United States Near Infrared Imaging Market Size, Share, and COVID-19 Impact Analysis, By Product (Near Infrared Fluorescence Imaging Systems and Near Infrared Fluorescence & Bioluminescence Imaging Systems), By Application (Preclinical Imaging, Medical Imaging, and Clinical Imaging), By End-User (Hospitals and Clinics, Research Laboratories), and United States Near Infrared Imaging Market Insights Forecasts to 2033

Industry: HealthcareUnited States Near Infrared Imaging Market Insights Forecasts to 2033

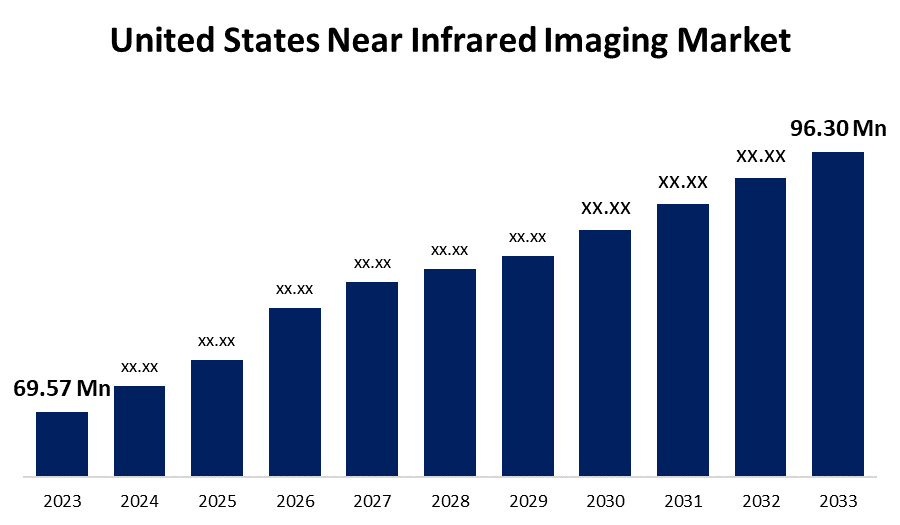

- The United States Near Infrared Imaging Market Size was valued at USD 69.57 Million in 2023.

- The Market Size is Growing at a CAGR of 3.3% from 2023 to 2033.

- The United States Near Infrared Imaging Market Size is Expected to Reach USD 96.30 Million by 2033.

Get more details on this report -

The United States Near Infrared Imaging Market Size is expected to reach USD 96.30 Million by 2033, at a CAGR of 3.3% during the forecast period 2023 to 2033.

Market Overview

Near-Infrared (NIR) Imaging examines the concentration and oxygenation of hemoglobin in the brain, muscle, and other tissues using near infrared light between 650 and 950 nm. The diagnostic tool detects changes caused by disease, injury, or brain activity. NIR can be used to supplement functional magnetic resonance imaging (fMRI) in brain studies because it measures both oxygenated and deoxygenated haemoglobin concentrations. Near-infrared imaging is increasingly being used in cancer research, joint diseases, major neurological diseases, and other areas. Despite technological advancements and the growing popularity of advanced optical methodologies such as NIR, there are still limitations associated with its implementation, such as the lack of awareness or skill required for system operation.

Report Coverage

This research report categorizes the market for United States near infrared imaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States near infrared imaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States near infrared imaging market.

United States Near Infrared Imaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 69.57 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.3% |

| 2033 Value Projection: | USD 96.30 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application, By End-User, and COVID-19 Impact Analysis. |

