United States Nylon Monofilament Market Size, Share, and COVID-19 Impact Analysis, By Application (Fishing Nets, Sewing Yarns, Surgical Sutures, Toothbrushes, Filter Fabrics, Sports Equipment, and Industrial Brushes), By End-Use Industry (Automotive, Construction, Medical, Consumer Products, and Industrial Machinery), and United States Nylon Monofilament Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Nylon Monofilament Market Insights Forecasts to 2035

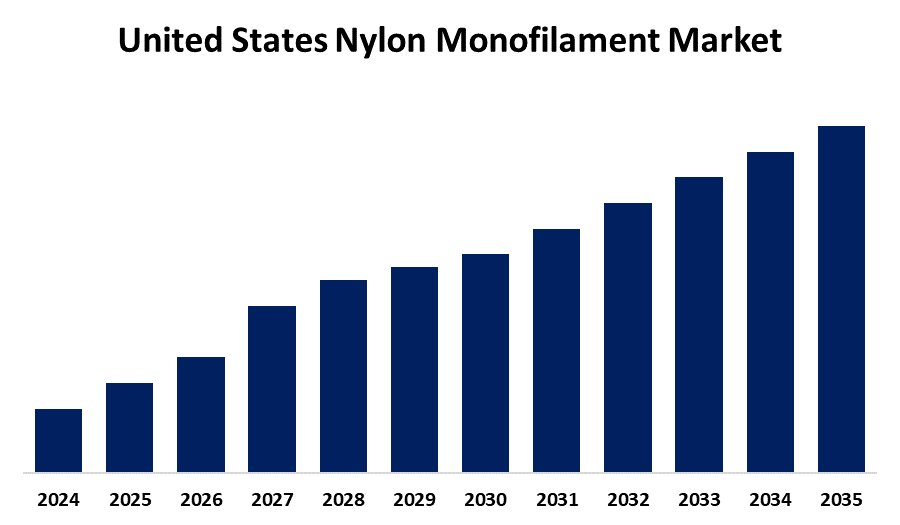

- The USA Nylon Monofilament Market Size is Expected to Grow at a CAGR of around 5.4% from 2025 to 2035.

- The United States Nylon Monofilament Market Size is Expected to Hold a Significant Share by 2035.

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the U.S. Nylon Monofilament Market Size is Expected to Hold a Significant Share by 2035, Growing at a CAGR of 5.4% from 2025 to 2035. The U.S. nylon monofilament market is growing due to rising demand for durable, lightweight materials across industries like fishing, automotive, and healthcare. Technological advancements, increased industrial use, and expanding medical and consumer markets further drive growth, supported by innovation and sustainability initiatives.

Market Overview

The United States nylon monofilament market refers to the production and application of single-strand nylon fibers used across various industries, including fishing, automotive, medical, consumer goods, and industrial manufacturing. Nylon monofilaments are known for their high tensile strength, durability, flexibility, and resistance to abrasion, moisture, and chemicals. Key market drivers include growing demand for strong, lightweight, and long-lasting materials, advancements in extrusion technology, and increased usage in healthcare and industrial sectors. The market’s strengths lie in nylon’s versatility, cost-effectiveness, and compatibility with high-performance applications. Opportunities continue to emerge through innovations in biodegradable alternatives and eco-friendly manufacturing processes. The rising popularity of monofilaments in 3D printing and medical applications also presents strong growth potential. Moreover, government initiatives promoting sustainable materials and investment in advanced manufacturing technologies further support the market. With increasing awareness of product performance and expanding industrial needs, the U.S. nylon monofilament market is poised for steady growth, backed by ongoing innovation, favourable regulatory support, and the versatility of nylon in both consumer and industrial applications.

Report Coverage

This research report categorizes the market for the United States nylon monofilament market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States nylon monofilament market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States nylon monofilament market.

United States Nylon Monofilament Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.4% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 140 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Application, By End-Use Industry and COVID-19 Impact Analysis |

| Companies covered:: | Consolidated Cordage Corporation, Rocky Mount Cord Company, Inc., AstenJohnson, Berkley & Co., Inc., Advanced Fiber Solutions, Inc., Zeus Industrial Products, Inc., Netco Extruded Plastics, Inc., ABC Polymer Industries, LLC, Shakespeare Company, LLC, Fluorotherm Polymers, Inc., Albany International Corp., Cortland Line Co., Inc., Johnson Filaments, CSR, Inc., TEPHA, Inc. and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demand across industries like fishing, automotive, medical, and consumer goods, along with the nylon monofilaments, are valued for their strength, flexibility, and resistance to abrasion, chemicals, and moisture, making them a go-to choice in everything from fishing nets and surgical sutures to automotive parts and toothbrush bristles. Advances in manufacturing technology are also helping improve product quality and reduce production costs. Plus, the increasing focus on precision applications, especially in healthcare and industrial machinery, is opening new opportunities. The growing trend toward performance-based materials in end-use applications further drives the market, encouraging ongoing innovation and adoption.

Restraining Factors

Fluctuating prices of raw materials, especially petroleum-based nylon, can drive up manufacturing costs. There’s also growing concern about environmental impact, as nylon isn’t biodegradable. On top of that, competition from other materials like polyester and polypropylene, and strict regulations in certain industries, can slow down growth.

Market Segmentation

The United States nylon monofilament market share is classified into application and end-use industry.

- The fishing nets segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States nylon monofilament market is segmented by application into fishing nets, sewing yarns, surgical sutures, toothbrushes, filter fabrics, sports equipment, and industrial brushes. Among these, the fishing nets segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to nylon’s superior strength, flexibility, and resistance to abrasion and moisture. These properties make it ideal for commercial and recreational fishing applications. The country’s robust fishing industry and demand for durable, long-lasting nets further drive widespread adoption of nylon monofilament.

- The automotive segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States nylon monofilament market is segmented by end-use industry into automotive, construction, medical, consumer products, and industrial machinery. Among these, the automotive segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to its demand for lightweight, durable, and heat-resistant materials. Nylon monofilaments are used in applications such as filters, belts, and cable ties. Their strength, flexibility, and resistance to wear make them ideal for improving vehicle efficiency, performance, and longevity in modern automotive manufacturing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States nylon monofilament market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Consolidated Cordage Corporation

- Rocky Mount Cord Company, Inc.

- AstenJohnson, Berkley & Co., Inc.

- Advanced Fiber Solutions, Inc.

- Zeus Industrial Products, Inc.

- Netco Extruded Plastics, Inc.

- ABC Polymer Industries, LLC

- Shakespeare Company, LLC

- Fluorotherm Polymers, Inc.

- Albany International Corp.

- Cortland Line Co., Inc.

- Johnson Filaments

- CSR, Inc.

- TEPHA, Inc.

- Others

Recent Developments:

- In June 2024, ABC Polymer Industries recently introduced advanced nylon monofilaments tailored for 3D printing and high-strength industrial applications. These innovations were developed to meet the growing demand for durable and precise materials across various sectors. Additionally, the company rebranded its FiberForce division to FullForce, reflecting an expanded product line and an enhanced focus on performance and sustainability.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the U.S., regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States nylon monofilament market based on the below-mentioned segments:

United States Nylon Monofilament Market, By Application

- Fishing Nets

- Sewing Yarns

- Surgical Sutures

- Toothbrushes

- Filter Fabrics

- Sports Equipment

- Industrial Brushes

United States Nylon Monofilament Market, By End-Use Industry

- Automotive

- Construction

- Medical

- Consumer Products

- Industrial Machinery

Need help to buy this report?