United States Nitric Acid Market Size, Share, and COVID-19 Impact Analysis, By Application (Toluene Di-Isocyanate, Fertilizers, Adipic Acid, Nitrobenzene, and Others) and US Nitric Acid Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Nitric Acid Market Insights Forecasts to 2035

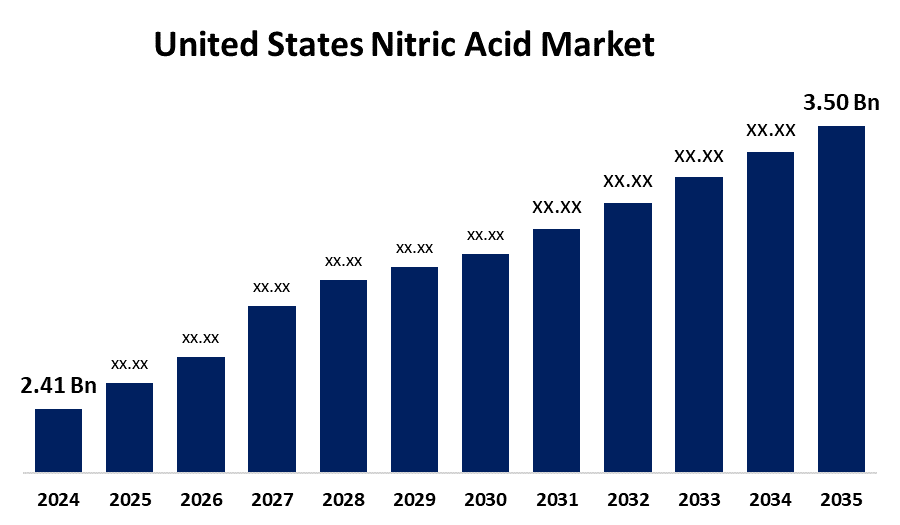

- The US Nitric Acid Market Size was Estimated at USD 2.41 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.45% from 2025 to 2035

- The USA Nitric Acid Market Size is Expected to reach USD 3.50 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Nitric Acid Market Size is Anticipated to Reach USD 3.50 Billion by 2035, Growing at a CAGR of 3.45% from 2025 to 2035. The market for nitric acid is growing as a result of rising agricultural demand, rising adipic acid production, and improvements in manufacturing technology.

Market Overview

The production, distribution, and consumption of nitric acid, a vital chemical used in fertilizers, explosives, metal processing, and chemical synthesis, are all included in the United States nitric acid market. This market is driven by both industrial advancements and agricultural demand. The chemical nitric acid (HNO3) is widely used for many purposes, such as making ammonium nitrate for explosives and fertilizers. It is also employed in the dye and explosive industries as a nitrating agent for aromatic and paraffin derivatives. The main ingredient in nitration, which is the process of adding a nitro group to an organic molecule or replacing a hydrogen atom with the nitro group, is nitric acid. Nitric acid is a strong-smelling, transparent, yellow liquid that is created when ammonia oxidizes on platinum webs to produce nitrous gases like NO2. After these gases are absorbed in water, a rectification process produces 99% concentrated nitric acid (C-NA) and weak nitric acid (W-NA) up to 68% (azeotrope). The demand for lightweight vehicles has driven manufacturers to innovate and advance in the automotive industry, creating high consumption opportunities for HNO3. This product is used to create adipic acid, which is then used to make nylon. Manufacturers are shifting to polymer composites like nylon for weight reduction and improved fuel capacity. Government regulations and rising consumer demand are driving the market growth owing to fuel-efficient and cost-effective automobile solutions.

Report Coverage

This research report categorizes the market for the US nitric acid market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US nitric acid market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US nitric acid market.

United States Nitric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.41 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.45% |

| 2035 Value Projection: | USD 3.50 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Application, and COVID-19 Impact Analysis. |

| Companies covered:: | Enaex S.A., EuroChem Group, Omnia Holdings Limited, CF Industries Holdings, Inc., BASF SE, Sasol, LSB Industries, Dyno Nobel, and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

In the agricultural sector, nitric acid is essential because it is used to make fertilizers such as nitro phosphate, potassium nitrate, calcium ammonium nitrate, and ammonium nitrate. The use of bio-based fertilizers is a result of the rising demand for high-quality, organic food. Growing construction activity also helps the market because polyurethane foams, wood and floor coatings, and insulation materials all use toluene di-isocyanate (TDI) and HNO3 intermediate. The textile industry's growing need for dye is another factor propelling market expansion. The demand for plastic products rises as a result of the growing population and product cycle, including fishing lines, tents, gloves, wear pads, and toothbrushes. These applications make use of nylon 6, a versatile polymer that produces nitric acid and has good thermal stability, flame resistance, and a high melting point, and drives the market growth.

Restraining Factors

Nitric acid, a hazardous compound, poses health and environmental risks such as diarrhoea, abdominal pain, throat infection, and increases the acidity level in the soil which may impede the growth of the market.

Market Segmentation

The USA nitric acid market share is classified into application.

- The fertilizers segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US nitric acid market is segmented by application into toluene di-isocyanate, fertilizers, adipic acid, nitrobenzene, and others. Among these, the fertilizers segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the rising demand for the agricultural sector, government initiatives, and the growing trend for nitrogen-based fertilizers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US nitric acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Enaex S.A.

- EuroChem Group

- Omnia Holdings Limited

- CF Industries Holdings, Inc.

- BASF SE

- Sasol

- LSB Industries

- Dyno Nobel

- Others

Recent Developments:

- In March 2025, ThyssenKrupp USA is a holding for the U.S. based operations of ThyssenKrupp companies, headquartered in Troy, Michigan. Gujarat Narmada Valley Fertilizers & Chemicals Ltd. has awarded ThyssenKrupp Uhde a contract for the construction of a Weak Nitric Acid (WNA-III) Plant in Bharuch, Gujarat, India. The plant, one of India's largest, will use Uhde's EnviNOx® technology to reduce greenhouse gas emissions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US nitric acid market based on the below-mentioned segments:

US Nitric Acid Market, By Application

- Toluene Di-Isocyanate

- Fertilizers

- Adipic Acid

- Nitrobenzene

- Others

Need help to buy this report?