United States Nylon Market Size, Share, and COVID-19 Impact Analysis, By Product (Nylon 6 and Nylon 66), By Application (Automobile, Electrical & Electronics, Engineering Plastics, Textile, and Others), and United States Nylon Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Nylon Market Insights Forecasts to 2035

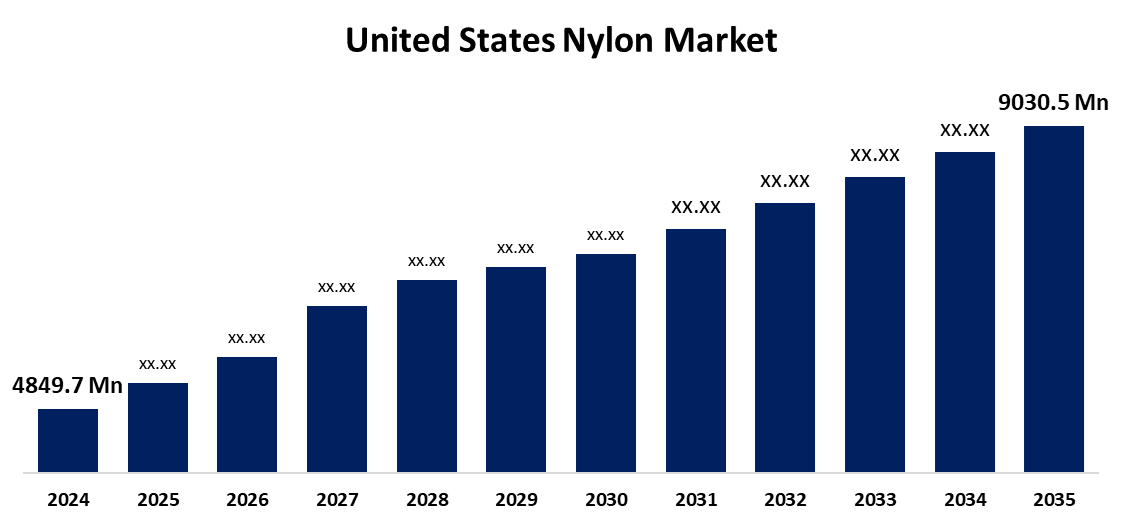

- The US Nylon Market Size Was Estimated at USD 4,849.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.81% from 2025 to 2035

- The US Nylon Market Size is Expected to Reach USD 9,030.5 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Nylon Market Size is anticipated to Reach USD 9,030.5 Million by 2035, Growing at a CAGR of 5.81% from 2025 to 2035. The expansion of the United States nylon market is propelled by mechanical parts, circuit boards, connections, and cable insulation.

Market Overview

Nylon is a synthetic polymer family of polyamides, characterized by long chains with repeating amide linkages, and has seen immense growth. A rise in US data in recent years is due to its many applications across all markets. Because of its strength, degradation resistance, and lifespan, nylon has become a key material in a multitude of applications, from textiles to automotive components. Due to its adaptability and moisture-wicking properties, nylon is widely used in the textile sector for apparel such as outerwear, hosiery, and active wear. Additionally, nylon is used in the automotive sector to produce parts, i.e., gears, bearings, and engine components, because of its impressive strength-to-weight ratio and thermal resistivity. One of the primary drivers of market demand in the United States is the growing use of nylon in consumer goods production. Nylon is lightweight and resistant to wear, and as a result, is a common material in everyday items like backpacks, luggage, and sporting goods. Demand is also increasing due to manufacturers creating sustainable alternatives with nylon from renewable resources, as more consumers are motivated by sustainability. Since nylon is used to create nylon fibres for carpets and rugs in bedrooms, the construction sector also contributes significantly to market demand.

Report Coverage

This research report categorizes the market for the United States nylon market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States nylon market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States nylon market.

United States Nylon Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,849.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.81% |

| 2035 Value Projection: | USD 9,030.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Product, By Application |

| Companies covered:: | AdvanSix Inc, Ascend Performance Materials, Huntsman Corp, DuPont, Nylon Corporation of America, Inc., Invista, Ashley Polymers, Inc., Goodfellow, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States nylon market is boosted by the automobile industry, which uses polyamide extensively because of its excellent processability, strength, and durability. The polymer can be used to create a variety of automotive parts because both making and extrusion are ways it can be processed. Polyamide is the go-to polymer for extreme conditions due to its features, including chemical and high-temperature resistance. As such of, polyamide is used to produce automotive parts that come in contact with high temperatures and fluids such as engine oils. Parts made from PA 6 & PA 6,6 materials are comparatively lighter compared to steel components. This factor can lead to huge increases in engine efficiency for conventional IC-powered vehicles.

Restraining Factors

The United States nylon market faces obstacles like plastic pollution. Non-degradable PA 6 and PA 6,6 plastics will remain in the environment for several years. The process of breaking down macroscopic plastics leads to microplastics, which also harm the environment because aquatic life consumes microplastics, facilitating pollution in the oceans.

Market Segmentation

The United States nylon market share is classified into product and application.

- The nylon 6 segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States nylon market is segmented by product into nylon 6 and nylon 66. Among these, the nylon 6 segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by PA 6's unique properties make it an economical alternative to steel, bronze, brass, gunmetal, aluminium, plastics, and rubbers. Because of these characteristics, producers of electrical protection devices will continue to seek to use PA 6 in their goods. Nylon 6 has had a variety of materials utilized in the past few years, demonstrating dependability, usefulness, and supporting the economics of price and performance.

- The automobile segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States nylon market is segmented into automobile, electrical & electronics, engineering plastics, textile, and others. Among these, the automobile segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by using nylon composites, making it possible to build automotive components that are more ecologically friendly and lighter in terms of weight. Such composites create automotive cooling systems, air intake manifolds, airbag canisters, hydraulic clutch lines, and headlamp bezels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States nylon market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AdvanSix Inc

- Ascend Performance Materials

- Huntsman Corp

- DuPont

- Nylon Corporation of America, Inc.

- Invista

- Ashley Polymers, Inc.

- Goodfellow

- Others

Recent Development

- In June 2023, Advansix, a U.S.-based company, announced the launch of a new product featuring 100% post-consumer and post-industrial recycled content nylon, namely Aegis Resins and Capran BOPA Films. This initiative is aimed at assisting customers in achieving their sustainability goals.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States nylon market based on the following segments:

United States Nylon Market, By Product

- Nylon 6

- Nylon 66

United States Nylon Market, By Application

- Automobile

- Electrical & Electronics

- Engineering Plastics

- Textile

- Othrs

Need help to buy this report?