United States Motor Vehicle Sensors Market Size, Share, and COVID-19 Impact Analysis, By Sensor (Temperature Sensors, Pressure Sensors, NOx Sensors), By Application (Engine & Drivetrain, Safety & Security), and United States Motor Vehicle Sensors Market Insights, Industry Trend, Forecasts to 2033.

Industry: Semiconductors & ElectronicsThe United States Motor Vehicle Sensors Market Insights Forecasts to 2033

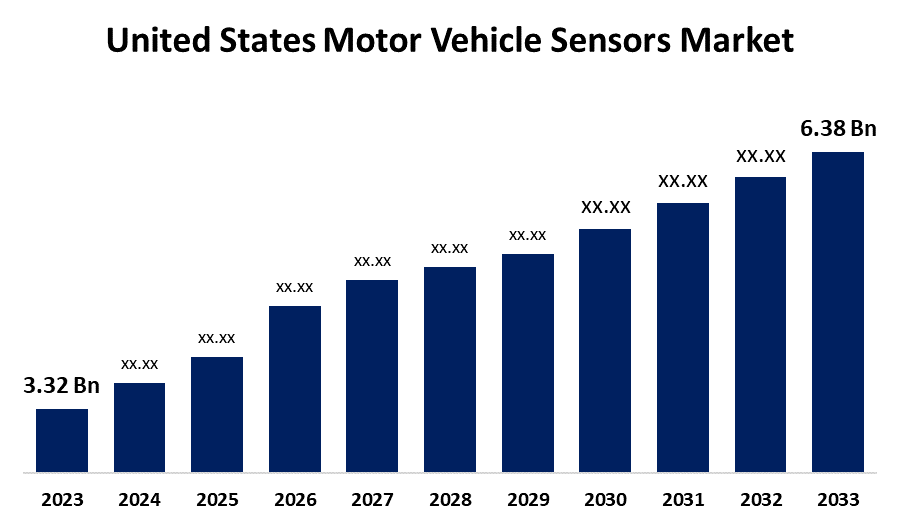

- The U.S. Motor Vehicle Sensors Market Size was Valued at USD 3.32 Billion in 2023

- The United States Motor Vehicle Sensors Market Size is Growing at a CAGR of 6.75% from 2023 to 2033

- The USA Motor Vehicle Sensors Market Size is Expected to Reach USD 6.38 Billion by 2033

Get more details on this report -

The USA Motor Vehicle Sensors Market Size is anticipated to exceed USD 6.38 Billion by 2033, growing at a CAGR of 6.75% from 2023 to 2033. The U.S. motor vehicle sensors market is growing rapidly due to advancements in vehicle safety, performance optimization, and the rise of electric and autonomous vehicles, driving demand for innovative sensor technologies.

Market Overview

The U.S. motor vehicle sensors market is an industry dedicated to designing, producing, and selling sensors that measure and report data on different functions of a vehicle. The sensors optimize performance, improve safety, comply with emission regulations, and enable technologies such as advanced driver assistance systems (ADAS) and electric vehicles, propelling innovation in current automotive systems. Moreover, the US motor vehicle sensors market is being driven by the growing adoption of advanced driver assistance systems (ADAS), vehicle electrification, and autonomous driving technologies. More stringent safety regulations, coupled with expanding aftermarket demand for retrofitting vehicles with advanced features, are major drivers of market growth and innovation in sensor applications. Furthermore, the U.S. automotive vehicle sensors market has market players like Robert Bosch GmbH, Continental AG, and others. These players have been concentrating more and more on R&D activities to diversify their product offerings in the market. They have pursued various organic strategies like strategic partnerships, acquisitions, and mergers. For instance, Bosch, a multinational engineering technology firm. It is a technology supplier and offers automotive component-related services, power tools, home appliances, and building technology. For the automotive segment, Bosch mainly deals with innovation in engine management, safety features, and driver assistance technologies. In recent times, the firm created hydrogen fuel cell technology.

Report Coverage

This research report categorizes the market for the US motor vehicle sensors market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. motor vehicle sensors market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA motor vehicle sensors market.

United States Motor Vehicle Sensors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 3.32 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.75% |

| 2033 Value Projection: | USD 6.38 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Sensor, By Application |

| Companies covered:: | Aptiv, Eaton, Sensata Technologies, Inc., Valeo, Robert Bosch GmbH, Autoliv, Hitachi, Ltd., Continental AG, DENSO CORPORATION, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The U.S. motor vehicle sensors market is driven by the rising demand for enhanced vehicle safety features and improved fuel efficiency. Technological advancements in sensors, such as integration with IoT for real-time data monitoring, along with the growing popularity of electric and autonomous vehicles, further propel market growth. Additionally, increasing government regulations for safety and emissions drive sensor adoption across vehicle types. Moreover, Hitachi Ltd is involved in various industries such as IT, energy, mobility, and smart life solutions. Hitachi, in recent years, emphasized digital innovation, IoT, and AI to improve its products and services. Hitachi has been working with different partners to create smart city solutions and has been heavily engaged in sustainability efforts, including the creation of energy-efficient technologies and circular economy solutions.

Restraining Factors

High manufacturing costs, complex sensor integration, and the need for continuous technological advancements pose challenges to the U.S. motor vehicle sensors market. Additionally, limited consumer awareness and slower adoption of autonomous vehicles hinder growth.

Market Segmentation

The United States motor vehicle sensors market share is classified into sensor and application.

- The temperature segment accounted for the largest share of the US motor vehicle sensors market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of sensor, the United States motor vehicle sensors market is divided into temperature sensors, pressure sensors, and NOx sensors. Among these, the temperature segment accounted for the largest share of the United States motor vehicle sensors market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This dominance is attributed to their widespread application in engine and drivetrain systems, where they monitor critical components like engines, transmissions, and batteries to ensure optimal performance and compliance with emissions standards.

- The engine & drivetrain segment accounted for a substantial share of the U.S. motor vehicle sensors market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of application, the U.S. motor vehicle sensors market is divided into engine & drivetrain, safety & security. Among these, the engine & drivetrain segment accounted for a substantial share of the U.S. motor vehicle sensors market in 2023 and is anticipated to grow at a rapid pace during the projected period. This dominance is attributed to the critical role these sensors play in optimizing engine performance, fuel efficiency, and emission control, which are essential for both internal combustion and electric vehicles. Technological advancements in engine management systems and the increasing complexity of modern engines further drive the demand for specialized sensors in this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA motor vehicle sensors market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aptiv

- Eaton

- Sensata Technologies, Inc.

- Valeo

- Robert Bosch GmbH

- Autoliv

- Hitachi, Ltd.

- Continental AG

- DENSO CORPORATION

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Robert Bosch GmbH and Qualcomm Technologies, Inc. launched the vehicle computer that will run both infotainment and advanced driver assistance system features on a single system-on-chip. The partnership was focused on creating highly integrated solutions that define the future of software-defined vehicles.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US motor vehicle sensors market based on the below-mentioned segments:

United States Motor Vehicle Sensors Market, By Sensor

- Temperature Sensors

- Pressure Sensors

- NOx Sensors

United States Motor Vehicle Sensors Market, By Application

- Engine & Drivetrain

- Safety & Security

Need help to buy this report?