United States Olive Oil Market Size, Share, and COVID-19 Impact Analysis, By Type (Refined, Virgin, Extra Virgin, and Others), By Packaging (Bottles, Pouches, and Cans), and United States Olive Oil Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Olive Oil Market Insights Forecasts to 2035

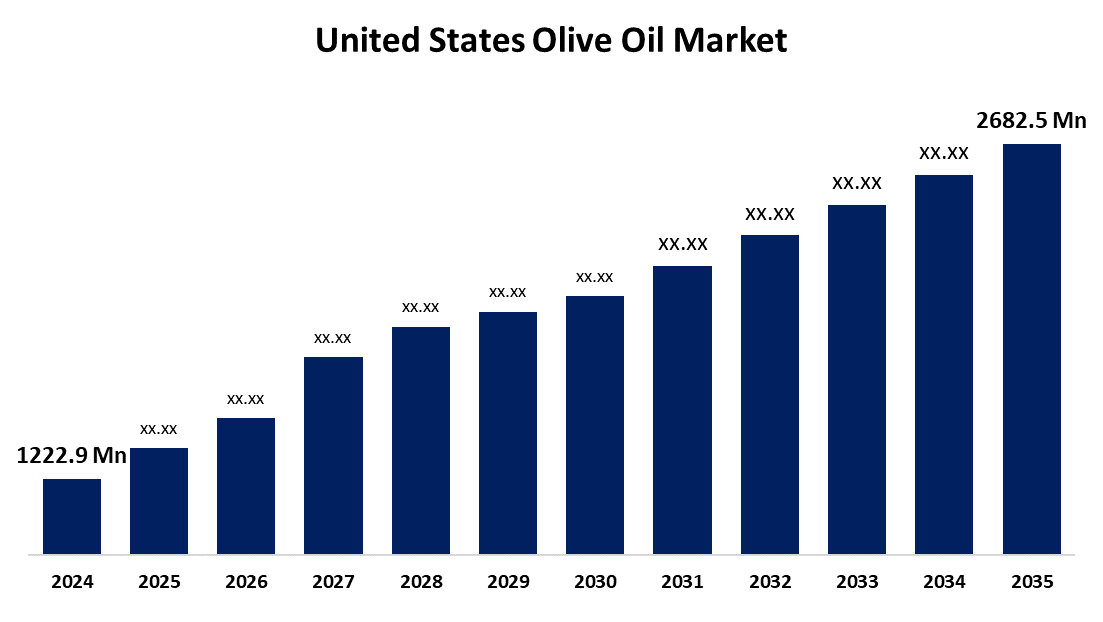

- The US Olive Oil Market Size Was Estimated at USD 1222.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.4% from 2025 to 2035

- The US Olive Oil Market Size is Expected to Reach USD 2682.5 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Olive Oil Market is Anticipated to Reach USD 2682.5 Million by 2035, Growing at a CAGR of 7.4% from 2025 to 2035. The expansion of the United States olive oil market is propelled by growing knowledge of the Mediterranean diet's beneficial effects on health.

Market Overview

Olive oil is a vegetable oil that is extracted from the fruit of the olive tree (Olea europaea). The increased popularity of olive oil has been enhanced by the support of doctors and medical professionals, and coverage by the media, appealing to a larger audience than solely health-conscious consumers. Olive oil is being well promoted by cooking shows, food blogs, and celebrity chefs, therefore being adopted by all homes as fashionable. The trend for consumers to adopt a healthy lifestyle has put a seismic shift in accepting healthier oils. Recently, consumers have started adopting healthy food options by adding healthy vegetable oils to combat lifestyle-related health issues. Olive fruit oil is a healthy oil and recognized for several health benefits, and is being accepted by an expanding number of consumers. Moreover, food franchisees have also begun adding olive oil-infused food products to the menu to cater to consumer practices. For example, in February 2023, Starbucks announced the introduction of three new coffee varieties, all containing olive as an ingredient, at first featured in Starbucks locations. The rise in reported cardiovascular-related episodes and the rise in obesity can be attributed to a sedentary and stressful lifestyle in society.

Report Coverage

This research report categorizes the market for the United States olive oil market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States olive oil market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States olive oil market.

United States Olive Oil Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1222.9 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.4% |

| 2035 Value Projection: | USD 2682.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Type, By Packaging and COVID-19 Impact Analysis. |

| Companies covered:: | Conagra Brands Inc, Cargill, Pompeian, Inc, Colavita USA, LLC, STAR Fine Foods, Goya Foods, Inc., California Olive Ranch Inc., Olivina, LLC, Botticelli Foods LLC and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States olive oil market is boosted by the demand for MUFA-rich fats and oils, which has increased several-fold due to consumer knowledge of their health benefits. In the last few months, a slew of clinical studies has indicated that omega-3-improved consumption can bolster studies on heart health and other body systems, which has dramatically increased consumer demand for high omega-3 levels in olive fruit oil, as their appreciation grew for the importance of essential fatty acids, which are vital for health. Because olive oils contain beneficial fatty acids with antioxidants and vitamins, olive oil has gained significant appeal as a healthy oil.

Restraining Factors

The United States olive oil market faces obstacles, like the price of which is a considerably high barrier to entry for its growth potential, because consumers will start to develop low-cost alternatives with comparable nutritional content.

Market Segmentation

The United States olive oil market share is classified into type and packaging.

- The refined segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States olive oil market is segmented by type into refined, virgin, extra virgin, and others. Among these, the refined segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by a range of metrics, including health trends, cooking trends. As many health-conscious consumers seek alternatives to traditional oils, the lower acidity and neutral flavor profile of refined olive oil make it the perfect alternative. Health studies that mention the health benefits of olive oil, such as those promoting its monounsaturated fats, which can reduce heart disease risk, have led to heightened consumer interest.

- The bottles segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the packaging, the United States olive oil market is segmented into bottles, pouches, and cans. Among these, the bottles segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by its convenience and storage, as it has become a fixture in many households due to its ease of use when cooking, dressing, and finishing. The benefits of olive oil, specifically its heart-healthy monounsaturated fats and antioxidant properties, are increasing its ease of use among consumers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States olive oil market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Conagra Brands Inc

- Cargill

- Pompeian, Inc

- Colavita USA, LLC

- STAR Fine Foods

- Goya Foods, Inc.

- California Olive Ranch Inc.

- Olivina, LLC

- Botticelli Foods LLC

- Others

Recent Development

- In March 2024, California Olive Ranch (COR), a leading producer of extra virgin olive oil (EVOO) and related types, launched its new Chef's Bottless, designed to provide a versatile and user-friendly option for enjoying high-quality EVOO in everyday cooking. This type follows COR's recent expansions, which include a 100% California EVOO Bag-in-Box and a recyclable aluminum bottles line. The Chef's Bottles offers improved pouring control and reflects the brand's dedication to California's stringent quality standards, which are recognized as the highest in the world for EVOO.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States olive oil market based on the following segments:

United States Olive Oil Market, By Type

- Refined

- Virgin

- Extra Virgin

- Others

United States Olive Oil Market, By Packaging

- Bottles

- Pouches

- Cans

Need help to buy this report?