United States Microarray Market Size, Share, and COVID-19 Impact Analysis, By Product & Services (Instruments, Consumables, and Software & Services), By Type (DNA Microarray, Protein Microarray, and Others), and United States Microarray Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Microarray Market Insights Forecasts to 2035

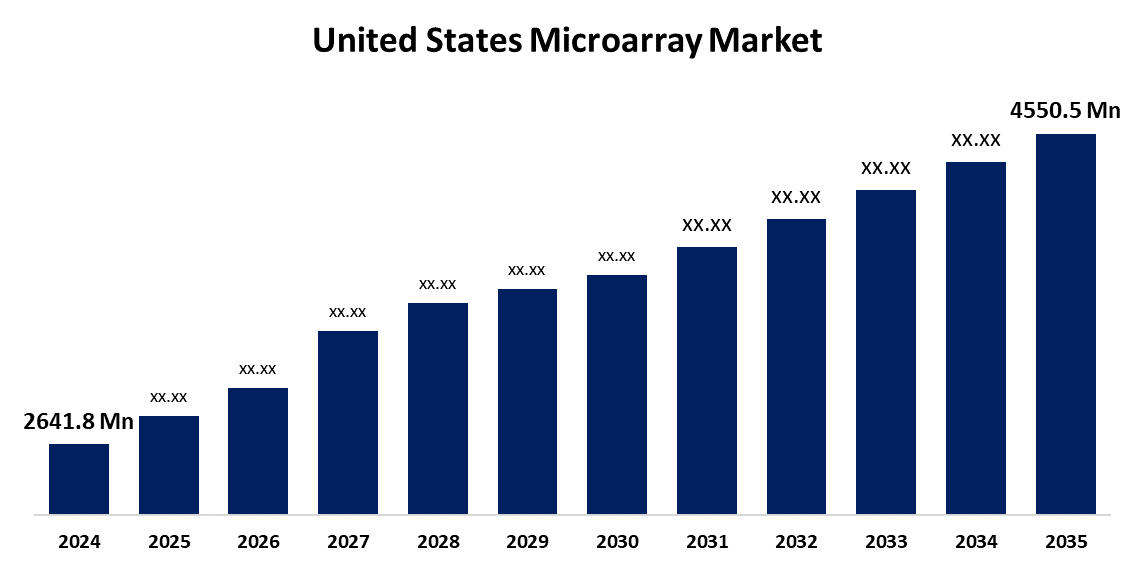

- The US Microarray Market Size Was Estimated at USD 2641.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.07% from 2025 to 2035

- The US Microarray Market Size is Expected to Reach USD 4550.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Microarray Market Size is Anticipated to Reach USD 4550.5 Million by 2035, Growing at a CAGR of 5.07% from 2025 to 2035. The expansion of the United States microarray market is propelled by the growing need for personalised medicine, particularly in pharmacogenomics and precision oncology.

Market Overview

A microarray, referred to as a DNA chip or biochip, is a high-throughput laboratory instrument that can analyse hundreds to millions of biological molecules on a solid surface, like a silicon chip or glass slide, at once. Microarray tools and reagents have been following the recent advances in cancer research to advance molecular profiling and diagnostic accuracy. The adoption of microarray platforms for gene expression profiling is increasing, allowing researchers to identify cancer-specific biomarkers, predict prognosis, and guide personalized therapy. Several new reagent kits, with low input RNA/DNA and high-throughput applications, are being launched in the U.S. by companies like Agilent Technologies, Thermo Fisher Scientific, and Illumina.

The U.S. encourages innovation through STTR and Small Business Innovation Research (SBIR) grants, which have helped both public and private sector applicants commercialise microarray-based platforms, including miniaturised genomics platforms and phenotype microarrays for drug toxicity screening. Additionally, by developing nanoscale manufacturing and biosensing technologies, larger technology initiatives like the National Nanotechnology Initiative (NNI), which has invested over $45 billion through FY 2025, indirectly speed up the development of microarrays.

Report Coverage

This research report categorizes the market for the United States microarray market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States microarray market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States microarray market.

United States Microarray Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2641.8 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 5.07% |

| 2035 Value Projection: | USD 4550.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Product & Services, By Type and COVID-19 Impact Analysis. |

| Companies covered:: | Microarrays, Arrayit, Danaher Corporation, PerkinElmer, Bio-Rad Laboratories Inc, Agilent Technologies Inc, Illumina Inc, Thermo Fisher Scientific Inc, Schott and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States microarray market is boosted because it comprises both traditional microarrays and new-generation sequencing microarrays, and is projected to grow at a rapid pace due to the increase in the incidence of cancer. The rise of advanced diagnostic tools has increased as a result of increased adoption of personalised therapies and testing for early diagnosis. The use of microarray technology in drug discovery and molecular diagnostics is expected to rise in tandem with the ongoing rise in cancer cases. This is a positive trend because these tools produce accurate genetic information, facilitate cancer biomarker discovery, and enable individualised treatment regimens. It is expected that increases in demand for advanced diagnostic modalities would lead to growth in the microarray industry in the coming years.

Restraining Factors

The United States microarray market faces obstacles, like the high costs associated with performing microarray experiments. Cost barriers limit widespread use, which is especially a concern for smaller labs and research facilities with less flexible budgets.

Market Segmentation

The United States microarray market share is classified into product & services and type.

- The consumables segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States microarray market is segmented by product & services into instruments, consumables, and software & services. Among these, the consumables segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the use of all reagents, slides, chips, and labelling kits is a common aspect of microarray life, whether applied or basic research. In the academic and diagnostics spaces, these consumables have a relatively short shelf-life and are used at a relatively high frequency, which encourages ongoing purchase. Also, companies like Thermo Fisher Scientific and Agilent Technologies have provided added consumables for better assurance of running high-density or custom arrays, notably for diagnostics where relevant to infectious disease, cancer, and pregnancy.

- The DNA microarray segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the type, the United States microarray market is segmented into DNA microarray, protein microarray, and others. Among these, the DNA microarray segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because of its high volume of use in comparative genomic hybridisation (CGH), SNP genotyping, and gene expression profiling. The ease-of-use and affordability of this technology makes it suitable for clinical contexts and for population-scale genomic research.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States microarray market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Microarrays

- Arrayit

- Danaher Corporation

- PerkinElmer

- Bio-Rad Laboratories Inc

- Agilent Technologies Inc

- Illumina Inc

- Thermo Fisher Scientific Inc

- Schott

- Others

Recent Development

- In February 2025, PathogenDx launched its rebranded D3 Array assays, including Combined, Bacterial, and Fungal versions, to replace its previous DetectX line. The D3 Array technology enables multiplex detection of up to 100 targets in a single test, offering rapid, cost-effective, and high-throughput solutions for agriculture, food safety, environmental, and clinical testing. The assays provide both quantitative and qualitative results with high sensitivity and specificity, enhancing laboratory efficiency and return on investment.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States microarray market based on the following segments:

United States Microarray Market, By Product & Services

- Instruments

- Consumables

- Software & Services

United States Microarray Market, By Type

- DNA Microarray

- Protein Microarray

- Others

Need help to buy this report?