United States Mattress Market Size, Share, and COVID-19 Impact Analysis, By Type (Innerspring, Foam, Hybrid, and Others), By Size (Single, Double, Queen, and King), and United States Mattress Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited States Mattress Market Insights Forecasts to 2035

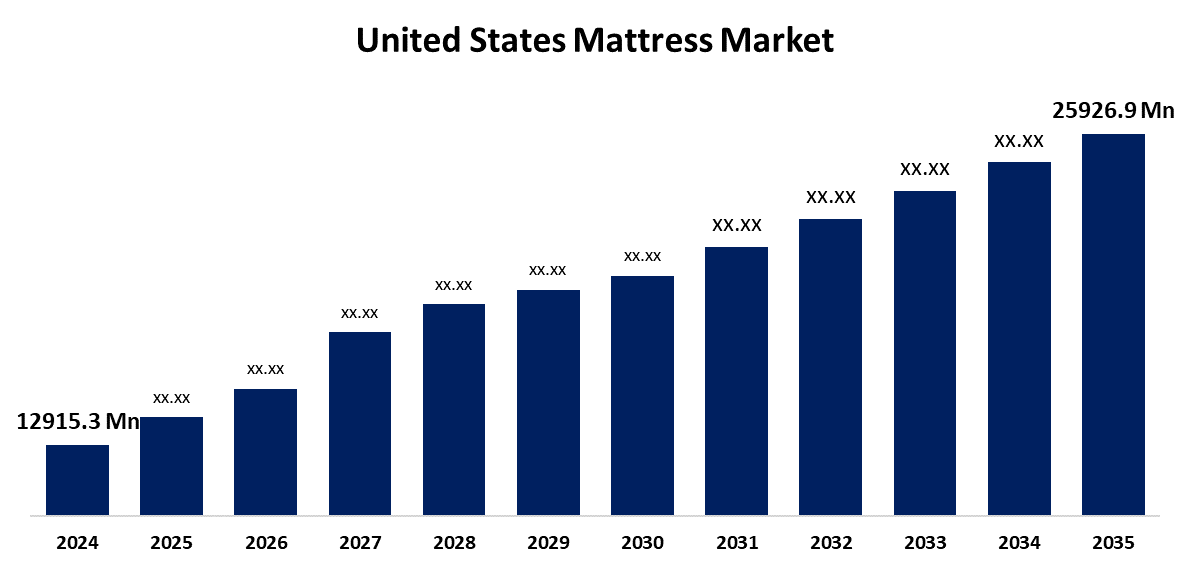

- The US Mattress Market Size Was Estimated at USD 12915.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.54% from 2025 to 2035

- The US Mattress Market Size is Expected to Reach USD 25926.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Mattress Market Size is Anticipated to Reach USD 25926.9 Million by 2035, Growing at a CAGR of 6.54% from 2025 to 2035. The expansion of the United States mattress market is propelled by many consumers who are prioritising sleep health as a result of the increased understanding of the significance of sleep quality.

Market Overview

A mattress is a sizable, typically rectangular pad made specifically for sleeping that supports a person while they are lying down. The US mattress market is being driven by consumers’ increased awareness of how restful sleep contributes to their overall health and well-being. Quality mattresses with features such as temperature control and adjustable support systems are growing in popularity, which is contributing to increased demand overall. For example, in August 2024, Brooklyn Bedding launched the Titan Plus Elite, a luxury mattress that supports a weight up to 1,000 pounds and has heavy-duty support, advanced cooling properties, and superior comfort. Furthermore, consumers wishing to buy mattresses now have easier access and convenience because of the growth of e-commerce platforms, which is propelling market penetration. The rising trend of online reviews and virtual trials, which shape customer preferences and increase purchase opportunities, has also impacted the mattress industry in the United States. With IoT technologies, smart mattresses, such as sleep tracking, firmness adjustment, and temperature control embedded into the mattress, are becoming increasingly popular through technological advances. These innovations cater to consumers who prioritize their health and seek more individualized comfort for better sleep and well-being. IoT technologies are often incorporated into smart mattresses to provide real-time data that enhances convenience and well-being.

Report Coverage

This research report categorizes the market for the United States mattress market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States mattress market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States mattress market.

United States Mattress Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12915.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.54% |

| 2035 Value Projection: | USD 25926.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Type, By Size and COVID-19 Impact Analysis. |

| Companies covered:: | Southerland Sleep, Spring Air International, Serta Simmons Bedding LLC, Tempur Sealy International Inc, Sleep Number Corp, Saatva Inc., Purple Innovations Inc., Tuft & Needle LLC, Kingsdown Mattress and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States mattress market is boosted as it has the capacity for high consumer expenditure, an impressive retail infrastructure, and the desire for high-end goods. Mattress sales are primarily being driven by direct-to-consumer brands, due to delivery in a box and long trial periods. As US consumers emphasis on sleep health continues to strengthen, sales for memory foam, hybrid & smart mattresses are also increasing. The United States remains a leader in innovation in the mattress market because of regular replacement cycles and interest in high-end goods.

Restraining Factors

The United States mattress market faces obstacles, like the high production and R&D costs being passed onto buyers, and many households find mattresses in this price range out of reach. Even though consumers appreciate the value of getting good sleep, many are financially unable to upgrade.

Market Segmentation

The United States mattress market share is classified into type and size.

- The foam segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States mattress market is segmented by type into Innerspring, foam, hybrid, and others. Among these, the foam segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the superior support, motion isolation, and pressure relief. These advantages make foam mattresses especially attractive to couples and individuals with different sleep styles. In addition, due to the increased understanding of how important sleep quality is, customers are interested in premium foam products, such as memory foam and latex mattresses, which are known for their comfort and durability.

- The queen segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on size, the United States mattress market is segmented into single, double, queen, and king. Among these, the queen segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because they offer the best balance between comfort and space. Queen mattress dimensions are the most popular with consumers, appealing to single individuals and couples. The queen size is a versatile option for many home types by providing adequate room for couples and remaining well-proportioned in varying bedroom sizes. As consumers become increasingly aware of the comfort and health of their sleep, the queen-size demand continues to grow with various brands offering queen products in different styles, including memory foam, innerspring, and hybrid.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States mattress market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Southerland Sleep

- Spring Air International

- Serta Simmons Bedding LLC

- Tempur Sealy International Inc

- Sleep Number Corp

- Saatva Inc.

- Purple Innovations Inc.

- Tuft & Needle LLC

- Kingsdown Mattress

- Others

Recent Development

- In April 2024, Brooklyn Bedding launched its first kids' mattress, BB Kids, starting at USD 265. It is designed in the U.S. to prioritize safety, comfort, and durability, featuring certified foams and a stain-resistant, environmentally friendly cover.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States mattress market based on the following segments:

United States Mattress Market, By Type

- Innerspring

- Foam

- Hybrid

- Others

United States Mattress Market, By Size

- Single

- Double

- Queen

- King

Need help to buy this report?