United States Molluscs Market Size, Share, and COVID-19 Impact Analysis, By Species (Crassostrea, Ruditapes Philippinarum, and Scallops), By Form (Frozen and Canned), and United States Molluscs Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesUnited States Molluscs Market Insights Forecasts to 2035

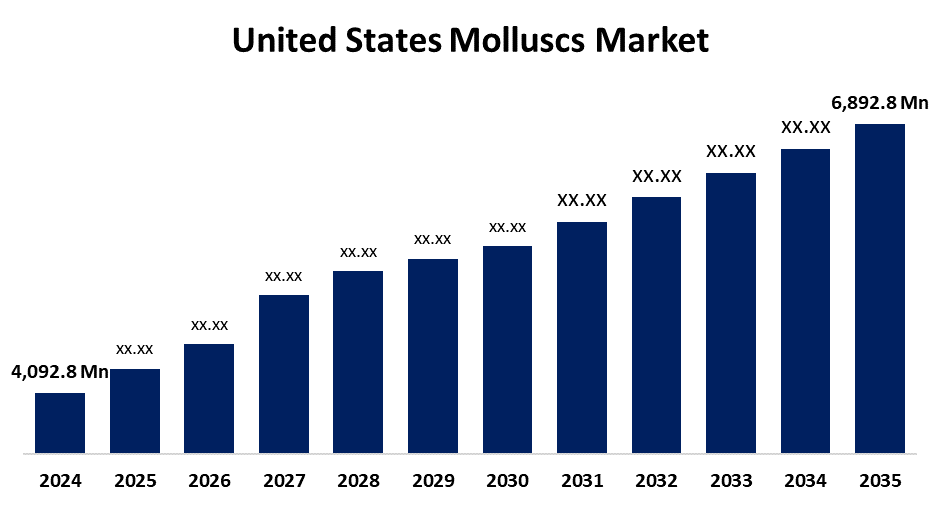

- The US Molluscs Market Size Was Estimated at USD 4,092.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.85% from 2025 to 2035

- The US Molluscs Market Size is Expected to Reach USD 6,892.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Molluscs Market Size is anticipated to reach USD 6,892.8 Million by 2035, growing at a CAGR of 4.85% from 2025 to 2035. The expansion of the United States mollusc market is propelled by the demand for nutrient-dense food goods and by consumers' growing health consciousness.

Market Overview

An invertebrate that belongs to the phylum Mollusca, one of the most varied and pervasive groupings in the biological kingdom, is called a mollusc (often spelt mollusc). Through taste and nutritional value, molluscs, like abalone, are considered luxury and premium seafood products. The difference in demand arises from increases in disposable income and rising demand for premium seafood. The major contributor to the expansion of the market in the last few years has been the food service industry. Due to shifting eating habits and the rapid expansion of the food delivery industry, the market has expanded dramatically. Many consumers are conscious of their health because molluscs are considered high in protein; while including many essential elements like vitamins, minerals, omega-3 fatty acids, and iron, they are popular for their taste, nutrition, and versatility. Seafood is a low-calorie, high-protein diet, which is often utilized to develop muscle. Seafood has vitamins, iron, omega-3 fatty acids, etc., which are all projected to grow in the market. The increasing aquaculture fish production in the United States is also expanding. Moreover, the increase in disposable income by consumers and a growing desire to maintain a healthy lifestyle have significantly increased the consumption of food high in protein.

Report Coverage

This research report categorizes the market for the United States molluscs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States molluscs market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States molluscs market.

United States Molluscs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,092.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.85% |

| 2035 Value Projection: | USD 6,892.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Species, By Form |

| Companies covered:: | Blue Ridge Aquaculture, Taylor Shellfish Company, Ward Oyster Company, Bevans Oyster Company, Hog Island Oyster Co., Chatham Shellfish Company, Cape Cod Oyster Company, Hoopers Island Oyster Co., Tomales Bay Oyster Company, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States molluscs market is boosted by the increased consumption of restaurant food, along with the fast-growing food delivery market. Molluscs are notable for their flavour, nutritional attributes, and versatility in the kitchen and appeal to the health-conscious consumer because they are high in protein and also rich in vitamins, iron, omega-3 fatty acids, and minerals. Also, this kind of seafood is a staple across traditional and fusion cuisines, accommodating and satisfying a variety of palates as culinary traditions continue to come together.

Restraining Factors

The United States molluscs market faces obstacles like the effects of climate change, such as rising sea levels, ocean acidification, and temperature increases. Rising temperatures are contributing to the melting of ice caps, which results in sea level rise.

Market Segmentation

The United States molluscs market share is classified into species and form.

- The crassostrea segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States molluscs market is segmented by species into crassostrea, ruditapes philippinarum, and scallops. Among these, the crassostrea segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the increasing production of crassostrea products in the US. The market is projected to increase over the forecast period because of the popularity of fish food and interest in a healthy lifestyle due to increased health concerns among consumers.

- The frozen segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the form, the United States molluscs market is segmented into frozen and canned. Among these, the frozen segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The demand for frozen fish products has surged due to consumers' consumption of a diet rich in protein, minerals, and health benefits. Also, the market is projected to grow in the forecasting period due to increased demand for packaged and processed fish products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States molluscs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Blue Ridge Aquaculture

- Taylor Shellfish Company

- Ward Oyster Company

- Bevans Oyster Company

- Hog Island Oyster Co.

- Chatham Shellfish Company

- Cape Cod Oyster Company

- Hoopers Island Oyster Co.

- Tomales Bay Oyster Company

- Others

Recent Development

- In June 2021, A.C. Inc., a major Maine harvester/distributor, expanded its footprint by acquiring Beals Lobster Company and Close to Coast Seafood. This move includes new vessels, enhanced clam operations, and additional buying stations, reinforcing their hard-shell clam production.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States molluscs market based on the following segments:

United States Molluscs Market, By Species

- Crassostrea

- Ruditapes Philippinarum

- Scallops

United States Molluscs Market, By Form

- Frozen

- Canned

Need help to buy this report?