United States Mezcal Market Size, Share, and COVID-19 Impact Analysis, By Product (Joven, Reposado, Anejo, and Others), By Category (100% Agave and Blend), and United States Mezcal Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Mezcal Market Insights Forecasts to 2035

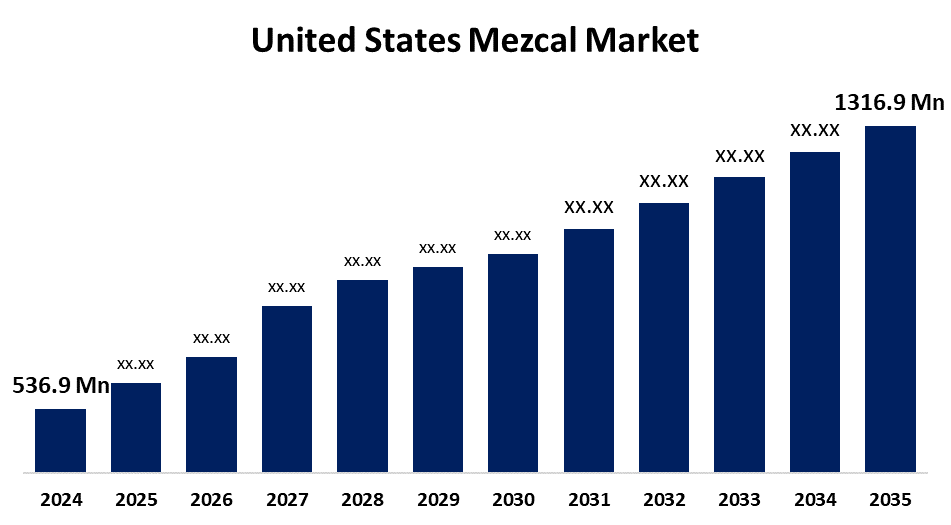

- The US Mezcal Market Size Was Estimated at USD 536.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.50% from 2025 to 2035

- The US Mezcal Market Size is Expected to Reach USD 1316.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United States Mezcal Market Size is anticipated to reach USD 1316.9 Million by 2035, growing at a CAGR of 8.50% from 2025 to 2035. The expansion of the United States mezcal market is propelled by increasing consumer demand for high-end alcohol. Because of its distinctive flavour profiles and age-old production techniques, mezcal has become popular as customers look for higher-quality, artisanal products.

Market Overview

Mezcal is a traditional distilled alcoholic beverage. It is produced from the fermented juice of the baked core of multiple species of agave. Mezcal, a distilled alcoholic beverage made from agave, is currently a category without spirits and appeals to consumers seeking unique and authentic drinking experiences. Moreover, the mezcal category is being driven by two main factors tequila's influence on mezcal's expansion and the growing interest in agave-based distillates. Since mezcal can be created from over 36 different agave species, it offers a greater range of flavours than tequila, which is made exclusively from blue agave. Customers would be drawn to mezcal's flavours, which would introduce them to new and exciting drinking experiences. The National Restaurant Association claims that this cuisine is still quite popular, and many eateries are now offering premium mezcal on their menus. The U.S. market can get a higher market share because of its enormous millennial population with disposable cash and its demand for luxury. Due to market demand and their projections for the beverage's future, major firms are placing a lot of money on the future of the mezcal market in the United States by constructing manufacturing facilities. The popularity of mezcal has also been fuelled by consumer demand for authentic, naturally made beverages. Drinkers are far more aware of where beverages come from and prefer sustainable and natural products. The mezcal industry, which relies on hand labour and local products, is in line with this environmental movement. A growing number of drinkers with historical and cultural significance are now linked to mezcal such of customers' growing appreciation for the artistry involved in beverage creation.

Report Coverage

This research report categorizes the market for the United States mezcal market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States mezcal market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States mezcal market.

United States Mezcal Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 536.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 8.50% |

| 2035 Value Projection: | USD 1316.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 267 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Product and By Category |

| Companies covered:: | Craft Distillers, El Silencio Holdings, Brown-Forman Corp Class A, MADRE Mezcal, Banhez Spirits Company LLC, Mezcal Vago, Ilegal Mezcal, Becle SAB de CV, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States mezcal market is driven by the increasing popularity of exotic and flavored agave spirits. According to the International Wine & Spirits Record Drinks Market Analysis, agave-based spirits are one of the fastest-growing categories of drinks in the U.S. In general, younger consumers are more familiar with trying new products, particularly alcoholic ones, which encourages them to try drinks made from agave. Additionally, the demand for the product will increase as consumer desire to keep looking for demand for cocktails. To increase market share and diversify their product ranges, the market's top companies are focusing on purchasing premium and artisanal manufacturers.

Restraining Factors

The United States mezcal market faces obstacles like its dependence on raw commodities, such as agave plants, and the ongoing difficulties faced by manufacturers. The manufacturing of mezcal may be hampered by the smaller agave plant cultivation area, which could limit the availability of raw materials and impede market expansion in the forecast year.

Market Segmentation

The United States Mezcal Market share is classified into product and category.

- The Joven segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States mezcal market is segmented by product into Joven, reposado, Anejo, and others. Among these, the Joven segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. Joven mezcal has capitalized on high growth due to its inexpensiveness and easy accessibility. The bright, fresh, agave flavour required for cocktails like mezcal margaritas and mezcal palomas is provided by this white spirit, which is also referred to as unaged or very lightly aged. Its attraction is further enhanced by the dozens of flavours, which include citrus, green apple, jalapeno, and white pepper. Joven mezcal has gained popularity, especially among younger consumers and mixologists, as they seek more genuine agave experiences to try their strong and refreshing flavour. Compared to older mezcals, which are more costly, this category is expanding quickly in the market since it is more accessible to a wider range of consumers.

- The 100% agave segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the category, the United States mezcal market is segmented into 100% agave and blend. Among these, the 100% agave segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The context of 100% agave mezcal is strong due to the reliability and high-end brand standing in the spirits industry. It is special because it is created completely of agave, which allows it to maintain its pure flavour. Customers who prefer artisanal goods and high-end spirits will find their natural flavour to be appealing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States mezcal market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Craft Distillers

- El Silencio Holdings

- Brown-Forman Corp Class A

- MADRE Mezcal

- Banhez Spirits Company LLC

- Mezcal Vago

- Ilegal Mezcal

- Becle SAB de CV

- Others

Recent Development

- In August 2021, in response to growing demand, the agave-based ready-to-drink cocktail startup Elenita partnered with DSDs to extend its territorial reach. The California-based company has announced that it has partnered with Hensley Beverage Company to expand its reach into Arizona.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States mezcal market based on the following segments:

United States Mezcal Market, By Product

- Joven

- Reposado

- Anejo

- Others

United States Mezcal Market, By Category

- 100% Agave

- Blend

Need help to buy this report?