| Companies covered:: | Hamamatsu Photonics K.K., Karl Storz Se & Co. Kg, Li-Cor, Inc., Medtronic PLC., Perkinelmer Inc., Shimadzu Corporation, Stryker, Zeiss. and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The frequency and incidence of a number of diseases, including cardiovascular diseases, cancer, neurovascular disorders, and gastrointestinal diseases, are on the rise, which is contributing to an increase in the number of surgical procedures performed. Trauma patients and people who get surgical aesthetic work done are also contributing factors to the surge in surgical treatment options. Intraoperative imaging with NIR technology is utilized for a wide variety of surgical procedures, including plastic and reconstructive surgeries, cancer surgeries, cardiothoracic surgeries, cardiovascular surgeries, gastrointestinal surgeries, and neurovascular surgeries. Major competitors can capitalize on high-growth possibilities in developing economies. In spite of the fact that the cost of doing business is a challenge in these emerging countries, the enormous population bases that they boast offer a market for imaging technologies that are likely to be sustained. Patients in emerging economies are also being encouraged to spend more money on high-quality healthcare services, which is encouraging participants to expand their involvement in these emerging markets.

Restraining Factors

Only methylene blue and indocyanine green (ICG), which received FDA approval for clinical application in 1959, are NIR fluorophores. ICG and MB are blood pool agents, however, and as such are not the best fluorophores for fluorescence image-guided operations because they are neither specific for malignancies nor healthy tissues. Because the degree of molecular absorption into the target and nearby normal tissues differs, the visibility of the target tissues mostly depends on the usefulness of fluorescent agents.

Market Segment

- In 2023, the medical imaging segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States near infrared imaging market is segmented into preclinical imaging, medical imaging, and clinical imaging. Among these, the medical imaging segment has the largest revenue share over the forecast period. The near infrared imaging process uses ear infrared light between 650 and 950 nm to non-invasively probe hemoglobin concentration and oxygenation in the brain, muscle, and other tissues. It is used to detect a variety of medical conditions, such as changes caused by brain activity, injury, or disease.

- In 2022, the near infrared fluorescence imaging systems segment accounted for the largest revenue share over the forecast period.

Based on the product, the United States near infrared imaging market is segmented into near infrared fluorescence imaging systems and near infrared fluorescence & bioluminescence imaging systems. Among these, the near infrared fluorescence imaging systems segment has the largest revenue share over the forecast period. The potential of near-infrared fluorescence (NIRF) molecular imaging as a new "point-of-care" medical imaging modality is enormous. It can provide nuclear medicine techniques' sensitivity. A variety of NIRF imaging device designs have recently emerged on the market. They have also been used in non-invasive and intraoperative investigational clinical studies using indocyanine green (ICG) as a non-targeting NIRF contrast agent to delineate the blood and lymphatic vasculatures.

- In 2022, the hospitals & clinics segment accounted for the largest revenue share over the forecast period.

Based on the end user, the United States near infrared imaging is segmented into hospitals & clinics, and research laboratories. Among these, the hospitals & clinics segment has the largest revenue share over the forecast period. In-hospital and clinic settings, near infrared imaging is used for non-invasive monitoring and diagnosis of patients who may require surgical intervention. It aids in the provision of information about the oxygen saturation of hemoglobin within the microcirculation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States near infrared imaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hamamatsu Photonics K.K.

- Karl Storz Se & Co. Kg

- Li-Cor, Inc.

- Medtronic PLC.

- Perkinelmer Inc.

- Shimadzu Corporation

- Stryker

- Zeiss.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In April 2022, Medtronic joined forces with GE Healthcare, a producer and distributor of diagnostic imaging agents and radiopharmaceuticals for imaging modalities. The collaboration focused on care demands and needs at Office-Based Laboratories (OBLs) and Ambulatory Surgery Centers (ASCs). Customers will have access to extensive financial solutions, product portfolios, and exceptional service as a result of this collaboration, which will improve clinical outcomes, workflow, and efficiency for ASCs and OBLs.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States near infrared imaging market based on the below-mentioned segments:

United States Near Infrared Imaging Market, By Product

- Near Infrared Fluorescence Imaging Systems

- Near Infrared Fluorescence & Bioluminescence Imaging Systems

United States Near Infrared Imaging Market, By Application

- Preclinical Imaging

- Medical Imaging

- Clinical Imaging

United States Near Infrared Imaging Market, By End-User

- Hospitals and Clinics

- Research Laboratories

Need help to buy this report?