osmometers Market Size is Expected to Reach USD 35.5 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Osmometers Market Size is Anticipated to Reach USD 35.5 Million by 2035, Growing at a CAGR of 3.31% from 2025 to 2035. The expansion of the United States osmometers market is propelled by improvements in technology and an increase in the frequency of electrolyte imbalances such as hyperchloremia, hyperkalaemia, and hypernatraemia.

Market Overview

An osmometer is a device that measures the osmotic strength or osmotic pressure of a solution, colloid, or compound. Osmometers have a very broad range of uses, but are mainly used in clinical research and treatment. They are used to measure the solute concentration of many biological materials, including blood plasma and human tears. These measurements provide a great deal of information at very low medical cost and are invaluable for the early diagnosis of a variety of disorders. A freezing point osmometer is a unique kind of osmometer that measures the osmotic strength of a solution because the presence of osmotically active components decreases the freezing point of a solution. A freezing point osmometer measures the freezing point of a solvent as a function of total solutes. Since there is a direct linear relationship between osmolality measurement and the freezing point of a solution, the unique properties of freezing point osmometers are quite significant. The most common osmometers are freezing point osmometers since they are easily calibrated and easily used. Consequently, the market for freezing point osmometers is expanding rapidly.

The U.S. government's emphasis on automation and smart technology allows osmometers to be easily linked with lab information systems and procedures. One prominent feature of the OsmoPRO MAX automatic freezing-point osmometer was its increased access to R&D support sources.

Report Coverage

This research report categorizes the market for the United States osmometers market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States osmometers market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States osmometers market.

United States Osmometers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 24.8 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.31% |

| 2035 Value Projection: | USD 35.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Sampling and COVID-19 Impact Analysis. |

| Companies covered:: | Advanced Instruments, Precision Systems, Nova Biomedical, Thermo Fisher Scientific, ELITechGroup Inc, ARKRAY Inc., Bio-Rad Laboratories, Inc, Wescor Inc. and Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States osmometers market is boosted by the utilization of osmometer instruments, which is valuable with respect to the early diagnosis and detection of certain diseases, specifically those associated with electrolyte imbalances and consideration of fluid balance. OSS can be used to assess the osmolality of bodily fluids, including blood, urine, and cerebrospinal fluid, in clinical settings, including clinics for outpatient and emergency purposes, hospitals, inpatient, outpatient, and ambulatory care, and laboratories in private, public, and research institutions. Accurate osmolality measurements indicate electrolyte, fluid balance, and whole-body health status of the patient. Osmometers help clinicians and medical staff detect electrolyte imbalance and dehydration, making informed decisions on patient care for better outcomes while lowering healthcare costs.

Restraining Factors

The United States osmometers market faces obstacles like High costs associated with equipment and availability. The procurement of osmometers is impacted by financial constraints and the reality that more recent osmometer alternatives can currently cost over $15K for smaller lab budgets.

Market Segmentation

The United States osmometers market share is classified into type and sampling capacity.

- The freezing point segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States osmometers market is segmented by type into freezing point osmometers, vapour pressure osmometers, and membrane osmometers. Among these, the freezing point segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by its use in various clinical settings, including clinical chemistry, quality control laboratories, drug manufacture, and pharmaceutical production, because of its effectiveness. The freezing point osmometers are also better than the other species of osmometers in many ways, including quick and inexpensive measuring capability, use of the preferred FP technological process, smaller sample size (μL), and applicability to diluted aqueous and biological solutions.

- The single-sample segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the sampling capacity, the United States osmometers market is segmented into single-sample and multi-sample. Among these, the single-sample segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by osmoTECH XT single-sample osmometers, along with some other advanced technologies, which have allowed measurement of the concentrations and difficult-to-measure processes in bioproduction.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States osmometers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Advanced Instruments

- Precision Systems

- Nova Biomedical

- Thermo Fisher Scientific

- ELITechGroup Inc

- ARKRAY Inc.

- Bio-Rad Laboratories, Inc

- Wescor Inc.

- Others

Recent Development

- In November 2023, Thermo Fisher Scientific announced a strategic partnership with a major pharmaceutical company, focusing on high-throughput drug formulation processes using osmometry.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States osmometers market based on the following segments:

United States Osmometers Market, By Type

- Freezing Point Osmometers

- Vapour Pressure Osmometers

- Membrane Osmometers

United States Osmometers Market, By Sampling Capacity

- Single-Sample

- Multi-Sample

Need help to buy this report?