United States Nanocellulose Market Size, Share, and COVID-19 Impact Analysis, By Type (Cellulose Nanofibers, Bacterial Cellulose, and Crystalline Nanocellulose), By Application (Pulp & Paperboard, Composites, Pharmaceuticals & Biomedical, Electronics, Food & Beverages, and Others), and United States Nanocellulose Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Nanocellulose Market Size Insights Forecasts to 2035

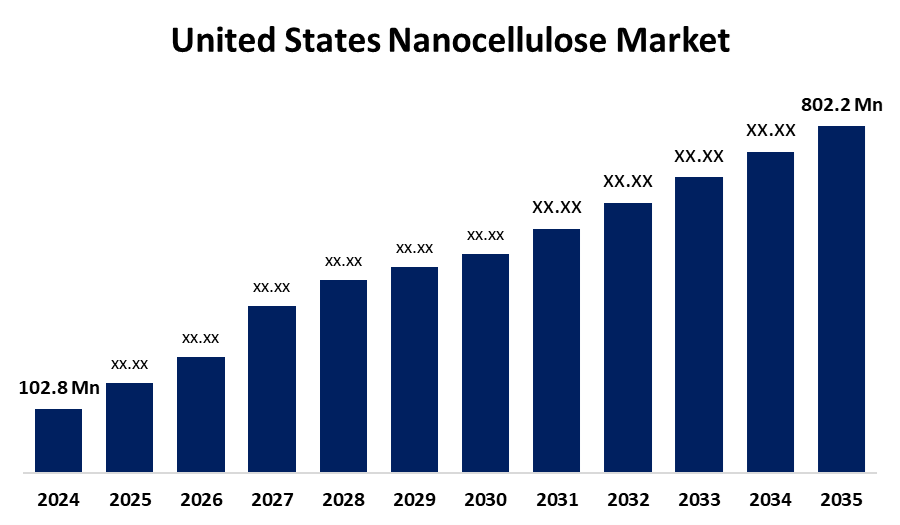

- The US Nanocellulose Market Size Was Estimated at USD 102.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 20.54% from 2025 to 2035

- The US Nanocellulose Market Size is Expected to Reach USD 802.2 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Nanocellulose Market Size is anticipated to reach USD 802.2 million by 2035, growing at a CAGR of 20.54% from 2025 to 2035. The expansion of the United States nanocellulose market is propelled by the product demand, including the growing need for a variety of applications and the changing trend towards the use of bio-based products.

Market Overview

Nanocellulose refers to the cellulose compounds that come from natural sources such as bacteria, algae, plants, or marine life and have at least one dimension in the nanometre range (1–100 nm). The main reason behind the growth of the US industry is increasing sustainability and environmental awareness. Because companies are exploring environmentally friendly and renewable substitutes to conventional materials, nanocellulose, directly sourced from renewable materials like wood pulp, is represented as a sustainable alternative. Also, the rapid pace of technological innovations and ongoing research in nanotechnology has propelled the market. New developments related to the extraction and processing steps have enhanced the ability to produce and use nanocellulose. Furthermore, the main contributor to market impact emanates from the paper and packaging industry. In this sector, demand is propelled by the uptick in need for high-performance and environmentally conscious packaging that also improves the mechanical strength and barrier properties of paper and cardboard. The demand arising from pharmaceuticals and biomedicals is also impacting the market.

The USDA-owned U.S. Forest Service has spearheaded the commercialisation of nanocellulose through its Forest Products Laboratory (FPL) Pilot Plant, the nation's first operating facility devoted to wood-derived nanomaterials. This laboratory enables researchers to acquire and test nanocellulose on a practical scale, particularly for uses in construction, automotive, and lightweight composites.

Report Coverage

This research report categorizes the market for the United States nanocellulose market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States nanocellulose market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States nanocellulose market.

United States Nanocellulose Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 102.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 20.54% |

| 2035 Value Projection: | USD 802.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | American Process Inc, Forest Products Laboratory, University of Maine, Stora Enso, Nippon Paper Industries, Borregaard, Kruger Biomaterials, Sappi, UPM, Oji Holdings, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States nanocellulose market is boosted by the increasing demand for eco-friendly and sustainable materials. Both producers and consumers are becoming more environmentally conscious, leading the way for biodegradable and renewable materials. In its 2018 report, the Environmental Protection Agency (EPA) stated that the US generated approximately 292.4 million tonnes of waste in 2018, which highlights the need for sustainable solutions across numerous industries. Organizations and associations are also supporting the transition to nanocellulose by actively promoting the use of renewable resources. It's projected that this push for renewable resources will encourage greater adoption of nanocellulose applications in construction, automotive, and packaging markets, therefore, growing the overall market at an accelerated rate.

Restraining Factors

The United States nanocellulose market faces obstacles like the limitations of suitable instrumental infrastructure. It's also expected that the low-cost substitutes will restrict the growth of the nanocellulose market throughout the forecast period.

Market Segmentation

The United States nanocellulose market share is classified into type and application.

- The cellulose segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States nanocellulose market is segmented by type into cellulose nanofibers, bacterial cellulose, and crystalline nanocellulose. Among these, the cellulose segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the product's improved tensile properties and availability. Generally, the cellulose bulk is mechanically and chemically treated to turn wood into MFC and NFC (Nano Fibrillated Cellulose). This is an easier path due to the availability of wood-based pulp.

- The pulp & paperboard segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States nanocellulose market is segmented into pulp & paperboard, composites, pharmaceuticals & biomedical, electronics, food & beverages, and others. Among these, the pulp & paperboard segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the rising consumer demand for goods packaged minimally and with no preservatives. Nanocellulose is a widely adopted sustainable nanomaterial additive in the paper industry due to many of its favorable properties, including high strength, good oxygen barrier properties, low density, mechanical properties, and excellent biocompatibility, compared to other bio-based resources.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States nanocellulose market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- American Process Inc

- Forest Products Laboratory

- University of Maine

- Stora Enso

- Nippon Paper Industries

- Borregaard

- Kruger Biomaterials

- Sappi, UPM, Oji Holdings

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States nanocellulose market based on the following segments:

United States Nanocellulose Market, By Type

- Cellulose Nanofibers

- Bacterial Cellulose

- Crystalline Nanocellulose

United States Nanocellulose Market, By Application

- Pulp & Paperboard

- Composites

- Pharmaceuticals & Biomedical

- Electronics

- Food & Beverages

- Others

Need help to buy this report?