United States Mushroom Market Size, Share, and COVID-19 Impact Analysis, By Product (Button, Shiitake, Oyster, Matsutake, Truffles, and Other), By Form (Fresh and Processed), and United States Mushroom Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Mushroom Market Size Insights Forecasts to 2035

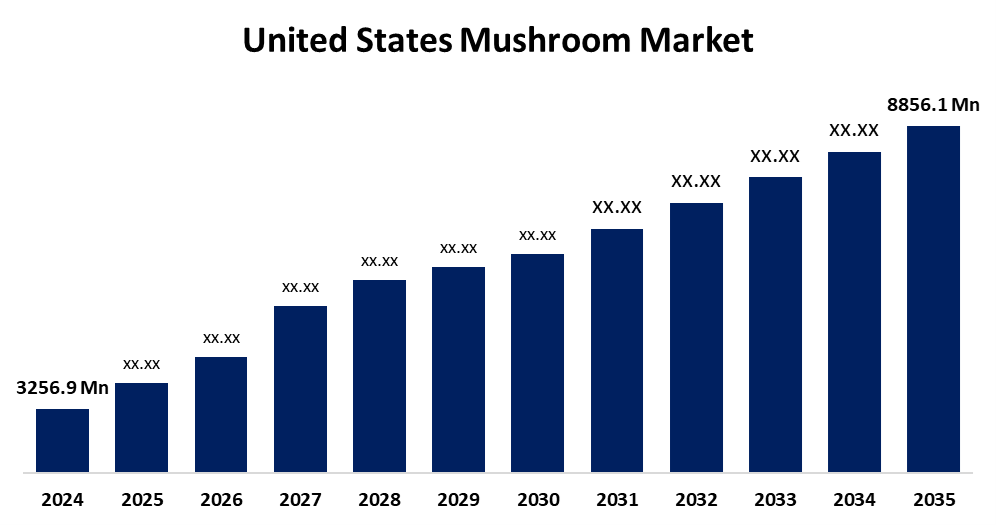

- The US Mushroom Market Size Was Estimated at USD 3256.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.52% from 2025 to 2035

- The US Mushroom Market Size is Expected to Reach USD 8856.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Mushroom Market Size is anticipated to reach USD 8856.1 million by 2035, growing at a CAGR of 9.52% from 2025 to 2035. The expansion of the United States mushroom market is propelled by growing consumer interest in exotic foods made using organic and natural components.

Market Overview

A mushroom is the fleshy, spore-bearing fruiting body of some fungi; they are usually produced above ground and are most frequently found in the phylum Basidiomycota, which includes the white button mushroom, Agaricus bisporus. The mushroom market is growing rapidly in the United States because consumers are becoming more knowledgeable about mushrooms, incorporating mushrooms into their variety of diets and supplementation regimens, and gaining awareness of mushrooms' nutritional and therapeutic attributes. The mushroom market is also driven by plant-based protein consumption and health-mindedness as mushrooms are nutrient-dense and seen as a lean replacement for meat protein. The popularity of different cuisines in the US food trends has a large influence on the growth of the mushroom market, as mushrooms can complement or substitute for many different ingredients when cooking. Since mushrooms have spread throughout the foodservice industry, the mushroom market has seen an increase in mushroom consumption.

The U.S. government supports the mushroom industry through the Mushroom Promotion, Research, and Consumer Information Act, which establishes the Mushroom Council under USDA's Agricultural Marketing Service and mandates that producers and importers pay a mandatory fee of around $0.0055 per pound.

Report Coverage

This research report categorizes the market for the United States mushroom market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States mushroom market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States mushroom market.

United States Mushroom Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3256.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.52% |

| 2035 Value Projection: | USD 8856.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Product, By Form and COVID-19 Impact Analysis |

| Companies covered:: | Bonduelle, Ryze, NeuRoast, Om Mushroom Superfood, Four Sigmatic, Laird Superfood Inc Ordinary Shares, Costa Group, Greenyard, Monaghan Group, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States mushroom market is boosted as individuals live their lives, as well as what they eat, has changed dramatically in the last 20 to 30 years. The tremendous growth in urbanisation paved the way for the rapid expansion of synthetic food consumption and the rise of various diseases, derived from a specific lifestyle. Consequently, emerging consumer knowledge and awareness of these problems has increased. As a result, consumers are slowly shifting to functional foods and products that are known to have higher benefits than just caloric value. Functional food items decrease the risk of illness and provide sufficient nutrients. As consumers become more health conscious, more of them are eating functional foods.

Restraining Factors

The United States mushroom market faces obstacles, as special treatment is required to attain high harvesting quality yields. Temperature, light, and humidity are major components that impact adequate and quality yield. Farmers can encounter significant issues with animals, insects, and pests, especially in rural areas.

Market Segmentation

The United States mushroom market share is classified into product and form.

- The button segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States mushroom market is segmented by product into button, shiitake, oyster, matsutake, truffles, and other. Among these, the button segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven due to its low cost, year-round cultivation simplicity, mild, adaptable flavour, and widespread consumer familiarity. They are industry mainstays due to their inexpensive production costs, extended shelf life, and versatility in both fresh and processed goods. Button mushrooms are overwhelmingly dominant, accounting for about 60% of the mushroom volume and 40–60% of the market.

The fresh segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the form, the United States mushroom market is segmented into fresh and processed. Among these, the fresh segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the number of restaurants, cafes, bars, and other fast-food outlets, which continue to rise in the country, indicating an increase in demand for fresh mushrooms. Sales at restaurants in bars in the United States increased by more than 10% in 2020 and 2021, and the trend is expected to continue through the forecast year.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States mushroom market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bonduelle

- Ryze

- NeuRoast

- Om Mushroom Superfood

- Four Sigmatic

- Laird Superfood Inc Ordinary Shares

- Costa Group

- Greenyard

- Monaghan Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States mushroom market based on the following segments:

United States Mushroom Market, By Product

- Button

- Shiitake

- Oyster

- Matsutake

- Truffles

- Other

United States Mushroom Market, By Form

- Fresh

- Processed

Need help to buy this report?