United States Mannitol Market Size, Share, and COVID-19 Impact Analysis, By Form (Powder and Granules), By Application (Food and Beverage, Pharmaceuticals, Industrial, and Others), and United States Mannitol Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Mannitol Market Insights Forecasts to 2035

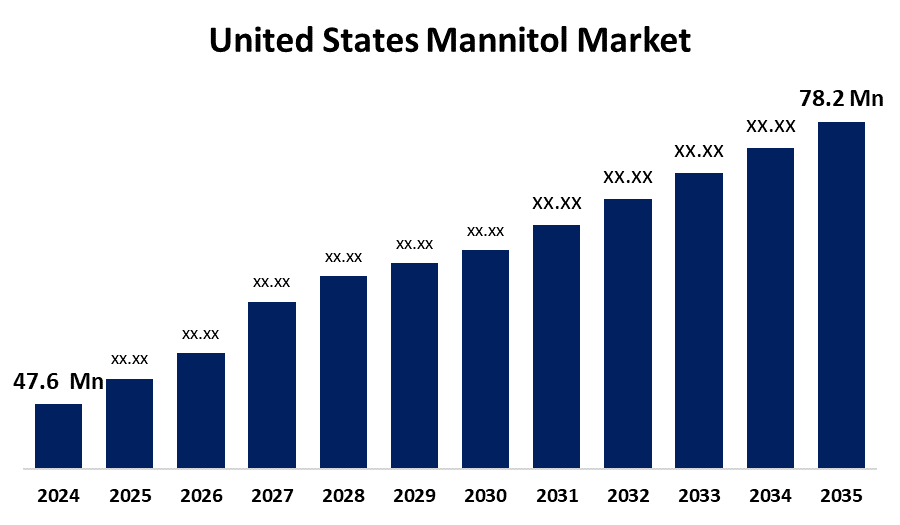

- The US Mannitol Market Size Was Estimated at USD 47.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.62% from 2025 to 2035

- The US Mannitol Market Size is Expected to Reach USD 78.2 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Mannitol Market Size is Anticipated to Reach USD 78.2 Million by 2035, Growing at a CAGR of 4.62% from 2025 to 2035. The expansion of the United States mannitol market is propelled by population growth, changing lifestyles, and the emergence of some diseases.

Market Overview

Mannitol is a sugar alcohol that occurs naturally. Found in plants, seaweed, mushrooms, and algae, it takes the form of colourless, sweet-tasting crystals and is frequently employed as a low-calorie sweetener in food and medications because of its poor intestinal absorption and negligible impact on blood glucose. Mannitol is a naturally occurring sugar alcohol. Due to its poor absorption in the intestine and insignificant effects on blood glucose, it is often used as a low-calorie sweetener in food products and pharmaceuticals. Rapid growth of the industry is primarily due to the increased use of mannitol as a food ingredient and artificial sweetener. Mannitol causes a much smaller increase in blood glucose than sucrose, thus leading to a higher use of products in diabetic meals. Moreover, the increasing prevalence of obesity and diabetes has facilitated a shift towards healthier foods, gained momentum, and grown in the industry. The increased use of mannitol in frozen fish, butter, and precooked pasta has also contributed to the increased demand for the product. The increased usage of artificial sweeteners like mannitol is also attributed to dietary changes and increased health awareness, leading to consumer preferences towards low and zero-calorie food substitutes.

Report Coverage

This research report categorizes the market for the United States mannitol market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States mannitol market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States mannitol market.

United States Mannitol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 47.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 4.62% |

| 2035 Value Projection: | USD 78.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 150 |

| Segments covered: | By Form, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | SPI Pharma, Cargill, Ingredion Inc, ingdao Bright Moon Seaweed Group, ZuChem, Inc., Merck KGaA, Rongde Seaweed Co and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States mannitol market is boosted because it has great growth potential as a useful product with strong diuretic effects, low glycaemic index, and non-cariogenic attributes in food, pharmaceutical, and personal care applications. The demand in the mannitol market continues to grow in pharmaceuticals as it is a commonly used bulking agent in tablets, stabiliser in injectable formulations, osmotic diuretic in renal and cardiac therapy, and is bolstered by the increasing amount of oral solid dose medications entering the market. Its function as a low-calorie sugar substitute in food and beverages is aligned with growing trends in functional nutrition, ketogenic attitudes, and diabetes management.

Restraining Factors

The United States mannitol market faces obstacles like the complex extraction and production processes, creating very volatile prices and limiting supply chains. Production costs are also significantly inflated by the price volatility of commonly used feedstocks, including maize, sugar, and cassava.

Market Segmentation

The United States mannitol market share is classified into form and application.

- The powder segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States mannitol market is segmented by form into powder and granules. Among these, the powder segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because it decreases downtime, and shows to validate batch consistency under rigorous GMP audits, because they rely on continuous processing lines that tightly meter excipients.

- The food and beverage segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States mannitol market is segmented into food and beverage, pharmaceuticals, industrial, and others. Among these, the food and beverage segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled because drug manufacturers value mannitol's osmotic properties in parenteral formulations, and its stability in high humidity, while drug manufacturers seek to charge higher average selling prices for the pharmaceutical grade than the food grade product. Mannitol is also being integrated into next-generation dosage forms as drug manufacturers focus on continuous manufacture and the latest modality of biologics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States mannitol market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SPI Pharma

- Cargill

- Ingredion Inc

- ingdao Bright Moon Seaweed Group

- ZuChem, Inc.

- Merck KGaA

- Rongde Seaweed Co.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States mannitol market based on the following segments:

United States Mannitol Market, By Form

- Powder

- Granules

United States Mannitol Market, By Application

- Food and Beverage

- Pharmaceuticals

- Industrial

- Others

Need help to buy this report?