United States Multiple Sclerosis Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Immunosuppressants and Immunomodulators), By Route of Administration (Injectables, Oral, and Others), By Distribution Channel (Retail Pharmacies, E-Commerce, and Hospital Pharmacies), and U.S. Multiple Sclerosis Drugs Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareU.S. Multiple Sclerosis Drugs Market Insights Forecasts to 2035

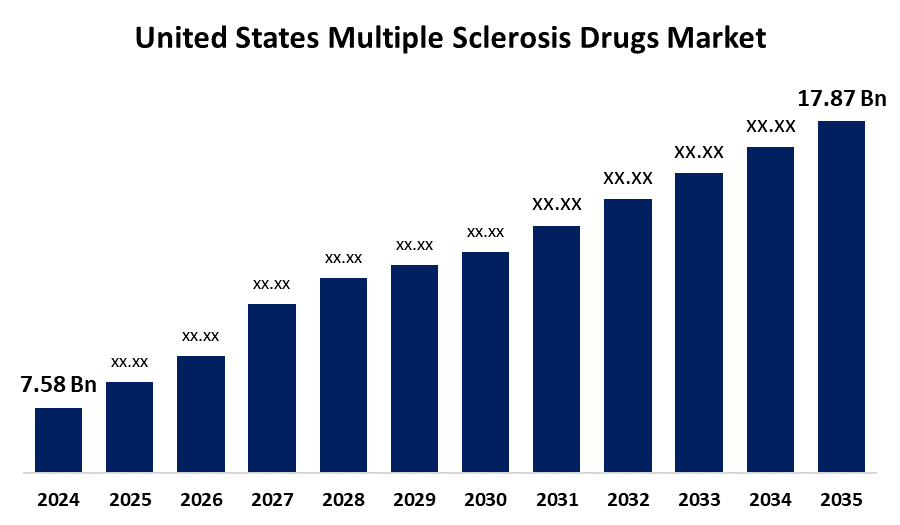

- The USA Multiple Sclerosis Drugs Market Size was Estimated at USD 7.58 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.11% from 2025 to 2035

- The US Multiple Sclerosis Drugs Market Size is Expected to Reach USD 17.87 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Multiple Sclerosis Drugs Market Size is Anticipated to Reach USD 17.87 Billion by 2035, Growing at a CAGR of 8.11% from 2025 to 2035. The growing awareness of multiple sclerosis, and rising prevalence in the United States, and the proliferation in the treatment of multiple sclerosis and regulatory approvals drive the market expansion.

Market Overview

This market focuses on the development, production, and commercialization of the therapeutic and diagnostic tools required for the management of multiple sclerosis. A chronic neurological condition known as multiple sclerosis (MS) is represented by an immune system autoimmune attack. Myelin in the central nervous system is affected, and symptoms usually start in young adults between the ages of 20 and 40. A protein and fatty acid mixture called myelin coats nerve fibers (axons) and facilitates neuronal communication. The brain, spinal cord, and optic nerves make up the central nervous system. Axons, nerve cell bodies, and the myelin sheath are all harmed by MS. Cortical atrophy is the result of the cerebral cortex shrinking as the disease worsens. There may be a connection between this process and other neurodegenerative diseases. Vision problems, muscle weakness, tingling, numbness, clumsiness, problems controlling one's bladder, and intermittent or continuous dizziness are some of the symptoms.

Disease-modifying medications, or DMDs, are used to treat multiple sclerosis (MS). They do this by altering the immune system and preventing relapses. Synthetic medications and biological protein formulations produced in laboratories are among these medications. Monoclonal antibodies and interferons are among the first biologic drugs approved by the FDA for MS. Teriflunomide, cladribine, and glatiramer are examples of synthetic immunomodulatory medications that are also utilized. The newest medications to be approved are S1P receptor modulators, such as siponimod and ozanimod. Cancer medications such as cyclophosphamide for off-label use and mitoxantrone for aggressive multiple sclerosis have also received FDA approval. Acute relapses are treated with corticosteroids to hasten recovery. Many drug classes are prescribed to treat symptoms like fatigue, pain, cognitive dysfunction, and issues with the bowels and bladder.

