United States Military Animals Market Size, Share, and COVID-19 Impact Analysis, By Animal (Dogs and Horses), By Application (Detection & Patrol, Search & Rescue, Combat Support, Medical Support, and Communication & Detection), and United States Military Animals Market Insights, Industry Trend, Forecasts to 2033

Industry: Aerospace & DefenseUnited States Military Animals Market Insights Forecasts To 2033

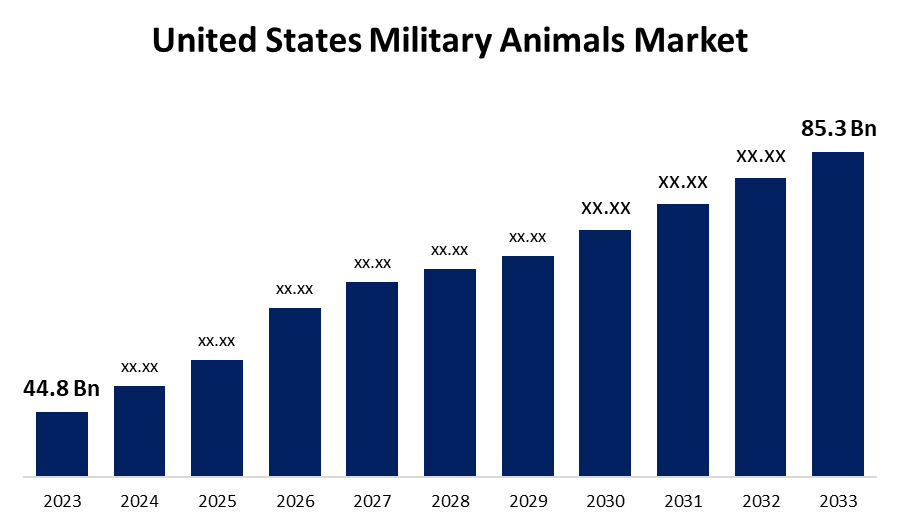

- The U.S. Military Animals Market Size was Valued at USD 44.8 Billion in 2023

- The United States Military Animals Market Size is Growing at a CAGR of 6.65% from 2023 to 2033

- The USA Military Animals Market Size is Expected to Reach USD 85.3 Billion by 2033

Get more details on this report -

The USA Military Animals Market size is Anticipated to exceed USD 85.3 Billion by 2033, Growing at a CAGR of 6.65% from 2023 to 2033. The U.S. military animals Market is experiencing significant growth, driven by increasing demand for specialized capabilities in defense and security operations. Military working dogs dominate this sector due to their effectiveness in detection, patrol, and combat support roles. Advancements in training programs and veterinary care are further enhancing the operational efficiency of these animals, solidifying their critical role in modern military strategies.

Market Overview

The U.S. military animals’ industry includes the specialized segment of the training, deployment, and sustainment of animals mainly dogs for numerous defense-related purposes. These animals are an important part of the military, providing capabilities that advance security and operational effectiveness. Moreover, the growth potential of the U.S. military animals market is increased global security risks, rising defense budgets, and established efficacy of trained animals, particularly dogs, in vital missions such as detection and patrol. Advances in training technology intensified military-civilian cooperation, and favourable government policies add to broader applications and continued demand for the market. Furthermore, in April 2022, the Princess Royal opened a Pound 4.1m state-of-the-art training facility for military dogs and handlers. The Canine Training Squadron (CTS) center included three classrooms, specialist training spaces, offices, and training accommodations. In April 2025, Military Working Dogs (MWDs) have had a heroic and long history serving with U.S. military units. These trained K9s are so much more than mere animals, they are devoted combat partners, expert protectors, and battlefield lifesaving heroes. The history of Military Working Dogs in the United States began on March 13, 1942. That's when the U.S. Army officially initiated its War Dog Program in World War II.

Report Coverage This research report categorizes the market for the US military animals market based on various segments and regions forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.S. military animals market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA military animal’s market.

United States Military Animals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 44.8 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.65% |

| 2033 Value Projection: | USD 85.3 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Animal, By Application |

| Companies covered:: | Lonza Group, Corning Incorporated, Thermo Fisher Scientific, Inc., Merck KGaA, Danaher Corporation, QIAGEN N.V., Becton, Dickinson and Company (BD), STEMCELL Technologies, Charles River Laboratories, Bio-Techne Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The drivers are the emotional intelligence and resilience of animals in uncertain combat situations, increased demand for non-lethal defense solutions, and expanded utilization of marine mammals for underwater missions. Also, heightened emphasis on animal welfare after service promotes ethical deployment, increasing public and institutional support for military animal programs. Moreover, key drivers are the emotional intelligence and resilience of animals in uncertain combat situations, increased demand for non-lethal defense solutions, and expanded utilization of marine mammals for underwater missions. Also, heightened emphasis on animal welfare after service promotes ethical deployment, increasing public and institutional support for military animal programs.

Restraining Factors

Restraining factors include high training and maintenance costs, limited versatility compared to dogs, and reduced operational relevance in modern warfare, where advanced technologies and robotics increasingly replace traditional animal roles.

Market Segmentation

The United States military animals market share is classified into animal and application.

- The dogs segment accounted for the largest share of the US military animals market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of animal, the United States military animals market is divided into dogs and horses. Among these, the dogs segment accounted for the largest share of the United States military animals market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is due to their superior versatility, intelligence, and trainability. Widely used for explosive detection, patrol, tracking, and search and rescue missions, dogs are indispensable to military operations, making them the dominant segment over horses in both usage and investment.

- The detection & patrol segment accounted for a substantial share of the U.S. military animals market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of application, the U.S. military animals market is divided into detection & patrol, search & rescue, combat support, medical support, and communication & detection. Among these, the detection & patrol segment accounted for a substantial share of the U.S. military animals market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is driven by the critical need for explosive and narcotic detection, base security, and perimeter surveillance. Military working dogs are highly effective in these roles, making this application dominant due to its operational importance and consistent demand across military branches.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the USA military animals market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lonza Group

- Corning Incorporated

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Danaher Corporation

- QIAGEN N.V.

- Becton, Dickinson and Company (BD)

- STEMCELL Technologies

- Charles River Laboratories

- Bio-Techne Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In March 2024, BluePearl and the U.S. Army Office of the Surgeon General joined forces with the U.S. Army Veterinary Corps to introduce a revolutionary program, Veterinary Trauma Readiness and Operational Medicine Agility (Vet-TROMA), on K9 Veterans Day. The revolutionary program was a first-of-its-kind military-civilian partnership that sought to advance veterinary training. Vet-TROMA is designed to create highly capable and confident veterinarians who can provide critical care for war dogs.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the US military animals market based on the below-mentioned segments:

United States Military Animals Market, By Animal

- Dogs

- Horses

United States Military Animals Market, By Application

- Detection & Patrol

- Search & Rescue

- Combat Suppor

- Medical Support

- Communication and Detection

Need help to buy this report?