United States Menopause Market Size, Share, and COVID-19 Impact Analysis, By Treatment (Dietary Supplements and OTC Pharma Products), By Diagnosis (Women’s Age, Menstrual History, and Symptoms), and United States Menopause Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited States Menopause Market Size Insights Forecasts to 2035

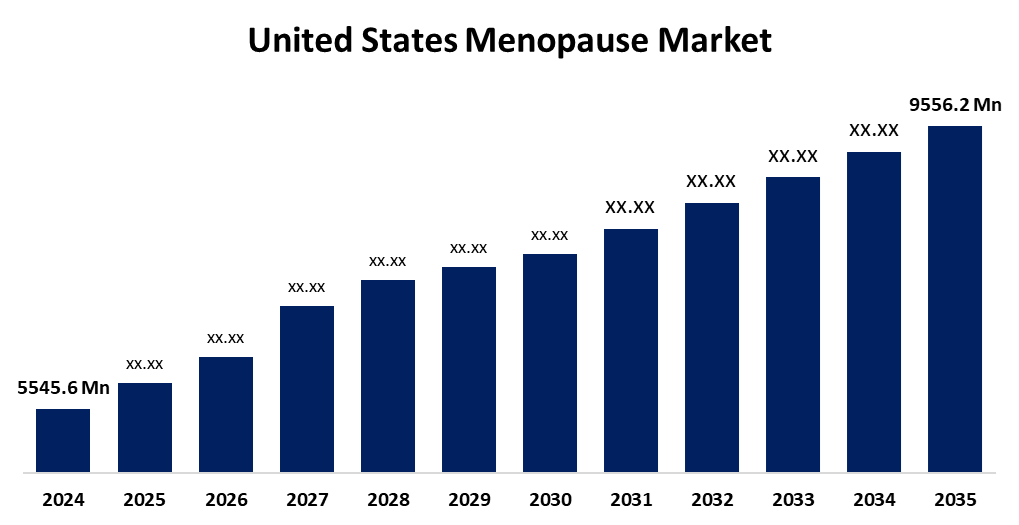

- The US Menopause Market Size Was Estimated at USD 5545.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.07% from 2025 to 2035

- The US Menopause Market Size is Expected to Reach USD 9556.2 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Menopause Market Size is anticipated to reach USD 9556.2 million by 2035, growing at a CAGR of 5.07% from 2025 to 2035. The expansion of the United States menopause market is propelled by the demand for menopause-related goods, services, and therapies is rising as more women approach menopause age and as knowledge and education about menopause and its symptoms increase.

Market Overview

Menopause is the natural biological milestone in a woman's life when her periods permanently stop, provided that there is no other physiological or pathological reason for the absence of periods. After 12 consecutive months without periods, a formal diagnosis is made. The U.S. market is expected to be driven by the increasing number of non-hormonal therapy options and the growing demand for individualised treatment since more women are exploring alternatives to traditional hormone replacement therapy. Increasingly, women want a custom treatment plan that is tailored to their individual medical history, symptoms, and preferences. Hence, the emergence of precision healthcare and personalised medicine focused on individualising treatment for each patient. For instance, in collaboration with the Mayo Clinic in the US, digital health company Lisa Health launched the Midday app in July 2022 to support women through menopause. This app provides a personalised health solution that provides the right intervention at the right time to enable healthy ageing using sensor technology, artificial intelligence, digital therapeutics, and the expertise of professional medical advice. The expansion of non-hormonal, plant-based, and natural remedies, which appeal to health-conscious consumers looking for alternatives to pharmaceuticals, represents a significant opportunity within the U.S. menopause market.

Report Coverage

This research report categorizes the market for the United States menopause market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States menopause market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States menopause market.

United States Menopause Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5545.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.07% |

| 2035 Value Projection: | USD 9556.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 169 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Treatment, By Diagnosis and COVID-19 Impact Analysis |

| Companies covered:: | Padagis, Rainbow Light Nutritional Systems, AbbVie Inc, Abbott Laboratories, Pfizer Inc, Novo Nordisk A/S, TherapeuticsMD, Bayer AG, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growth of the United States menopause market is boosted by a number of elements, including the ageing demographic, increased awareness, lifestyle issues, and improvements in technology. Other elements affecting the market include the changing nature of attitudes, affordability, and accessibility to healthcare. As the population ages, and more women transition into menopause, there will be increasing demand for menopause products and services. With increasing life expectancy rates and declining birth rates in many regions, this demographic trend is expected to continue for some time. Consumers' awareness of menopause, and the symptoms of menopause, is growing substantially, thereby increasing the market for menopausal products. Women are becoming more aware of the significance of changes happening to them during menopause and the health risks that may cause problems.

Restraining Factors

The United States menopause market faces obstacles, as there is considerable growth potential in the market such Safety issues, stigma, lack of awareness, regulatory constraints, and lack of service or research and development may inhibit the market from growing. Women who use hormone replacement therapy (HRT) are at risk for increased heart disease, stroke, and breast cancer.

Market Segmentation

The United States menopause market share is classified into treatment and diagnosis.

- The dietary supplements segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States menopause market is segmented by treatment into dietary supplements and OTC pharma products. Among these, the dietary supplements segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the extensive list of dietary supplements available, a growing interest in natural treatments, and their relative cost when compared to pharmaceuticals. Additionally, dietary supplements are easily assessable to consumers given the huge number of pharmacies, grocery stores, and online retailers they are readily available to consumers.

- The women’s age segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the diagnosis, the United States menopause market is segmented into women’s age, Menstrual History, and Symptoms. Among these, the women’s age segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the population ages and life expectancy rates, which are increasing the number of women entering menopause. With this demographic shift, there is an expanding target market in goods and services related to menopause because of the increased number of women experiencing menopausal symptoms.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States menopause market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Padagis

- Rainbow Light Nutritional Systems

- AbbVie Inc

- Abbott Laboratories

- Pfizer Inc

- Novo Nordisk A/S

- TherapeuticsMD

- Bayer AG

- Others

Recent Development

- In September 2023, Midi Health, a virtual clinic that offers insurance-covered care for women dealing with perimenopause and menopause, raised $25 million in a funding round led by Google Ventures. The startup provides personalized care plans that include lifestyle coaching, prescription medications, evidence-based supplements, and integrative therapy recommendations, based on the patient's health history.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States menopause market based on the following segments:

United States Menopause Market, By Treatment

- Dietary Supplements

- OTC Pharma Products

United States Menopause Market, By Diagnosis

- Women’s Age

- Menstrual History

- Symptoms

Need help to buy this report?