United States Ophthalmic Sutures Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural, Synthetic), By Material (Nylon, Polypropylene, Silk, PGA), By Coating (Coated, Uncoated), By Material Structure (Monofilament, Multifilament), By Absorption (Absorbable, Non-absorbable), and United States Ophthalmic Sutures Market Insights Forecasts to 2033

Industry: HealthcareUnited States Ophthalmic Sutures Market Insights Forecasts to 2033

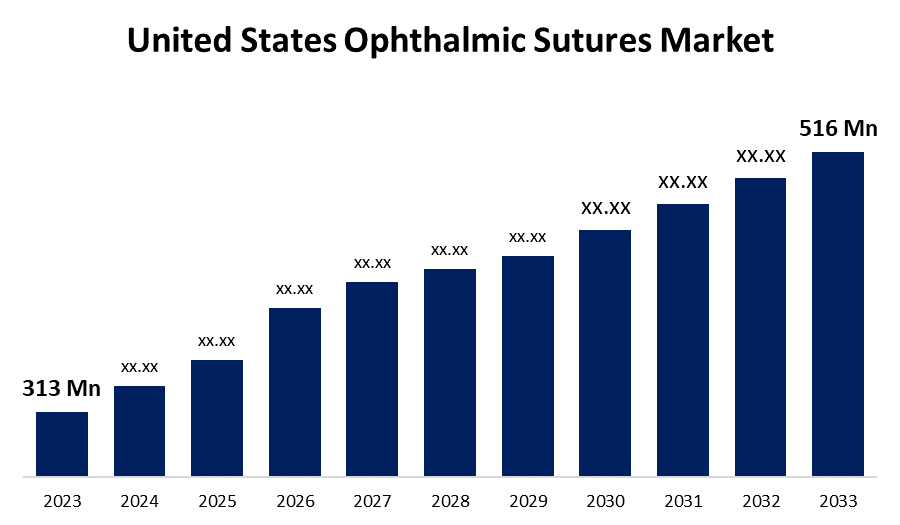

- The United States Ophthalmic Sutures Market Size was valued at USD 313 Million in 2023.

- The Market Size is Growing at a CAGR of 5.1% from 2023 to 2033.

- The United States Ophthalmic Sutures Market Size is Expected to Reach USD 516 Million by 2033.

Get more details on this report -

The United States Ophthalmic Sutures Market Size is Expected to Reach USD 516 Million by 2033, at a CAGR of 5.1% during the forecast period 2023 to 2033.

Market Overview

Ophthalmic sutures are essential in eye surgeries such as cataract removal, corneal transplantation, and glaucoma surgery. They are critical for securing tissue and facilitating precise wound closure, resulting in faster healing and better outcomes. Ophthalmic surgeons rely on these sutures to achieve the desired surgical results while also maintaining the eye's structural integrity. The United States ophthalmic sutures market is a thriving sector of the healthcare industry. Ophthalmic sutures are surgical threads used to close wounds and incisions during eye surgeries, ensuring proper healing and reducing the risk of complications. These sutures are specifically designed to meet the unique needs of ophthalmic procedures, and they come in a variety of materials and sizes. Factors such as rising prevalence of eye disorders, advances in ophthalmic surgical techniques, and a growing geriatric population all contribute to market growth. Furthermore, rising demand for minimally invasive ophthalmic procedures and the development of novel suture materials are driving market growth.

Report Coverage

This research report categorizes the market for United States ophthalmic sutures market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States ophthalmic sutures market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States ophthalmic sutures market.

United States Ophthalmic Sutures Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 313 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 5.1% |

| 2033 Value Projection: | USD 516 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Material, By Coating, By Material Structure, By Absorption and COVID-19 Impact Analysis. |

| Companies covered:: | Teleflex Incorporated, Mani, DemeTECH Corporation, Corzamedical, B Braun Melsungen AG, Ethicon, Medtronic, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Technological advances in ophthalmology, such as self-sealing incisions, are expected to drive market expansion. Other market drivers include increased awareness of various eye diseases, an increase in the number of ophthalmologists, and improved reimbursement policies. Various government initiatives, increased investment in R&D, and rising healthcare spending are also expected to drive the market during the forecast period. Furthermore, the growing number of ambulatory surgical centers and single-day surgeries are expected to boost the market. Most ophthalmic procedures are one-day surgeries that do not require a hospital stay. Thus, with an increasing number of outpatient surgeries, the ophthalmic sutures market is expected to grow significantly over the forecast period.

