United States Online Accommodation Market Size, Share, and COVID-19 Impact Analysis, By Platform Type (Mobile Application and Website), By Mode of Booking Type (Thir-Party Online Portals and Direct/Captive Portals), and United States Online Accommodation Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited States Online Accommodation Market Insights Forecasts to 2035

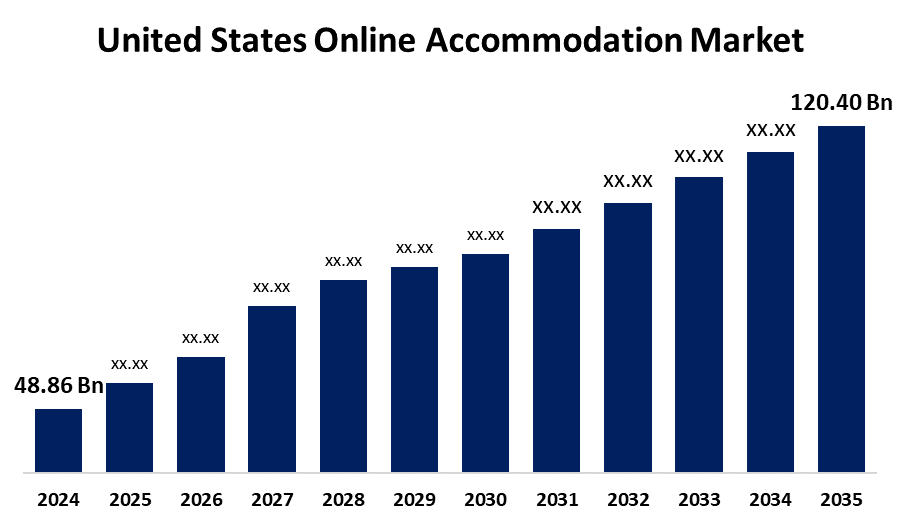

- The U.S. Online Accommodation Market Size Was Estimated at USD 48.86 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.54% from 2025 to 2035a

- The USA Online Accommodation Market Size is Expected to Reach USD 120.40 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Online Accommodation Market is anticipated to reach USD 120.40 billion by 2035, growing at a CAGR of 8.54% from 2025 to 2035. The U.S. online accommodation market is expanding steadily, driven by convenience, mobile accessibility, and diverse lodging options. Key players and tech innovations continue to enhance booking experiences and customer engagement.

Market Overview

The United States online accommodation market refers to digital platforms and services that enable the reservation of accommodation properties, such as hotels, vacation rentals, and others, via websites and mobile apps. The market comprises third-party online travel agencies (OTAs) such as Expedia, Booking.com, and Airbnb, as well as direct booking channels offered by accommodation suppliers themselves. Moreover, emerging growth factors in the U.S. online lodging market are the growth of AI-driven personalization platforms, blockchain secure bookings, voice search adoption for travel planning, and influencer partnerships for direct booking links. These technology-driven trends are transforming user behavior beyond the conventional online booking incentives observed in other markets. Furthermore, technologies such as AI chatbots, dynamic pricing, and interactive virtual tours make the user experience better. Leaders like Airbnb, Booking.com, and Expedia can drive the market by promoting loyalty programs, intelligent integrations, and adding products in underpenetrated or niche travel niches.

Report Coverage

This research report categorizes the market for the U.S. online accommodation market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States online accommodation market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA online accommodation market.

United States Online Accommodation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 48.86 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.54% |

| 2035 Value Projection: | USD 120.40 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 186 |

| Tables, Charts & Figures: | 135 |

| Segments covered: | By Platform Type, By Mode of Booking Type and COVID-19 Impact Analysis |

| Companies covered:: | Expedia.com, Agoda.com, Hotels.com, Orbitz.com, Priceline.com, Booking.com, Airbnb.com, Tripadvisor.com, Hotwire, Laterooms.com, HRS.com and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The U.S. online accommodation industry is driven by the growing phenomenon of spontaneous trip planning, remote work that enables flexible stays, and the growing need for novel lodging experiences such as tiny homes and green retreats. Seamless mobile payment system integration and last-minute booking functionality also drive growth. Social media influence and user-generated content also drive trust and decision-making in online accommodation selection, further driving market growth.

Restraining Factors

Restraining factors are information privacy issues, high competition reducing profit margins, regulatory issues for short-term rentals, and dependence on internet connectivity, which can hinder access to particular user segments or areas.

Market Segmentation

The United States online accommodation market share is classified into platform type and mode of booking type.

- The website segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States online accommodation market is segmented by platform type into mobile application & website. Among these, the website segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Despite growing mobile usage, many users prefer desktop websites for detailed research, comparison, and booking due to larger screen visibility, ease of navigation, and trust in traditional browsing, especially for high-value or complex travel arrangements like extended stays or group bookings.

- The third-party online portals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States online accommodation market is segmented by mode of booking type into third- party online portals & direct/captive portals. Among these, the third- party online portals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Platforms like Expedia, Booking.com, and Airbnb attract large user bases with broad listings, competitive pricing, and trusted reviews. Their strong marketing, loyalty programs, and user-friendly interfaces make them preferred choices over direct or captive hotel booking portals.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US online accommodation market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Expedia.com

- Agoda.com

- Hotels.com

- Orbitz.com

- Priceline.com

- Booking.com

- Airbnb.com

- Tripadvisor.com

- Hotwire

- Laterooms.com

- HRS.com

- Others

Recent Developments:

- In September 2023, Philippine Airlines introduced PAL Holidays powered by Expedia Group, a one-stop travel website that provides travelers with a seamless and complete platform for all their travel requirements. The new website is now live in the US, Canada, Australia, and the Philippines. The new platform is driven by Expedia Group's White Label Template technology. It is created to assist travelers easily organize and arranging the whole trip, such as PAL flights, accommodations, transports, and fun travel activities, in a single convenient place.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA Online Accommodation market based on the below-mentioned segments:

United States Online Accommodation Market, By Platform Type

- Mobile application

- Website

United States Online Accommodation Market, By Mode of Booking Type

- Third-party online portal

- Direct/Captive portals

Need help to buy this report?