United States Oil Refining Market Size, Share, and COVID-19 Impact Analysis, By Complexity Type (Topping, Hydro-Skimming, Conversion, Deep Conversion), By Product Type (Light Distillates, Middle Distillates, Fuel Oil, Others), By Fuel Type (Gasoline, Gasoil, Kerosene, LPG, Others), By Application (Transportation, Aviation, Marine Bunker, Petrochemical, Residential & Commercial, Agriculture, Electricity, Rail & Domestic Waterways, Others), and United States Oil Refining Market Insights Forecasts to 2033

Industry: Energy & PowerUnited States Oil Refining Market Insights Forecasts to 2033

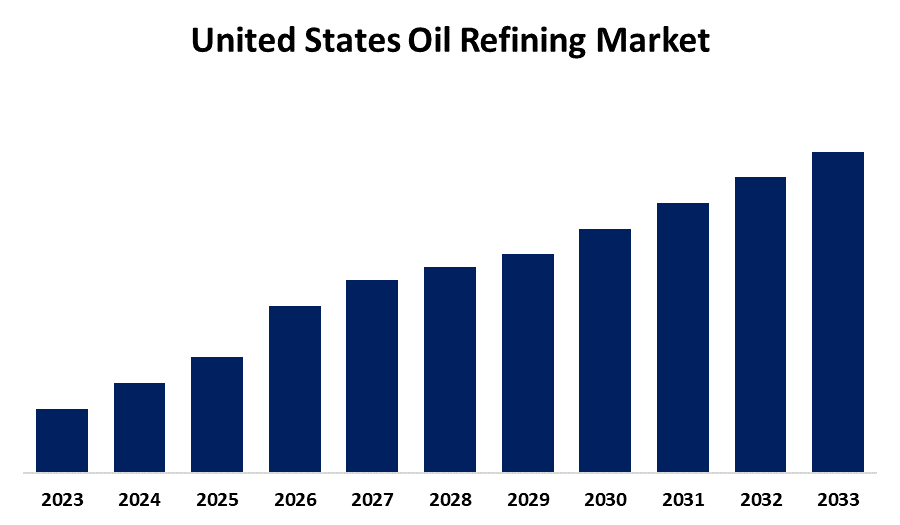

- The Market Size is Growing at a CAGR of 3.5% from 2023 to 2033.

- The United States Oil Refining Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The United States Oil Refining Market Size is expected to Hold a Significant Share by 2033, at a CAGR of 3.5% during the forecast period 2023 to 2033.

Market Overview

The United States oil refining market is a critical component of the country's energy landscape, distinguished by its significant capacity and strategic importance. It represents one of the world's largest refining sectors, with a diverse range of facilities strategically located throughout the country. These refineries, which boast cutting-edge technologies and infrastructure, not only meet domestic demand but also play an important role in global energy markets. The market's resilience and growth are the result of a number of factors, including strong consumption patterns, evolving regulatory frameworks, technological innovations, and strategic investments in upgrading existing facilities. Furthermore, the sector's adaptability to fluctuating crude oil prices and ability to refine a wide range of crude oil grades position the United States as a key player in the global energy landscape, influencing not only regional but also international energy dynamics.

Report Coverage

This research report categorizes the market for United States oil refining market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States oil refining market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States oil refining market.

United States Oil Refining Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.5% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Complexity Type, By Product Type, By Fuel Type, By Application |

| Companies covered:: | Exxon Mobil Corporation, Chevron Corporation, Phillips 66 Company, Marathon Petroleum Corporation, Valero Energy Corporation, Royal Dutch Shell PLC (Shell Oil Company), BP America Inc., ConocoPhillips Company, PBF Energy Inc., HollyFrontier Corporation and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The interaction of domestic consumption patterns and dynamics is the primary driver of the trajectory of the United States oil refining market. Domestically, the country's vast and diverse energy requirements provide a significant market for refined petroleum products. Gasoline for transportation, heating oil, and petrochemicals for various industries are all in high demand. Furthermore, the United States' position as a major player means that its refining industry is inextricably linked to demand trends. Emerging economies' growing appetite for energy, particularly in Asia, drives demand for refined products sourced from United States refineries. As a result, fluctuations in domestic consumption and international market demand have a significant impact on the industry's growth and strategic decisions. Another important factor influencing the United States oil refining market is the ongoing advancement of refining technologies and processes. Technological advancements play an important role in improving refining efficiency, lowering environmental impact, and enabling the production of higher-quality refined products.