Restraining Factors

The growing popularity of minimally invasive surgeries is expected to slow market revenue growth. Minimally invasive procedures are popular for several reasons, including smaller incisions, less scarring, less blood loss, and other benefits. Many surgeons with extensive minimally invasive surgery training are qualified to discuss the techniques they recommended. Every minimally invasive surgery requires putting the patient to sleep with a general anesthetic. Because minimally invasive surgeries do not involve large incisions, surgical sutures are rarely used.

Market Segment

- In 2023, the synthetic segment accounted for the largest revenue share over the forecast period.

Based on the type, the United States ophthalmic sutures market is segmented into natural and synthetic. Among these, the synthetic segment has the largest revenue share over the forecast period. As people become more aware of the benefits of synthetic ophthalmic sutures, such as their high flexibility, durability, cost-effectiveness, and tensile strength. Furthermore, ophthalmologists are increasingly using such sutures to ensure wound security. All of these factors are expected to accelerate segmental growth during the estimated timeframe.

- In 2023, the silk segment accounted for the largest revenue share over the forecast period.

Based on the material, the United States ophthalmic sutures market is segmented into nylon, polyproplene, silk, and PGA. Among these, the silk segment has the largest revenue share over the forecast period. The growth can be attributed to product characteristics such as non-absorbable, natural, and braided material, which has encouraged some ophthalmologists to use it for increased stability over longer periods.

- In 2023, the uncoated segment accounted for the largest revenue share over the forecast period.

Based on the coating, the United States ophthalmic sutures market is segmented into coated and uncoated. Among these, the uncoated segment has the largest revenue share over the forecast period. The growth is attributed to the exceptional product features, which include permanent or dissolvable, braided or monofilament attributes. Furthermore, these sutures are made of silk, polypropylene, nylon, and other materials.

- In 2023, the non-absorbable segment accounted for the largest revenue share over the forecast period.

Based on the absorption, the United States ophthalmic sutures market is segmented into absorbable, and non-absorbable. Among these, the non-absorbable segment has the largest revenue share over the forecast period owing to its increasing use in a variety of ophthalmic surgeries, including cataract surgery, corneal transplantation surgery, and glaucoma surgery.

- In 2023, the monofilament segment accounted for the largest revenue share over the forecast period.

Based on the material structure, the United States ophthalmic sutures market is segmented into monofilament and multifilament. Among these, the monofilament segment has the largest revenue share over the forecast period. The growth can be attributed to the constant innovations in monofilament sutures, which has left key players eager for new innovations in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States ophthalmic sutures market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Teleflex Incorporated

- Mani

- DemeTECH Corporation

- Corzamedical

- B Braun Melsungen AG

- Ethicon

- Medtronic

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2021, Ethicon announced that Ethicon Plus Sutures would be approved for use in National Health Service surgeries. These sutures offer antibacterial protection and are recommended as part of a package of care for preventing surgical site infection in the NHS for people who require wound closure following a surgical procedure. This recommendation marks a significant milestone for Ethicon, assisting the company in strategically expanding into international markets.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States ophthalmic sutures market based on the below-mentioned segments:

United States Ophthalmic Sutures Market, By Type

- Natural

- Synthetic

United States Ophthalmic Sutures Market, By Material

- Nylon

- Polyproplene

- Silk

- PGA

United States Ophthalmic Sutures Market, By Coating

- Coated

- Uncoated

United States Ophthalmic Sutures Market, By Material Structure

- Monofilament

- Multifilament

United States Ophthalmic Sutures Market, By Absorption

- Absorbable

- Non-absorbable

Need help to buy this report?