United States Nanodiamonds Market Size, Share, and COVID-19 Impact Analysis, By Product (Detonation Nanodiamonds (DNDs), High-Pressure High-Temperature (HPHT) Nanodiamonds, Chemical Vapor Deposition (CVD) Nanodiamonds, and Others), By End-use (Healthcare & Pharmaceuticals, Automotive, Electronics, Industrial, Cosmetic, and Other), and United States Nanodiamonds Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUnited States Nanodiamonds Market Insights Forecasts to 2035

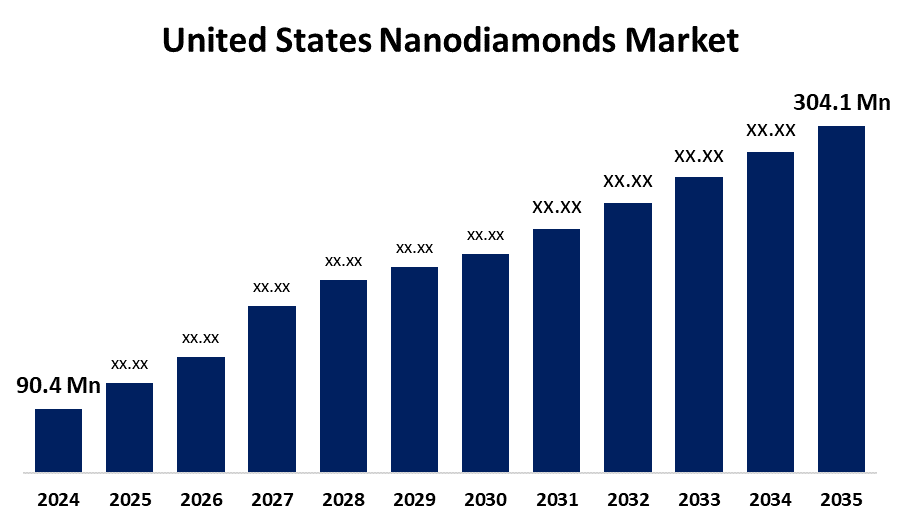

- The US Nanodiamonds Market Size Was Estimated at USD 90.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.66% from 2025 to 2035

- The US Nanodiamonds Market Size is Expected to Reach USD 304.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Nanodiamonds Market is anticipated to reach USD 304.1 million by 2035, growing at a CAGR of 11.66% from 2025 to 2035. The expansion of the United States nanodiamonds market is propelled by the growing need across numerous industries for high-performance materials. Nanodiamonds' remarkable mechanical qualities, including their high electrical, thermal, and hardness conductivity.

Market Overview

Nanodiamonds are incredibly tiny carbon-based nanoparticles, usually having a diameter of less than 100 nanometres. The industry is also seeing expansion with the demand for nanodiamonds in biomedical applications. Nanodiamonds show growing potential for use in medication delivery, imaging, and diagnostics because of their proven stability, biocompatibility, and ability to transport different bioactive compounds. Because of the continued focus of the healthcare and pharmaceutical sectors on finding more effective treatment options, there is a growth market for the use of nanodiamonds in biomedical applications due to the potential for increased therapeutic efficacy and medical outcomes. Rapid growth is projected within the nanodiamond market due to an increased investment in green or sustainable nanotechnology. The goal of green nanotechnology is to develop sustainable methods for producing nanodiamonds. Continued investigation into nanodiamonds potential for the creation of sustainable materials and environmental remediation is occurring. Given the high surface area and catalytic properties of nanodiamonds, they can be used in applications such as carbon capture, energy storage, and water purification.

The U.S. government has been actively promoting the market for nanodiamonds through programs meant to benefit national security, promote commercialisation, and advance research. A noteworthy instance is the partnership between Adamas Nanotechnologies, the University of California, Berkeley, and the Berkeley National Laboratory of the U.S. Department of Energy. This collaboration focuses on encasing nanodiamonds in water droplets to increase the precision of quantum sensing, a technique that has uses in environmental monitoring and defence.

Report Coverage

This research report categorizes the market for the United States nanodiamonds market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States nanodiamonds market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States nanodiamonds market.

United States Nanodiamonds Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 90.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.66% |

| 2035 Value Projection: | USD 304.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Columbus Nanoworks, Adamas Nanotechnologies, Inc., Pureon Inc., Strem Chemicals, Inc., Element Six, Cerion Nanomaterials, Diamon-Fusion International, NDB, Inc., Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States nanodiamonds market is boosted by the increased usage of these diamonds for biological imaging and diagnostics. The use of nanoparticles speeds up the diagnostic process by allowing rapid detection of disease, which leads to better diagnostic decisions and ultimately better treatment decisions in oncology. The increased use of nanodiamond-based biosensors that detect biomarkers of infectious disease or cancer helps the recognition of nanodiamonds in the early diagnostic processes. Technological developments would be supported by increases in government funding to the medical nanotechnology field and industry-academia collaborative approaches. These nascent programs are part of a larger effort to spur on biomedical innovations like nanodiamonds for use in diagnostics and imaging.

Restraining Factors

The United States nanodiamonds market faces obstacles like the competition from alternative nanomaterials. The field of alternative nanomaterials like graphene, carbon nanotubes, and silica-based nanoparticles puts a limit on many of the comparable advantages of usage, including medications, coatings, and electronic applications of nanodiamonds.

Market Segmentation

The United States nanodiamonds market share is classified into product and end-use.

- The detonation nanodiamonds segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States nanodiamonds market is segmented by product into detonation nanodiamonds (DNDs), high-pressure high-temperature (HPHT) nanodiamonds, chemical vapor deposition (CVD) nanodiamonds, and others. Among these, the detonation nanodiamonds segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by its incredible physical and chemical properties that make it suitable for a range of industries. DNDs could be used in coatings, lubricants, and composites as they offer unique hardness, exceptional thermal conductivity, and chemical stability through the controlled detonation of explosives.

- The healthcare & pharmaceuticals segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end-use, the United States nanodiamonds market is segmented into healthcare & pharmaceuticals, automotive, electronics, industrial, cosmetic, and other. Among these, the healthcare & pharmaceuticals segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the increasing usage of nanodiamond-based technologies in biomedicine, medical imaging, and drug delivery. DNDs have consequently gained a great deal of attention. DNDs have also found success as a delivery method for specific drugs due to their unique surface properties, chemical stability, and biocompatibility.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States nanodiamonds market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Columbus Nanoworks

- Adamas Nanotechnologies, Inc.

- Pureon Inc.

- Strem Chemicals, Inc.

- Element Six

- Cerion Nanomaterials

- Diamon-Fusion International

- NDB, Inc.

- Others

Recent Development

- In March 2023, NDB, Inc. introduced its innovative Nanodiamond Battery technology. This innovative battery is designed for energy generation by utilizing diamonds, the hardest known transducer materials, to harvest energy.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States nanodiamonds market based on the following segments:

United States Nanodiamonds Market, By Product

- Detonation Nanodiamonds (DNDs)

- High-Pressure High-Temperature (HPHT) Nanodiamonds

- Chemical Vapor Deposition (CVD) Nanodiamonds

- Others

United States Nanodiamonds Market, By End-use

- Healthcare & Pharmaceuticals

- Automotive

- Electronics

- Industrial

- Cosmetic

- Other

Need help to buy this report?