United States Myomectomy Market Size, Share, and COVID-19 Impact Analysis, By Product (Laparoscopic Sealer, Laparoscopic Power Morcellators, Harmonic Scalpel, and Others), By Type (Abdominal, Myomectomy, Hysteroscopic Myomectomy, and Laparoscopic Myomectomy), and United States Myomectomy Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Myomectomy Market Insights Forecasts to 2035

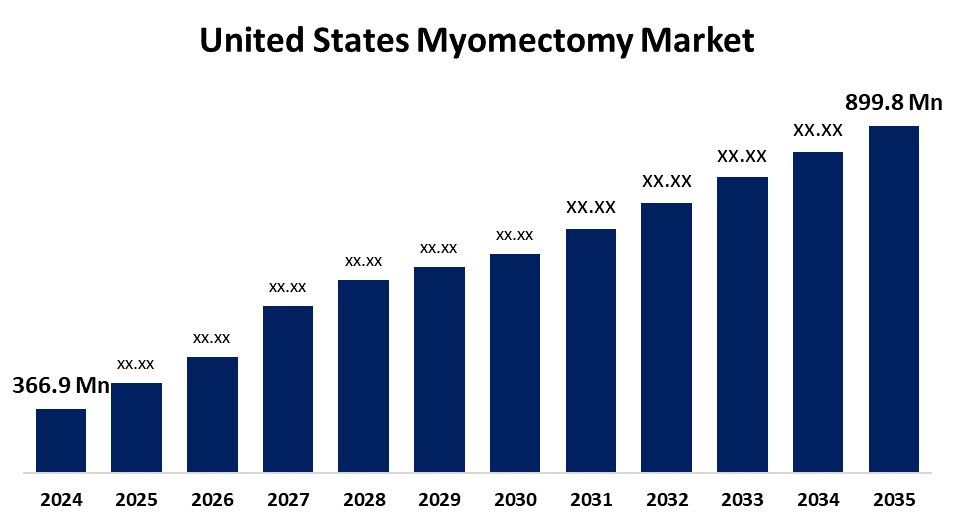

- The US Myomectomy Market Size Was Estimated at USD 366.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.5% from 2025 to 2035

- The US Myomectomy Market Size is Expected to Reach USD 899.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Myomectomy Market is anticipated to reach USD 899.8 million by 2035, growing at a CAGR of 8.5% from 2025 to 2035. The rise in less invasive procedures propels the expansion of the United States myomectomy market, the growing number of patients with uterine fibroids, related disorders, and the growing use of cutting-edge technology for safe and efficient myomectomy methods.

Market Overview

A myomectomy, referred to as a fibroidectomy, is a surgical treatment that eliminates uterine fibroids, or leiomyomas, without removing the uterus altogether, as opposed to a hysterectomy. For myomectomy, patients with uterine fibroids are an extremely important basis of market growth. The preferred method of intervention for fibroids, and also to preserve the uterus, is myomectomy. Myomectomy can be performed in many different ways, depending on the location and size of the fibroid. According to the NCBI study report, around 30,000 myomectomy surgeries are carried out annually in the United States for fibroids. Thus, myomectomy procedures will continue to grow as uterine fibroids become more prevalent. With the increase in myomectomy procedures for uterine fibroids, increase in sophisticated, technologically advanced biopharmaceutical products that will provide additional pathways of business growth. The myomectomy market is undergoing significant disruption as there is a move toward less invasive surgery. Due to shorter recovery times and lower complications, laparoscopic and hysteroscopic myomectomy procedures are gaining in popularity. This movement is aided by technological advancements that can achieve accurate fibroid removal, with little disturbance to the adjoining tissue, and also meet current health care goals of improved patient outcomes and shorter hospital stays. There is a substantial growth opportunity in robotic-assisted surgical interventions in the myomectomy market.

Report Coverage

This research report categorizes the market for the United States myomectomy market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States myomectomy market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States myomectomy market.

United States Myomectomy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 366.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.5% |

| 2035 Value Projection: | USD 899.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Product, By Type and COVID-19 Impact Analysis |

| Companies covered:: | CooperSurgical, Conmed Corp, Hologic Inc, Intuitive Surgical Inc, Stryker Corp, Medtronic, Boston Scientific Corporation, C. R. Bard, Inc, General Electric Company, Richard Wolf Medical Instruments Corp, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States myomectomy market is boosted by the increase in the prevalence of uterine fibroids. As the results of improved screening and recognition have resulted in increased diagnoses, more women are seeking a fertility-saving treatment option. Myomectomy's ability to retain uterine integrity certainly sets it apart as a preference for treatment. The rise in detection from advances in medical imaging, while also leading to increased need for an effective treatment option, is also significant to the market.

Restraining Factors

The United States myomectomy market faces obstacles like the high incidence of fibroids recurring following myomectomy, and associated with up to 50% of patients, is a significant commercial barrier. This recurrence warrants additional procedures, which often creates a negative connotation to surgery for the patient.

Market Segmentation

The United States myomectomy market share is classified into product and type.

- The laparoscopic sealer segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States myomectomy market is segmented by product into laparoscopic sealer, laparoscopic power morcellators, harmonic scalpel, and others. Among these, the laparoscopic sealer segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because this significantly enhances minimally invasive surgery outcomes. They allow precise vessel sealing and cutting, which reduces blood loss and operative complications. This leads to smaller incisions, shorter hospital stays, and faster patient recovery benefits that have driven widespread adoption in laparoscopic fibroid surgery.

- The abdominal segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the United States myomectomy market is segmented into abdominal myomectomy, hysteroscopic myomectomy, and laparoscopic myomectomy. Among these, the abdominal segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because there are increasing numbers of those with uterine fibroids, who will need myomectomy surgeries to treat them. This is the most common yet also the most frequently used method of treating fibroids. Additionally, this procedure is the gold standard for removing uterine fibroids and preserving the uterus, as long as the patient is still able to conceive. It is the proven long-term treatment for uterine fibroids.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States myomectomy market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- CooperSurgical

- Conmed Corp

- Hologic Inc

- Intuitive Surgical Inc

- Stryker Corp

- Medtronic

- Boston Scientific Corporation

- C. R. Bard, Inc

- General Electric Company

- Richard Wolf Medical Instruments Corp

- Others

Recent Development

- In September 2024, Stryker launched its advanced 1788 camera platform, designed to enhance surgical outcomes with improved imaging capabilities. The platform supports minimally invasive surgeries with clearer visualization of critical anatomy and blood flow.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States myomectomy market based on the following segments:

United States Myomectomy Market, By Product

- Laparoscopic Sealer

- Laparoscopic Power Morcellators

- Harmonic Scalpel

- Others

United States Myomectomy Market, By Type

- Abdominal

- Myomectomy

- Hysteroscopic Myomectomy

- Laparoscopic Myomectomy

Need help to buy this report?