United States Municipal and Environmental Machinery Market Size, Share, and COVID-19 Impact Analysis, By Туре (Water Truck, Gаrbаgе Truck, Ѕuсtіоn Truck, and Vacuum Truck), By Аррlісаtіоn (Urban Соnѕtruсtіоn, and Fасtоrу), and United States Municipal and Environmental Machinery Market Insights, Industry Trend, Forecasts to 2035

Industry: Machinery & EquipmentUnited States Municipal and Environmental Machinery Market Insights Forecasts to 2035

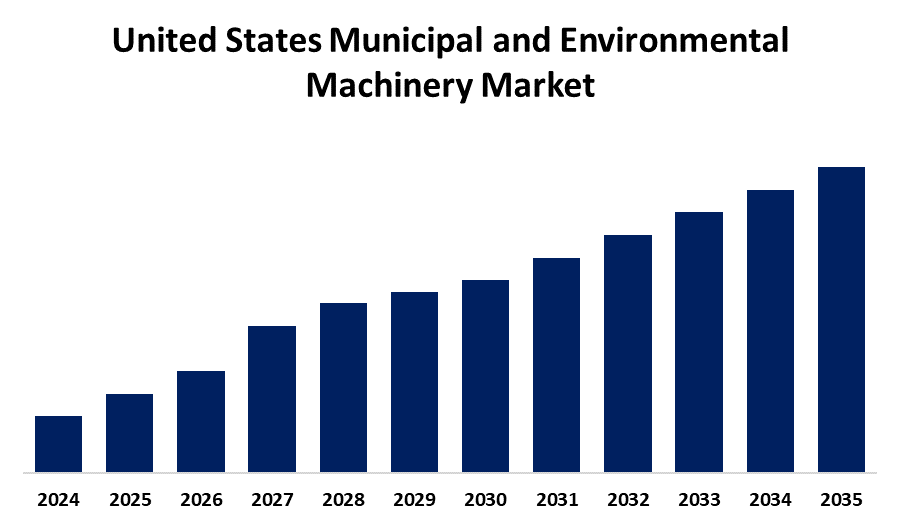

- The United States Municipal and Environmental Machinery Market Size is Expected to Grow at a CAGR of around 7.4% from 2025 to 2035.

- The U.S. Municipal and Environmental Machinery Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States municipal and environmental machinery market is expected to hold a significant share by 2035, growing at a CAGR of 7.4% from 2025 to 2035. The U.S. environmental and municipal machinery market is expanding with rising urbanization, aging infrastructure, and the growing emphasis on sustainability. Government spending, mainly through the Infrastructure Investment and Jobs Act, and innovations, including automation, electric cars with intelligent monitoring systems, are improving efficiency of operation and the environment.

Market Overview

The United States municipal and environmental machinery market encompasses equipment and technologies used for waste management, water and wastewater treatment, street cleaning, and other urban environmental services. This sector includes machinery such as refuse trucks, sewer cleaning equipment, compactors, and water treatment systems, serving both municipal and private entities. Market growth is driven by increasing urbanization, rising environmental awareness, and stricter EPA regulations on waste and water management. A growing demand for smart and energy-efficient solutions, such as electric garbage trucks and IoT-enabled waste collection systems, is reshaping the competitive landscape. The market benefits from strong domestic manufacturing capabilities and innovation in sustainability-focused machinery. Opportunities lie in upgrading aging municipal infrastructure and expanding services to underserved rural areas. Government programs at the federal and state levels, such as the Infrastructure Investment and Jobs Act, deliver considerable funding to environmental and municipal projects, driving demand for advanced equipment. Further, sustainability requirements and decarbonization efforts are leading municipalities to embrace cleaner, more efficient technologies, driving long-term investment in the market.

Report Coverage

This research report categorizes the market for the United States municipal and environmental machinery market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA municipal and environmental machinery market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. municipal and environmental machinery market.

United States Municipal and Environmental Machinery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.4% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Flowserve Corporation, Terex Corporation, Veolia North America, Davey Tree Expert Company, General Electric (GE), Municipal Equipment, Inc. (MEI), Environmental Equipment Sales & Service (EESS), Heil Environmental Industries, AIMS Companies, Xylem Inc., Ingersoll Rand Inc., and Other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing urbanization, strict environmental laws, and higher government spending on infrastructure fuel U.S. municipal and environmental machinery demand. Federal programs such as the Infrastructure Investment and Jobs Act are accelerating demand for sophisticated machinery in water treatment, waste management, and public works. Increasing public pressure for cleaner cities and infrastructure resilience further increases the demand for new municipal equipment. On the other hand, public-private partnerships and local green movements are underpinning the take-up of green solutions, putting the industry on track for long-term expansion underpinned by innovation, policy support, and changing urban infrastructure demands.

Restraining Factors

High initial capital expenditures on sophisticated machinery, Supply chain disruptions, and increasing raw material costs create affordability issues for smaller municipalities. Also, an inadequacy of trained labor restricts efficient utilization and maintenance of technologically sophisticated machinery. Even with robust demand, lower operational efficiency, particularly for local governments facing tight budgets, can constrain the technical market expertise for equipment upgrades.

Market Segmentation

The United States municipal and environmental machinery market share is classified into type and application.

- The vacuum truck segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States municipal and evironmental machinery market is segmented by type into water truck, garbage truck, suction truck, and vaccum truck. Among these, the vaccum truck segment held the largest share in 2024 and is expected to grwo at a significant CAGR during the forecast period. This is because vaccum trucks are applied in a broad scope of applications, for example, industrial cleaning, excavation, and municipal services, positioning them as a versatile and sought-after product.

- The Urban construction segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States municipal and environmental machinery market is segmentd by application into urban construction and factory. Among these, the urban construction segment held a substantial share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to large and ongoing infrastructure projects, construction activities in metropolitan areas, and government support for urban development, which drive demand for municipal and environmental mchinery.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States municipal and environmental machinery market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Flowserve Corporation

- Terex Corporation

- Veolia North America

- Davey Tree Expert Company

- General Electric (GE)

- Municipal Equipment, Inc. (MEI)

- Environmental Equipment Sales & Service (EESS)

- Heil Environmental Industries

- AIMS Companies

- Xylem Inc.

- Ingersoll Rand Inc.

- Others

Recent Developements:

- In October 2024, Terex corporation (NYSE: TEX) (Terex or Company) annouced the completion of its acquisition of Environmental solution Group (ESG) from Dover Corporation (NYSE: DOV). This acquisition enhances Terexs presense in the waste and recycling industry, adding brands like Heil, Marathon, and Curotto-Can to its protfolio. The integration is expected to generate USD 25 million in synergies by 2026.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States municipal and environmental machinery market based on the below-mentioned segments:

USA Municipal and Environmental Machinary Market, By Type

- Water Truck

- Garbage Truck

- Suctio Truck

- Vaccum Truck

USA Municipal and Environmental Machinary Market, By Application

- Uarbon Construction

- Factory

Need help to buy this report?