The marketed drugs used for the treatment of the multiple sclerosis are Copaxone, Betaseron, Avinex, etc. Governments are actively supporting the treatment of primary progressive multiple sclerosis and relapsing remitting multiple sclerosis due to the growing demand for accurate diagnosis and treatment of these conditions in United States and driving the expansion of the market.

Report Coverage

This research report categorizes the market for the U.S. Multiple Sclerosis Drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. multiple sclerosis drugs market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. multiple sclerosis drugs market.

United States Multiple Sclerosis Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.58 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.11% |

| 2035 Value Projection: | USD 17.87 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 150 |

| Tables, Charts & Figures: | 137 |

| Segments covered: | By Drug Class, By Route of Administration By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | Novartis AG, Teva Pharmaceuticals, Pfizer, Janssen Pharmaceuticals, Sanofi, Merck and Co. Inc., Zenas BioPharma, Inc., Immunic Therapeutics, Genentech, AbbVie Inc., and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing number of MS cases makes the creation of safe and efficient medications for treatment imperative. As MS is becoming more common, governments and health organizations are funding research for disease-modifying therapies (DMTs). Ongoing clinical trials and an increasing focus on progressive MS are driving the market for multiple sclerosis medications in the United States. Research funding for MS prevention and treatment is provided by AHRQ and the National Institutes of Health. The market is expanding owing to developments in the pharmaceutical sector, including oral formulations and generics. The market expansion in the US is anticipated to be fueled by the major market players' emphasis on research and development during the forecast period.

Restraining Factors

The side effects associated with the repeated use of multiple sclerosis drugs, stringent regulatory approvals, limited awareness in middle-income countries, and high cost of branded medications may restrict the growth of the market.

Market Segmentation

The USA multiple sclerosis drugs market share is classified into drug class, route of administration, and distribution channel.

- The immunomodulators segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. multiple sclerosis drugs market is segmented by drug class into immunosuppressants and immunomodulators. Among these, the immunomodulators segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by the patient convenience, effectiveness, and safety, which improve the immune system, minimize the lesions' activity, and innovations in drug delivery.

- The injectables segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.S. multiple sclerosis drugs market is segmented by route of administration into injectables, oral, and others. Among these, the injectables segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is attributed to the rapid onset of action, 100% bioavailability, patient compliance, long acting, accurate dosing, and fast absorption.

- The hospital pharmacies segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period.

The U.S. multiple sclerosis drugs market is segmented by distribution channel into retail pharmacies, e-commerce, and hospital pharmacies. Among these, the hospital pharmacies segment accounted for the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period. The sectoral expansion is ascribed to the rising patient admissions in OPD services, increasing prevalence of multiple sclerosis, and availability of a wide range of medications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US multiple sclerosis drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novartis AG

- Teva Pharmaceuticals

- Pfizer

- Janssen Pharmaceuticals

- Sanofi

- Merck and Co. Inc.

- Zenas BioPharma, Inc.

- Immunic Therapeutics

- Genentech

- AbbVie Inc.

- Others

Recent Developments:

- In April 2025, Genentech, a Roche Group member, has announced that the Phase III MUSETTE trial comparing a high dose of Ocrevus® (ocrelizumab) intravenous infusion to the approved Ocrevus IV 600 mg dose in people with relapsing multiple sclerosis did not show additional benefit in slowing disability progression, as measured by a composite disability endpoint over 120 weeks of treatment.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA multiple sclerosis drugs market based on the below-mentioned segments:

US Multiple Sclerosis Drugs Market, By Drug Class

- Immunosuppressants

- Immunomodulators

US Multiple Sclerosis Drugs Market, By Route of Administration

- Injectables

- Oral

- Others

US Multiple Sclerosis Drugs Market, By Distribution Channel

- Retail Pharmacies

- E-Commerce

- Hospital Pharmacies

Need help to buy this report?