United States Naloxone Market Size, Share, and COVID-19 Impact Analysis, By Strength (1 mg/ml, 0.4 mg/ml, 2.0 mg/0.1 ml and 4.0 mg/ml, Others), By Administration (Intranasal, Intramuscular/Subcutaneous, Intravenous), By Distribution Channel (Hospitals Pharmacies, Clinics Pharmacies, Retail Pharmacies, Others), and United States Naloxone Market Insights Forecasts to 2033

Industry: HealthcareUnited States Naloxone Market Size Insights Forecasts to 2033

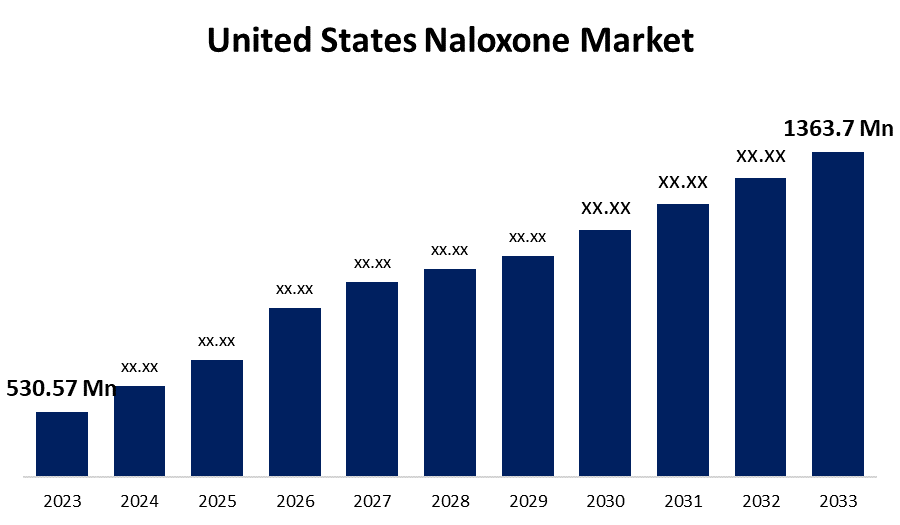

- The United States Naloxone Market Size was valued at USD 530.57 Million in 2023.

- The Market Size is Growing at a CAGR of 9.9% from 2023 to 2033.

- The United States Naloxone Market Size is Expected to Reach USD 1363.7 Million by 2033.

Get more details on this report -

The United States Naloxone Market Size is Expected to Reach USD 1363.7 Million by 2033, at a CAGR of 9.9% during the forecast period 2023 to 2033.

Market Overview

Naloxone is a medication that is used to reverse the effects of opioid overdose. It works by blocking the effects of opioids on the brain, which can restore breathing and consciousness. Naloxone is available in a variety of formulations, including injectable, nasal spray, and auto-injector. Naloxone, also recognized by its brand names Narcan or naxolene, is a medication designed for the swift reversal of opioid overdoses. Opioids encompass a wide spectrum, from prescription painkillers like oxycodone and hydrocodone to illicit substances such as heroin and the potent synthetic opioid, fentanyl. Naloxone's mechanism of action involves binding to the same brain receptors that opioids target, effectively blocking their effects. In doing so, it rapidly reverses life-threatening symptoms associated with overdose, notably the slowed breathing. Available in both injectable and nasal spray forms, naloxone is designed to be user-friendly and can be administered by individuals with basic training. This accessibility extends to family members, healthcare professionals, and first responders. Studies have consistently demonstrated the high effectiveness of naloxone in reversing opioid overdoses, making it a crucial tool in saving lives when administered promptly.

Report Coverage

This research report categorizes the market for United States naloxone market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States naloxone market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States naloxone market.

