United States Margarine Market Size, Share, and COVID-19 Impact Analysis, By Product (Hard, Soft and Liquid), By Application (Commercial and Household), and United States Margarine Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Margarine Market Insights Forecasts to 2035

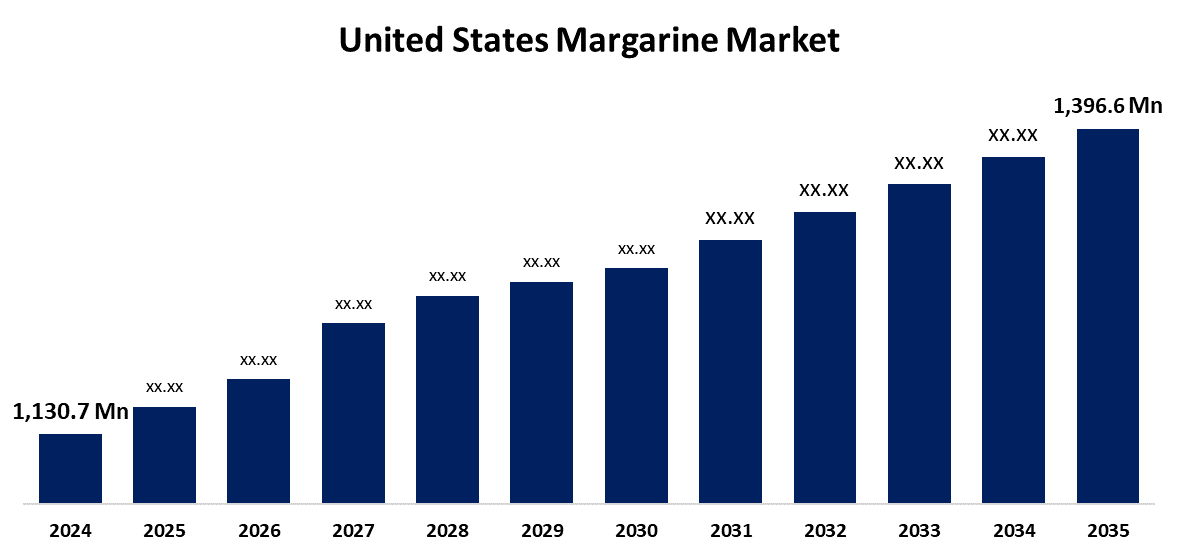

- The US Margarine Market Size Was Estimated at USD 1,130.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 1.94% from 2025 to 2035

- The US Margarine Market Size is Expected to Reach USD 1,396.6 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Margarine Market Size is Anticipated to Reach USD 1,396.6 Million by 2035, Growing at a CAGR of 1.94% from 2025 to 2035. The expansion of the United States' margarine market is propelled by the growing ageing population and the rising use of baked goods and confections.

Market Overview

The margarine is a semi-solid spread that is mostly used to flavour, bake, and cook in place of butter. The use of margarine is expanding rapidly as the food industry continues to meet the demands of the health-conscious consumer, and the uses of margarine are virtually limitless in baking, cooking, and spreading. The United Nations Department of Economic and Social Affairs has stated that in 2050, there will be two billion citizens aged 65 and older. The unaffordable growth rates of this population segment will reshape the consumption trend back toward healthier options, and there will likely be an increased demand for heart-healthy products such as margarine. The bakery segment is becoming a major market for margarine, a product that is affordable and a flexible ingredient that may be used in a variety of baking functions. The bakery segment has enjoyed momentum with consumption driven by rapid growth and evolving eating habits, resulting in large numbers of new small-scale bakeries, artisanal bakeries, and industrial producers in the US. The bakery segment has an amazing opportunity to consume bakery products, for example, in the US alone, there were 5601.61 million units of fresh bread and rolls sold, followed by 3668.04 million units of cookies.

Report Coverage

This research report categorizes the market for the United States margarine market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States margarine market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States margarine market.

United States Margarine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,130.7 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 1.94% |

| 2035 Value Projection: | USD 1,396.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 134 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | KKR & Co Inc Ordinary Shares, Conagra Brands Inc, Bunge Limited, Upfield, Cargill, Blue Bonnet, Parkay, Boulder Brands and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States' margarine market is boosted as the demand for margarine is increasing due to the rapid shift towards healthier choices, due by consumers' health awareness. So, see more individual focusing on their health, and this has created a push for healthier, plant-based alternatives. The shift in behavior has also created consumers seeking lower-fat, vegan, and cholesterol-lowering products. Margarine usually contains lower saturated fats than butter. Additionally, margarine can be fortified with vitamins and other nutrients to make it a more appealing choice to health-conscious customers. Furthermore, margarine would be a desirable alternative because it would be more user-friendly than butter, it is easier to store, and can be stored at room temperature.

Restraining Factors

The United States margarine market faces obstacles as trans fats are a type of fat that is linked to chronic disease; many regulatory agencies have imposed restrictions to limit or eliminate trans fats in food products, which has direct consequences for the market.

Market Segmentation

The United States margarine market share is classified into product and application.

- The hard segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States margarine market is segmented by product into hard, soft, and liquid. Among these, the hard segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by due to its widespread utilization in food prep and baking. Hard margarine has a high melting point, and its structure provides desirable attributes for flaky cakes, pastries, and other baked foods. The long shelf life and cost-effectiveness are reasons of both restaurants and households prefer hard margarine. While its lower saturated fat percentage generally makes margarine a healthier alternative to butter, therefore further advances its popularity in the food industry.

- The commercial segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States margarine market is segmented into commercial and household. Among these, the commercial segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled as it is an essential ingredient in many processed food products like baked products, snacks, and prepared meals. Margarine contributes to texture, flavour, longer shelf stability, etc. Food manufacturers choose margarine because it is cheaper than butter, and margarine is so versatile to bake, fry, and cook with.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States margarine market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- KKR & Co Inc Ordinary Shares

- Conagra Brands Inc

- Bunge Limited

- Upfield

- Cargill

- Blue Bonnet

- Parkay

- Boulder Brands

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States margarine market based on the following segments:

United States Margarine Market, By Product

- Hard

- Soft

- Liquid

United States Margarine Market, By Application

- Commercial

- Household

Need help to buy this report?