United States Naphthalene Market Size, Share, and COVID-19 Impact Analysis, By Source (Coal Tar and Petroleum), By Application (Phthalic Anhydride, Naphthalene Sulfonates, Low-Volatility Solvents, Moth Repellent, Pesticides, and Other), and United States Naphthalene Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Naphthalene Market Insights Forecasts to 2035

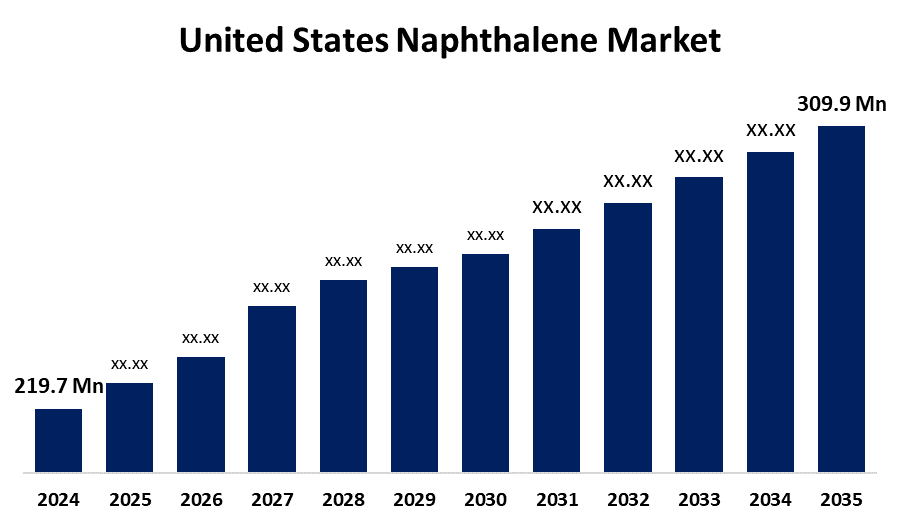

- The US Naphthalene Market Size Was Estimated at USD 219.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.18% from 2025 to 2035

- The US Naphthalene Market Size is Expected to Reach USD 309.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Naphthalene Market Size is anticipated to reach USD 309.9 Million by 2035, growing at a CAGR of 3.18% from 2025 to 2035. The expansion of the United States naphthalene market is propelled by increasing usage as a plasticiser in several concrete admixtures, particularly naphthalene sulfonate formaldehyde, in the building sector.

Market Overview

Naphthalene is a white, crystalline polycyclic aromatic hydrocarbon. The US naphthalene market is undergoing notable changes due to the growing demand from the coatings and plastics sectors. The market is seeing rising consumption as more manufacturers introduce naphthalene into the production of their various goods. The market is also undergoing a clear trend towards upgrading and eco-friendly chemical products, urging companies to lessen their environmental impact and innovate. Additionally, infrastructure growth and opportunities in the construction industry are creating flexible market opportunities for naphthalene, such as concrete additives. Moreover, companies are also not changing but primarily focusing on energy efficiency and renewable energy, which affects market dynamics as naphthalene is a significant chemical intermediate in the production of other specialty chemicals. Therefore, increased potential lies in raising investment in research and development to further expand the potential of naphthalene outside traditional production. For instance, companies in the United States are exploring ways to improve applications of naphthalene beyond traditional manufacturing processes and even developing new materials. The naphthalene industry, in particular, is being spurred on to adapt and innovate to expand possible applications as more strict environmental regulations have been introduced in the United States.

Report Coverage

This research report categorizes the market for the United States naphthalene market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States naphthalene market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States naphthalene market.

United States Naphthalene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 219.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.18% |

| 2035 Value Projection: | USD 309.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 116 |

| Segments covered: | By Source and By Application |

| Companies covered:: | ExxonMobil, Tulstar Products, Koppers Holdings Inc, Rain Carbon Inc., Huntsman Corporation, Evonik Corporation, BASF SE, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States naphthalene market is boosted because it is important as an intermediate chemical in a variety of products, including dyes, pigments, and surfactants. The increase in naphthalene use in the petrochemical sector has provided a crucial boost for the growth of the US naphthalene market. The US is one of the largest producers of, having experienced a resurgence since the shale gas boom. The petrochemical industry is expected to grow, which will increase the demand for naphthalene used in the production of plastics and polymers.

Restraining Factors

The United States naphthalene market faces obstacles like the volatility in feedstock prices, which influence the production economics and ultimately the market pricing of naphthalene, as crude oil and coal tar are processed to produce naphthalene.

Market Segmentation

The United States naphthalene market share is classified into source and application.

- The coal tar segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States naphthalene market is segmented by source into coal tar and petroleum. Among these, the coal tar segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the rising use of its in naphthalene from the textile industry for use in dyes and pigments. Also, use of coal tar naphthalene as a solvent in several industrial processes, and the growth in uses for coal tar naphthalene in manufacturing asphalt additives.

- The phthalic anhydride segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States naphthalene market is segmented into phthalic anhydride, naphthalene sulfonates, low-volatility solvents, moth repellent, pesticides, and others. Among these, the phthalic anhydride segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the increasing need for phthalic anhydride for the major application of naphthalene, commonly used in a production setting. It is further utilized as an intermediate in producing dyes, resins, insect repellents, and plasticizers. It is one of the most essential industrial chemicals used in the production of plastic plasticizers on a massive scale.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States naphthalene market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ExxonMobil

- Tulstar Products

- Koppers Holdings Inc

- Rain Carbon Inc.

- Huntsman Corporation

- Evonik Corporation

- BASF SE

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States naphthalene market based on the following segments:

United States Naphthalene Market, By Source

- Coal Tar

- Petroleum

United States Naphthalene Market, By Application

- Phthalic Anhydride

- Naphthalene Sulfonates

- Low-Volatility Solvents

- Moth Repellent

- Pesticides

- Others

Need help to buy this report?