United States Organic Beauty and Personal Care Ingredients Market Size, Share, and COVID-19 Impact Analysis, By Plant Type (Aloe Vera, Avocado, Rose, Lavender, Jojoba, Rosemary, Neem, and others), By Application (Cleansing, Exfoliation, Moisturization, UV-protection, Anti-aging, Multi-functional, and others), and United States Organic Beauty and Personal Care Ingredients Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Organic Beauty and Personal Care Ingredients Market Insights Forecasts to 2035

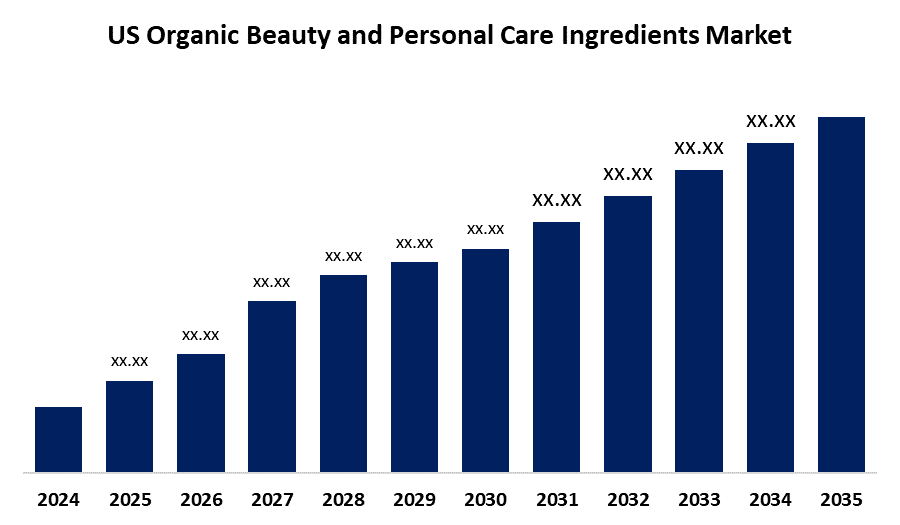

- The USA Organic Beauty and Personal Care Ingredients Market Size is Expected to Grow at a CAGR of around 6.2% from 2025 to 2035.

- The United States Organic Beauty and Personal Care Ingredients Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The U.S. organic beauty and personal care ingredients market Size is expected to hold a significant share by 2035, growing at a CAGR of 6.2% from 2025 to 2035. The U.S. organic beauty and personal care ingredients market is growing rapidly due to rising consumer demand for natural, safe products, increased awareness of synthetic chemical risks, and a strong focus on sustainability. Innovations in biotechnology and eco-friendly packaging, combined with social media influence, further drive market expansion and consumer preference for clean, ethical beauty solutions.

Market Overview

The U.S. organic beauty and personal care ingredients market refers to the segment of the cosmetics and personal care industry that utilizes naturally derived, chemical-free, and environmentally sustainable ingredients in product formulations. These include plant-based oils, essential oils, botanical extracts, and naturally sourced preservatives used in skincare, haircare, and hygiene products. The market is witnessing strong growth driven by rising consumer awareness about the potential health risks of synthetic chemicals and a growing preference for clean, green, and eco-conscious beauty products. Innovation, improved availability of organic-certified components, and the growth of e-commerce channels supporting specialty and premium product visibility are driving market strength. There are growing opportunities in developing multifunctional organic ingredients, biodegradable packaging, and personalized organic formulations. Government initiatives such as the USDA’s National Organic Program support regulatory oversight, helping establish trust and product credibility. As consumer demand for ethical, sustainable, and skin-friendly products continues to rise, the U.S. organic beauty and personal care ingredients market is positioned for ongoing innovation and robust growth.

Report Coverage

This research report categorizes the market for the United States organic beauty and personal care ingredients market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA organic beauty and personal care ingredients market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. organic beauty and personal care ingredients market.

United States Organic Beauty and Personal Care Ingredients Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.2% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Plant Type and By Application |

| Companies covered:: | Estee Lauder Companies, Procter & Gamble (P&G), Johnson & Johnson, Avalon Organics, Burt’s Bees, Tom’s of Maine, Juice Beauty, Dr. Bronner’s, Alaffia, SheaMoisture, RMS Beauty, Acure Organics, True Botanicals, Beautycounter, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising consumer awareness of the health risks linked to synthetic chemicals and a growing demand for clean, sustainable products. Consumers, especially Millennials and Gen Z, prioritize transparency, ethical sourcing, and eco-friendly practices, aligning with the clean beauty movement. Advancements in biotechnology, such as lab-grown rose and palm oils, are enabling more sustainable ingredient sourcing. Regulatory support through certifications like USDA Organic and Ecocert enhances consumer trust and product authenticity. Digital marketing and e-commerce have expanded access to organic beauty products, amplifying demand. These factors, combined with a shift toward wellness and environmentally conscious lifestyles, continue to fuel the market’s steady growth and innovation in natural formulations.

Restraining Factors

The high production costs and limited availability of certified organic raw materials, these challenges can result in higher product prices, limiting accessibility for some consumers. Additionally, inconsistent regulatory standards and potential greenwashing practices may hinder consumer trust and slow market adoption and expansion.

Market Segmentation

The United States Organic Beauty And Personal Care Ingredients Market share is classified into plant type and application.

- The aloe vera segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA organic beauty and personal care ingredients market is segmented by plant type into aloe vera, avocado, rose, lavender, jojoba, rosemary, neem, and others. Among these, the aloe vera segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its widespread use and consumer preference, with its versatility and effectiveness across various skin types contributing to its dominant market position. Aloe vera is renowned for its soothing, hydrating, and healing properties, making it a staple in moisturizers, gels, and lotions.

- The moisturization segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. organic beauty and personal care ingredients market is segmented by application into cleansing, exfoliation, moisturization, UV-protection, anti-aging, multi-functional, and others. Among these, the moisturization segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to growing consumer focus on hydration and skin health. Natural, plant-based moisturizers effectively address dryness and sensitivity, with the increased awareness of organic ingredient benefits further boosting this segment, making it essential in skincare routines and contributing to its market leadership.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States organic beauty and personal care ingredients market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Estee Lauder Companies

- Procter & Gamble (P&G)

- Johnson & Johnson

- Avalon Organics

- Burt’s Bees

- Tom’s of Maine

- Juice Beauty

- Dr. Bronner’s

- Alaffia

- SheaMoisture

- RMS Beauty

- Acure Organics

- True Botanicals

- Beautycounter

- Others

Recent Developments:

- In February 2024, Dr. Bronner’s, the family-owned maker of the top-selling natural soap brand in North America, announced the nationwide launch of a new 32 oz. Soap Refill Carton package for its Pure-Castile Liquid Soap. The Soap Refill Carton became available at multiple retailers across the United States and was designed to refill existing bottles or other containers for personal care and home cleaning use.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA organic beauty and personal care ingredients market based on the below-mentioned segments:

United States Organic Beauty and Personal Care Ingredients Market, By Plant Type

- Aloe Vera

- Avocado

- Rose

- Lavender

- Jojoba

- Rosemary

- Neem

- others

United States Organic Beauty and Personal Care Ingredients Market, By Application

- Cleansing

- Exfoliation

- Moisturization

- UV-protection

- Anti-aging

- Multi-functional

- others

Need help to buy this report?