United States Medical Marijuana Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Flower, Oil & Tinctures), By Application (Pain Disorders, Cancer, Others), By Distribution Channel (Dispensaries, Online Channel, Others), and United States Medical Marijuana Market Insights Forecasts to 2033

Industry: HealthcareUnited States Medical Marijuana Market Insights Forecasts to 2033

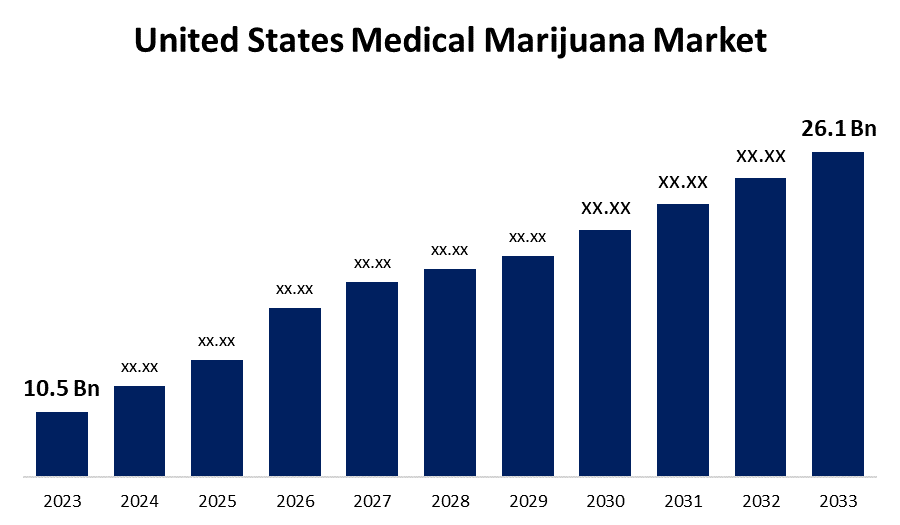

- The United States Medical Marijuana Market Size was valued at USD 10.5 Billion in 2023.

- The Market Size is Growing at a CAGR of 9.5% from 2023 to 2033.

- The United States Medical Marijuana Market Size is Expected to Reach USD 26.1 Billion by 2033.

Get more details on this report -

The United States Medical Marijuana Market Size is expected to reach USD 26.1 Billion by 2033, at a CAGR of 9.5% during the forecast period 2023 to 2033.

Market Overview

Medical marijuana, also known as medical cannabis, is an extract from the marijuana plant that is used to treat a variety of illnesses and symptoms. Also, government restrictions and production concerns have prevented comprehensive testing of marijuana as a medicine. Cannabinoid-based medications treat a wide range of conditions, including HIV/AIDS-related weight loss and appetite loss, chemotherapy-induced vomiting and nausea, and a few rare forms of neurological disease. Furthermore, the growing number of clinical trial initiatives for this marijuana will have a significant impact on market growth. As a result, clinical research into the safety and efficacy of using marijuana to treat various diseases was insufficient. However, the use of cannabis for both medicinal and recreational purposes is already legal in United States jurisdictions. Rising demand for medical cannabis legalization in several states in the United States has fueled the legal market's growth during the forecast period.

Report Coverage

This research report categorizes the market for United States medical marijuana market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States medical marijuana market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States medical marijuana market.

United States Medical Marijuana Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 10.5 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 9.5% |

| 2033 Value Projection: | USD 26.1 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application, By Distribution Channel, and COVID-19 Impact Analysis. |

| Companies covered:: | Aurora Cannabis Inc, GW Pharmaceuticals, Cannabis Sativa Inc, Emerald Health Therapeutics Inc, The Cronos Group Inc, Tilray, Lexaria Bioscience Corp, Curaleaf, Green Roads, CHARLOTTE’S WEB, Canopy Growth Corporation, Gaia Herbs, Medical Marijuana, Folium Biosciences, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The marijuana plant was used medicinally, when it was legalized. The plant's medical benefits are expected to increase product demand, thereby driving medical marijuana market growth over the forecast period. Cannabidiol is a non-psychoactive compound found in the cannabis plant. CBD is thought to have several medicinal properties. For example, epidiolex is a CBD oil extract that is currently in clinical trials for epilepsy. The increasing number of clinical research trials will provide lucrative growth opportunities for the market to grow during forecast period. Cannabinoids-containing therapeutics are used to treat certain rare forms of neurological disorders, chemotherapy-induced vomiting and nausea, HIV/AIDS-induced weight loss and appetite, and a variety of other conditions. Increasing initiatives for clinical trials of this marijuana will significantly boost market growth.

Restraining Factors

Despite the growing use of legal medical marijuana to treat a variety of health conditions, the side effects associated with marijuana consumption may limit market growth to some extent. Side effects such as dizziness, hallucinations, low blood pressure, and a few others are expected to limit the growth of the key market. Another important factor limiting market expansion is a lack of public awareness of marijuana's various associated benefits.

Market Segment

- In 2023, the oil & tinctures Marijuana segment accounted for the largest revenue share over the forecast period.

Based on product type, the United States medical marijuana market is segmented into flower, oil & tinctures. Among these, the oil & tinctures segment has the largest revenue share over the forecast period. The growth is largely owing to its increasing medicinal use. Clinical studies have shown that non-psychoactive compounds in marijuana, such as CBD, have the ability to reduce inflammation, making them a potential new treatment for chronic pain.

- In 2023, the pain disorders segment accounted for the largest revenue share over the forecast period.

Based on the application, the United States medical marijuana market is segmented into pain disorders, cancer, and others. Among these, the pain disorders segment has the largest revenue share over the forecast period. This growth can be attributed to the increasing incidence of pain-related conditions such as migraine, cancer pain, and others. People suffering from chronic pain tend to take large doses of painkillers for immediate relief. However, increasing painkiller intake may cause a variety of side effects. As a result, the medical community began to use cannabis as a pain reliever, which aided the growth of the United States medical marijuana market during forecast period.

- In 2023, the dispensaries segment accounted for the largest revenue share over the forecast period.

Based on the distribution channel, the United States medical marijuana market is segmented into dispensaries, online channel, and others. Among these, the dispensaries segment has the largest revenue share over the forecast period. High demand for this marijuana, combined with an increasing number of dispensaries distributing cannabis-infused medical products, will drive market growth over the forecast period. The main driver of growth is the rapid increase in the number of authorized dispensaries that sell the product.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States medical marijuana market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aurora Cannabis Inc

- GW Pharmaceuticals

- Cannabis Sativa Inc

- Emerald Health Therapeutics Inc

- The Cronos Group Inc

- Tilray

- Lexaria Bioscience Corp

- Curaleaf

- Green Roads

- CHARLOTTE’S WEB

- Canopy Growth Corporation

- Gaia Herbs

- Medical Marijuana

- Folium Biosciences

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2020, Verda Innovations, a medical cannabis company based in the United States, has announced the launch of its legal cannabis e-commerce and delivery platform in both Canada and the United States. The launch of such online platforms is one of the major drivers of growth.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States medical marijuana market based on the below-mentioned segments:

United States Medical Marijuana Market, By Product Type

- Flower

- Oil & Tinctures

United States Medical Marijuana Market, By Application

- Pain Disorders

- Cancer

- Others

United States Medical Marijuana Market, By Distribution Channel

- Dispensaries

- Online Channel

- Others

Need help to buy this report?