Restraining Factors

Clean fuels are more environmentally friendly than regular gasoline because they produce fewer hydrocarbons overall and emit fewer hazardous and reactive ones. Furthermore, harmful and ozone-forming hydrocarbon emissions from automobiles powered by electricity, natural gas, or alcohol can be up to 90% lower than those from conventional gasoline vehicles. Clean fuels may also help to reduce the accumulation of carbon dioxide in the atmosphere, a 'greenhouse gas' that contributes to the possibility of global warming. Carbon dioxide is produced during the combustion of any carbon-based fuel.

Market Segment

- In 2023, the topping segment accounted for the largest revenue share over the forecast period.

Based on the complexity type, the United States oil refining market is segmented into topping, hydro-skimming, conversion, and deep conversion. Among these, the topping segment has the largest revenue share over the forecast period. Topping Refineries concentrate on the early stages of crude oil processing, producing lighter petroleum products such as gasoline, diesel, and jet fuel. These facilities are strategically located to process lower-cost, less complex crude oils, allowing for faster and more efficient refining operations. Several factors contribute to this dominance, such as the relative ease and cost-effectiveness of processing crude oil with fewer heavy components, which aligns with market demand for lighter, high-demand petroleum products.

- In 2023, the middle distillates segment accounted for the largest revenue share over the forecast period.

Based on the product type, the United States oil refining market is segmented into light distillates, middle distillates, fuel oil, and others. Among these, the middle distillates segment has the largest revenue share over the forecast period. Middle distillates include a variety of refined petroleum products such as diesel, jet fuel, and heating oil, which are essential for transportation, industry, and residential use. This dominance is due to a number of factors, including the long-term demand for diesel fuel in the transportation sector and the critical role of jet fuel in aviation. The increase in commercial transportation and freight movements, combined with ongoing industrial activity, has consistently driven demand for diesel, a key component of middle distillates.

- In 2023, the transportation segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States oil refining market is segmented into transportation, aviation, marine bunker, petrochemical, residential & commercial, agriculture, electricity, rail & domestic waterways, and others. Among these, the transportation segment has the largest revenue share over the forecast period. The Transportation sector includes a wide range of refined petroleum products such as gasoline, diesel, and jet fuel, which are essential for vehicle operations on roads, railways, and in aviation. The segment's dominance is based on the widespread use of gasoline-powered vehicles and the critical role of diesel in commercial trucks and freight transportation. Despite ongoing shifts to electric vehicles, infrastructure and consumer adoption rates continue to support gasoline and diesel demand in the transportation sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States oil refining market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Exxon Mobil Corporation

- Chevron Corporation

- Phillips 66 Company

- Marathon Petroleum Corporation

- Valero Energy Corporation

- Royal Dutch Shell PLC (Shell Oil Company)

- BP America Inc.

- ConocoPhillips Company

- PBF Energy Inc.

- HollyFrontier Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2023, EcoRefine, a leading refining corporation, launched a comprehensive sustainability initiative to demonstrate its commitment to environmental responsibility and regulatory compliance. The initiative entails implementing environmentally friendly practices, strict emission control measures, and investing in renewable energy integration throughout its refining operations. EcoRefine's commitment to sustainability reflects the growing importance of environmental stewardship in the United States Oil Refining Market, demonstrating a commitment to both ethical practices and regulatory compliance.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States oil refining market based on the below-mentioned segments:

United States Oil Refining Market, By Complexity

- Topping

- Hydro-Skimming

- Conversion

- Deep Conversion

United States Oil Refining Market, By Product Type

- Light Distillates

- Middle Distillates

- Fuel Oil

- Others

United States Oil Refining Market, By Fuel Type

- Gasoline

- Gasoil

- Kerosene

- LPG

- Others

United States Oil Refining Market, By Application

- Transportation

- Aviation

- Marine Bunker

- Petrochemical

- Residential & Commercial

- Agriculture

- Electricity

- Rail & Domestic Waterways

- Others

Need help to buy this report?