United States Orthopedic Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Fixation, Replacement Devices, Braces, Spinal Implants, Arthroscopy, Orthobiolgics), By Application (Hip, Knee, Spine, Cranio-Maxillofacial, Sports, Medical Extremities & Trauma), By End User (Hospitals, Orthopedic Clinic, Ambulatory Surgical Centers, and Others), and United States Orthopedic Devices Market Insights, Industry Trend, Forecasts to 2032

Industry: HealthcareUnited States Orthopedic Devices Market Insights Forecasts to 2032

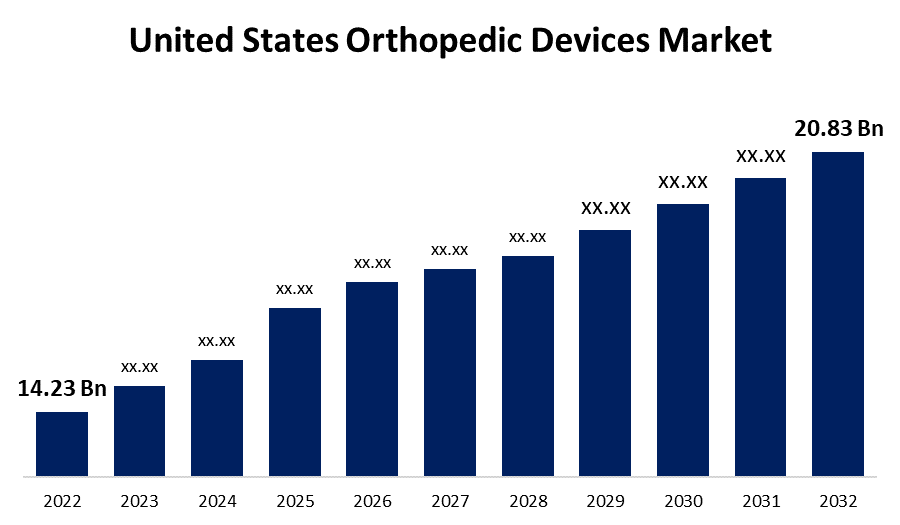

- The United States Orthopedic Devices Market Size was valued at USD 14.23 billion in 2022.

- The Market is growing at a CAGR of 3.8% from 2022 to 2032

- The U.S Orthopedic Devices Market Size is expected to reach USD 20.83 billion by 2032.

Get more details on this report -

The United States Orthopedic Devices Market is anticipated to exceed USD 20.83 billion by 2032, growing at a CAGR of 3.8% from 2022 to 2032. The high incidence of orthopedic disorders, such as an aging population, rising cases of degenerative bone disease, and an increasing number of accidents, are driving market growth in the U.S.

Market Overview

Orthopedic devices are used to treat musculoskeletal problems in the joints or bones. The rising incidences of osteoporosis and musculoskeletal diseases, innovations in technology, the increasing incidence of sports and traumatic injuries, and the aging population are driving the U.S. orthopedic devices market growth. According to a report by Definitive Healthcare, LLC., orthopedic complaints are the leading reason for patients visiting physicians in the United States. The increasing number of surgical procedures involving various types of orthopedic implants and instruments is expected to fuel market growth during the forecast period. According to a 2019 report revealed by the American Academy of Orthopedic Surgeons, approximately 6.8 million patients with orthopedic injuries require medical attention in the United States alone each year. Furthermore, an increase in the prevalence of osteoporosis (brittle bone), which is characterized by physical weakening of bone tissues and a low bone-to-mass density ratio, is projected to increase demand for orthopedic surgical devices during the forecast period.

Report Coverage

This research report categorizes the market for the US orthopedic devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the orthopedic devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the orthopedic devices market.

Driving Factors

Orthopedic devices are becoming more prevalent in the clinical management of a wide range of orthopedic diseases and disorders, including osteoarthritis, osteoporotic fractures, rheumatoid arthritis, and carpal tunnel syndrome. The significant rise in the prevalence of orthopedic diseases in the United States has increased demand for and adoption of orthopedic treatment products among major end users. The CDC estimates that approximately 54 million adults in the United States suffer from arthritis. Furthermore, government initiatives to support the healthcare industry, strengthen export trade, and raise awareness among surgeons and patients about the most recent orthopedic treatments are likely to fuel the growth of the US orthopedic devices industry.

Restraining Factors

The two most common orthopedic surgeries are total hip and total knee arthroplasty. Though hip arthroplasty produces positive results, it can also result in risks and complications such as surgical-site infections, deep vein thrombosis, and implant failures due to the cement's failure to hold the hip implants in place. Other complications that can arise from hip and knee replacement surgery are periprosthetic fractures. All of these risks are expected to limit market growth during the forecast period.

Market Segmentation

The United States Orthopedic Devices Market share is classified into product and end user.

- The spinal implants segment is expected to grow at a rapid pace in the United States orthopedic devices market during the forecast period.

The United States orthopedic devices market is segmented by product into fixation, replacement devices, braces, spinal implants, arthroscopy, and orthobiolgics. Among these, the spinal implants segment is expected to grow at a rapid pace in the United States orthopedic devices market during the forecast period. Rising spinal cord injury (SCI) cases, an elderly population, an upsurge in the number of players offering sophisticated spinal implants, an increasing demand for less-invasive spine surgeries, and the introduction of innovative bone grafts are some of the factors driving the growth of the spinal implants segment of the US orthopedic devices market during the forecast period.

- The hospitals segment is expected to hold the largest share of the U.S. orthopedic devices market during the forecast period.

Based on the end user, the United States orthopedic devices market is divided into hospitals, orthopedic clinic, ambulatory surgical centers, and others. Among these, the hospitals segment is expected to hold the largest share of the United States orthopedic devices market during the forecast period. The rapidly increasing cases of osteoarthritis among elderly people, a rising percentage of road accidents, and the growing need for improved care among the United States' expanding population are all contributing to the increased adoption of orthopedic treatment among hospitals.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US orthopedic devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Stryker Corporation

- Zimmer Biomet

- Medtronic

- Smith+Nephew

- NuVasive

- Arthrex

- DJO Global

- Johnson & Johnson

- Exactech, Inc.

- Enovis

- Conmed Corporation

- Aesculap Implant Systems

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2023, Zimmer Biomet has agreed to buy Embody, a medical device company based in the United States, for $155 million. Embody will also receive an additional $120 million if future regulatory and commercial milestones are met within the next three years, according to the terms of the agreement.

Market Segment

This study forecasts revenue at United States, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the United States Orthopedic Devices Market based on the below-mentioned segments:

United States Orthopedic Devices Market, By Product

- Fixation

- Replacement Devices

- Braces

- Spinal Implants

- Arthroscopy

- Orthobiolgics

United States Orthopedic Devices Market, By Application

- Hip

- Knee

- Spine

- Cranio-Maxillofacial

- Sports

- Medical Extremities & Trauma

United States Orthopedic Devices Market, By End User

- Hospitals

- Orthopedic Clinic

- Ambulatory Surgical Centers

- Others

Need help to buy this report?