United States Luxury Hair Care Market Size, Share, and COVID-19 Impact Analysis, By Product (Shampoos, Conditioners, Hair Colouring Products, Hair Styling Products, Hair Oil, and Others), By Price Range (USD 30 to USD 65, USD 65 to USD 100, USD 100 to USD 150, USD 150 to USD 200, and Above USD 200), By Distribution Channel (Hypermarkets & Supermarkets, Pharmacy & Drugstore, Specialty Stores, Online, and Others), and United States Luxury Hair Care Market Insights, Industry Trend, Forecasts To 2035

Industry: Consumer GoodsUnited States Luxury Hair Care Market Size Insights Forecasts to 2035

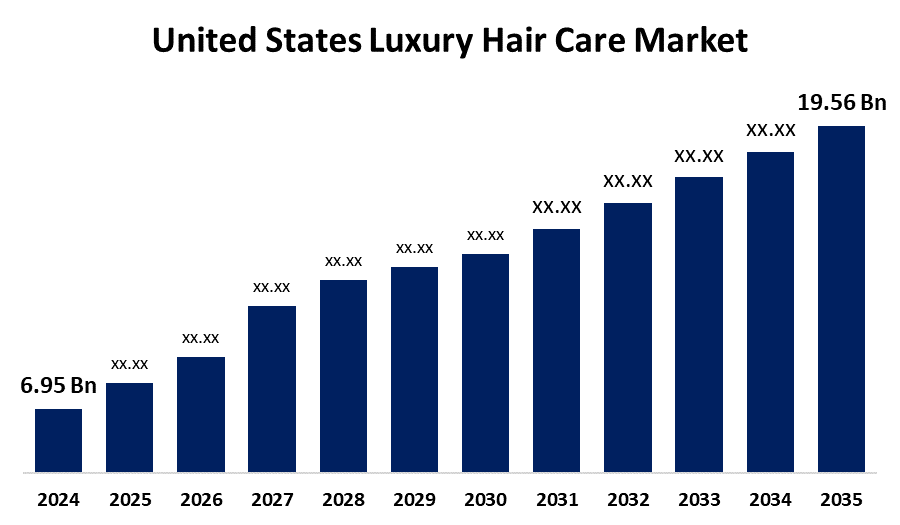

- The US Luxury Hair Care Market Size Was Estimated at USD 6.95 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.86% from 2025 to 2035

- The US Luxury Hair Care Market Size is Expected to Reach USD 19.56 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Luxury Hair Care Market is anticipated to Reach USD 19.56 Billion by 2035, Growing at a CAGR of 9.86% from 2025 to 2035. The United States luxury hair care market is being driven by rising preference of individuals for effective and personalized hair care products that are designed to work on specific hair conditions, also due to increasing disposable income and upgrading lifestyle standards are pushing individuals to spend on beauty and personal care, which in turn is boosting the market share

Market Overview

Luxury hair care includes high-end products and remedies designed to preserve and improve hair health using premium quality ingredients and innovative formulas. These products are beyond standard cleaning and conditioning. They are for providing clear benefits, improving user experience, and promoting the feeling of enjoyment. Luxury shampoos, conditioners, hair oil, masks, serum, and scalp treatment are some examples. Luxury hair care refers to high-end hair products and remedies that provide greater adaptation than mass performance, rich experience, and mass-market options. These products often include high-quality, morally sourced materials, dermatologist-tested formulas, and excellent packaging that appeal to intelligent customers. Luxury hair care includes shampoos, conditioners, hair masks, oil, serum, styling products, scalp treatment, and professional salon services. Unlike regular hair care products, which address large-scale fundamental requirements such as washing and hydration, luxury options are often supported by scientific research, physician or stylist endorsement, and owner of botanical, natural extracts, or high-demonstrations active materials. Many luxury brands prefer stability, clean beauty standards, and cruelty-free testing, reflecting the increasing consumer preference for honest consumption.

Report Coverage

This research report categorizes the United States luxury hair care market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States luxury hair care market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States luxury hair care market.

United States Luxury Hair Care Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.95 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.86% |

| 2035 Value Projection: | USD 19.56 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Price Range and COVID-19 Impact Analysis |

| Companies covered:: | LOreal Groupe, Living proof, Aveda (Estée Lauder Companies), Briogeo Hair, Rucker Roots, MOROCCANOIL, Advent International (Olaplex), and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factor

The US luxury hair care market is driven by Increased disposable income, a prediction for high-end beauty products, and increased awareness about hair health. Clean and natural formulas, personal solutions, and effective digital marketing strategies all contribute to the increased demand. Expanding e-commerce platforms and salon cooperation improve access to access, boosting overall market penetration and growth.

Restraining Factor

The US luxury hair care market has to face restrictions due to high product prices, massive competition from market and professional brands, and low customer understanding of premium benefits can slow the growth. Additionally, transferring restrictions on fake products and the cosmetics business disrupts market growth.

The United States luxury hair care market share is classified into product, price range, and distribution channel.

- The shampoo segment accounted for the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The U.S. luxury hair care market is segmented by product into up to shampoos, conditioners, hair colouring products, hair styling products, hair oil, and others. Among these, the shampoo segment accounted for the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The shampoo product line is often designed to address a wide range of hair care issues, including hair loss, everyday glow and care, dandruff, hair breakage, partition ends, and more. Shampoo natural ingredients such as plant oil, aloe, organic honey, olive oil, essential oil, almond oil, and shea butter are in high demand among consumers in this area.

- The USD 30 to USD 65 segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the projected timeframe.

The U.S. luxury hair care market is segmented by price range into USD 30 to USD 65, USD 65 to USD 100, USD 100 to USD 150, USD 150 to USD 200, and above USD 200. Among these, the USD 30 to USD 65 segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the projected timeframe. This is due to Customers frequently choosing the items offered by companies in this price category because of two key factors, which basically include the fragrances and the unique components utilized in the product formulation.

- The online segment is anticipated to grow at the fastest CAGR during the forecast period.

The U.S. luxury hair care market is segmented by distribution channel into hypermarkets & supermarkets, pharmacy & drug stores, specialty stores, online, and others. Among these, the online segment is anticipated to grow at the fastest CAGR during the forecast period. This is due to working hours are spent traveling more time traveling, and the unique feature provided by internet distribution has an attractive capacity for online sale of premium hair care products in the United States.

Competitive Analysis

The report offers the appropriate analysis of the key organizations/companies involved within the United States Luxury Hair Care market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- LOreal Groupe

- Living proof

- Aveda (Estée Lauder Companies)

- Briogeo Hair

- Rucker Roots

- MOROCCANOIL

- Advent International (Olaplex)

- Others

Recent Development

- In February 2024, L'Oréal Paris announced the debut of Hyaluron + Pure, which includes a Shampoo, Conditioner, and oil-erasing scalp serum, through an exclusive partnership with Walmart. The launch is believed to be inspired by the success of a comparable Walmart exclusive launch of L'Oréal Paris Elvive Hyaluron + Plump line.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States luxury hair care market based on the below-mentioned segments:

United States Luxury Hair Care Market, By Product

- Shampoos

- Conditioners

- Hair Colouring Products

- Hair Styling Products

- Hair Oil

- Others

United States Luxury Hair Care Market, By Price Range

- USD 30 to USD 65

- USD 65 to USD 100

- USD 100 to USD 150

- USD 150 to USD 200

- Above USD 200

United States Luxury Hair Care Market, By Distribution Channel

- Hypermarkets & Supermarkets

- Pharmacy & Drugstore

- Specialty Stores

- Online

- Others

Need help to buy this report?