United States Naloxone Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 530.57 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 9.9% |

| 2033 Value Projection: | USD 1363.7 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Strength, By Administration, By Distribution Channel |

| Companies covered:: | Pfizer, West Ward Pharmaceuticals, Amneal Pharmaceuticals, Sandoz, ADAPT Pharma, Mylan, kaleo, Amphastar Pharmaceuticals, and other key companies. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The urgent need to mitigate the opioid crisis is driving the US naloxone market, with naloxone being a critical life-saving intervention for opioid overdoses. The rising rate of opioid abuse and overdoses across all demographics highlights the need for effective naloxone solutions. Additionally, efforts to improve naloxone accessibility through distribution programs and community initiatives help to drive market growth. Also, supportive legislative measures, such as expanding naloxone access and enacting good samaritan laws, foster a favorable environment for market development. Naloxone delivery system advancements, such as nasal sprays and auto-injectors, improve ease of use and effectiveness in emergencies. The incorporation of naloxone into addiction treatment combination therapies emphasizes its role in comprehensive opioid use disorder management. Moreover, naloxone administration training programs for first responders, law enforcement, and community members promote its widespread use.

Restraining Factors

There are several pricing and affordability challenges for naloxone products. Also, limiting naloxone access stigma associated with opioid use disorders. In addition, with variability in naloxone distribution and training across states. Hence, risky opioid behavior enabling concerns about naloxone.

Market Segment

- In 2023, the 1 mg/ml segment accounted for the largest revenue share over the forecast period.

Based on the strength, the United States naloxone market is segmented into 1 mg/ml, 0.4 mg/ml, 2.0 mg/0.1 ml and 4.0 mg/ml, and others. Among these, the 1 mg/ml segment has the largest revenue share over the forecast period. Due to it is the most generally available strength of naloxone for opioid overdose reversal because it is the most frequent available amount. The ability to reverse opioid overdoses, even those involving high opioid dosages, further emphasizes its critical role in lifesaving. Its adaptability in forms including nasal sprays, injectables, and auto-injectors also contributes to its appeal by meeting a variety of market administration preferences and emergency scenarios.

- In 2022, the intranasal segment accounted for the largest revenue share over the forecast period.

Based on the administration, the United States naloxone market is segmented into intranasal, intramuscular/subcutaneous, and intravenous. Among these, the intranasal segment has the largest revenue share over the forecast period. According to a naloxone market analysis conducted in the United States, intranasal administration entails administering naloxone via nasal spray. This route is particularly popular due to its simplicity, making it accessible to first responders, family members, and laypeople. It delivers naloxone in a non-invasive manner, making it suitable for community-based overdose response programs.

- In 2022, the hospitals pharmacies segment accounted for the largest revenue share over the forecast period.

Based on the distribution channel, the United States naloxone market is segmented into hospitals pharmacies, clinics pharmacies, retail pharmacies, and others. Among these, the hospitals pharmacies segment has the largest revenue share over the forecast period. Hospitals are also well-positioned to provide thorough naloxone delivery training to both their medical personnel and patients, supporting their crucial role in handling opioid overdose emergencies. According to the forecast for the United States naxolene market, hospital pharmacies play a critical role in supplying naloxone within healthcare institutions. They ensure that naloxone is easily accessible to medical personnel in emergency rooms, intensive care units, and other hospital settings. Hospitals are critical hubs for responding to severe opioid overdoses, and having naloxone on hand is critical in these settings.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States naloxone market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer

- West Ward Pharmaceuticals

- Amneal Pharmaceuticals

- Sandoz

- ADAPT Pharma

- Mylan

- kaleo

- Amphastar Pharmaceuticals

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In March 2023, Amphastar, announced that the United States Food and Drug Administration ("FDA") has approved its New Drug Application ("NDA") for naloxone hydrochloride nasal spray 4mg, which is delivered via the Company's proprietary nasal delivery device. Naloxone hydrochloride nasal spray 4mg is indicated for the emergency treatment of known or suspected opioid overdose in adult and pediatric patients, as manifested by respiratory and/or central nervous system depression.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States naloxone market based on the below-mentioned segments:

United States Naloxone Market, By Strength

- 1 mg/ml

- 0.4 mg/ml

- 2.0 mg/0.1 ml & 4.0 mg/ml

- Others

United States Naloxone Market, By Administration

- Intranasal

- Intramuscular/Subcutaneous

- Intravenous

United States Naloxone Market, By Distribution Channel

- Hospitals Pharmacies

- Clinics Pharmacies

- Retail Pharmacies

- Others

Need help to buy this report?