United States Microfluidics Market Size, Share, and COVID-19 Impact Analysis, By Product (Microfluidic-based Devices and Microfluidic Components), By Technology (Lab-on-a-chip, Organ-on-a-chip, Continuous Flow Microfluidics, Optofluidics & Microfluidics, Acoustofluidics & Microfluidics, and Electrophoresis & Microfluidics), and United States Microfluidics Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Microfluidics Market Insights Forecasts to 2035

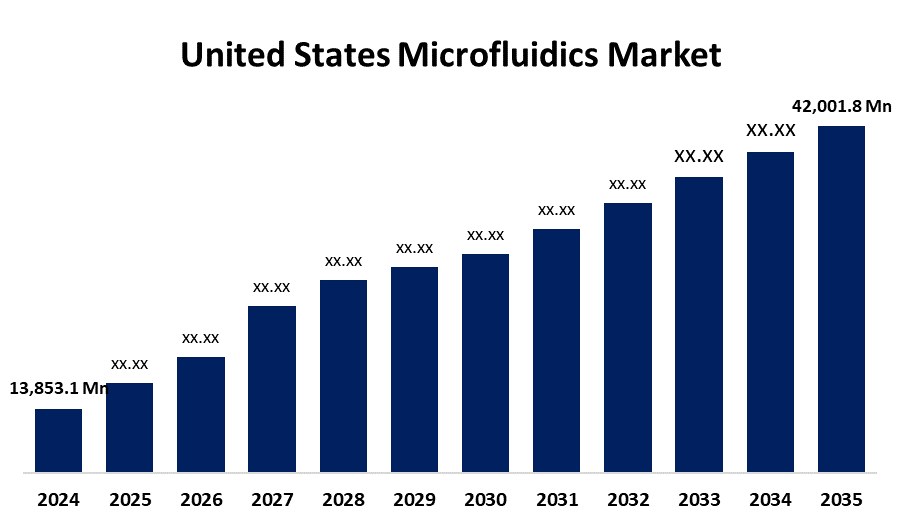

- The US Microfluidics Market Size Was Estimated at USD 13,853.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.61% from 2025 to 2035

- The US Microfluidics Market Size is Expected to Reach USD 42,001.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Microfluidics Market is anticipated to reach USD 42,001.8 million by 2035, growing at a CAGR of 10.61% from 2025 to 2035. The expansion of the United States microfluidics market is propelled by the growing use of microfluidic devices in various diagnostic and research domains.

Market Overview

Microfluidics is an emerging science and technology associated with systems containing channels, usually in the size range of tens to hundreds of micrometers, used to manipulate or process small amounts of fluids. Relevant to the US microfluidics market, there are considerable R&D investments, well-established healthcare infrastructures, and substantial industry players in the US market. Furthermore, the microfluidics community benefits from both domestic and foreign cooperation between government, industry, and academia that allows for even more advances in microfluidics technology over time. The US is the dominant country in the microfluidics market and especially in biotechnology and medical diagnostics applications, largely due to the powerful ecosystem available and the ability to invest in research and development. A study carried out in the United States used an analytical method based on microfluidics to increase detection and accuracy. It claimed to revolutionise chemical analysis with applications in pharmaceuticals, environmental testing, and food safety. Microfluidic applications have successfully detected levels of vascular endothelial growth factor, glucose levels, infections, and dry eye disease, and these applications are projected to have a positive contribution to market growth in the coming years. The U.S. Food and Drug Administration established an accelerated approval process for diagnostic devices that incorporate microfluidics to lessen time to market. The U.S. government, comprising NIH, NSF, DOE, and others, is making a significant interagency effort to coordinate nanoscale research, including microfluidics.

Report Coverage

This research report categorizes the market for the United States microfluidics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States microfluidics market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States microfluidics market.

United States Microfluidics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13,853.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.61% |

| 2035 Value Projection: | USD 42,001.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Product, By Technology and COVID-19 Impact Analysis |

| Companies covered:: | PerkinElmer, Standard BioTools Inc, Bio-Rad Laboratories Inc, Agilent Technologies Inc, Illumina Inc, Danaher Corp, Thermo Fisher Scientific Inc, Abbott Laboratories, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States microfluidics market is boosted by the rising demand for point-of-care (POC) diagnostics. POC testing removes the need for laborious laboratory processing by providing quick and easy diagnostic results right at the patient's side. This capacity is especially important in situations where prompt diagnostic and treatment choices are essential, including in clinics, emergency rooms, and remote or resource-constrained locations. POC testing is made possible in large part by microfluidic devices, which automate and reduce complicated laboratory procedures to a tiny chip or cartridge.

Restraining Factors

The obstacles in the US microfluidics market include the high cost of microfluidics to the industry's growth and accessibility. The manipulation of small fluid quantities is the focus of the discipline of microfluidics, which has enormous potential for several industries, including biotechnology, diagnostics, and healthcare.

Market Segmentation

The United States microfluidics market share is classified into product and technology.

- The microfluidics segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States microfluidics market is segmented by product into microfluidic-based devices and microfluidics. Among these, the microfluidics segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by drug delivery, analytical equipment, and diagnostics are all based on components including pumps, valves, processors, and sensors. As there is increasing interest in point-of-care testing, lab-on-a-chip platforms, and personalized medicine, there is far greater need for reliable and scalable microfluidic components than ever. The expansion of this segment has also been greatly influenced by the presence of key manufacturers and increasing biomedical R&D spend.

- The lab-on-a-chip segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the technology, the United States microfluidics market is segmented into lab-on-a-chip, organ-on-a-chip, continuous flow microfluidics, optofluidics & microfluidics, acoustofluidics & microfluidics, and electrophoresis & microfluidics. Among these, the lab-on-a-chip segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the ability to swiftly handle a large number of cells while controlling them at the single-cell level. To bridge the gap between laboratory work and clinical practice, the study emphasised the significance of enhanced accessibility, usability, and manufacturability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States microfluidics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PerkinElmer

- Standard BioTools Inc

- Bio-Rad Laboratories Inc

- Agilent Technologies Inc

- Illumina Inc

- Danaher Corp

- Thermo Fisher Scientific Inc

- Abbott Laboratories

- Others

Recent Development

- In January 2024, Standard BioTools Inc. (Nasdaq: LAB), a company committed to propelling advancements in human health, declared the completion of its merger with SomaLogic. This merger has resulted in forming a leading entity in the field of research, providing unique multi-omics tools.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States microfluidics market based on the following segments:

United States Microfluidics Market, By Product

- Microfluidic-based Devices

- Microfluidic

United States Microfluidics Market, By Technology

- Lab-on-a-chip

- Organ-on-a-chip

- Continuous Flow Microfluidics

- Optofluidics & Microfluidics

- Acoustofluidics & Microfluidics

- Electrophoresis & Microfluidics

Need help to buy this report?