United States LTCC and HTCC Market Size, Share, and COVID-19 Impact Analysis, By Product (LTCC and HTCC), By Application (Automotive, Telecommunication, Aerospace & Defense, Consumer Electronics, and Others), and United States LTCC and HTCC Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States LTCC and HTCC Market Insights Forecasts to 2035

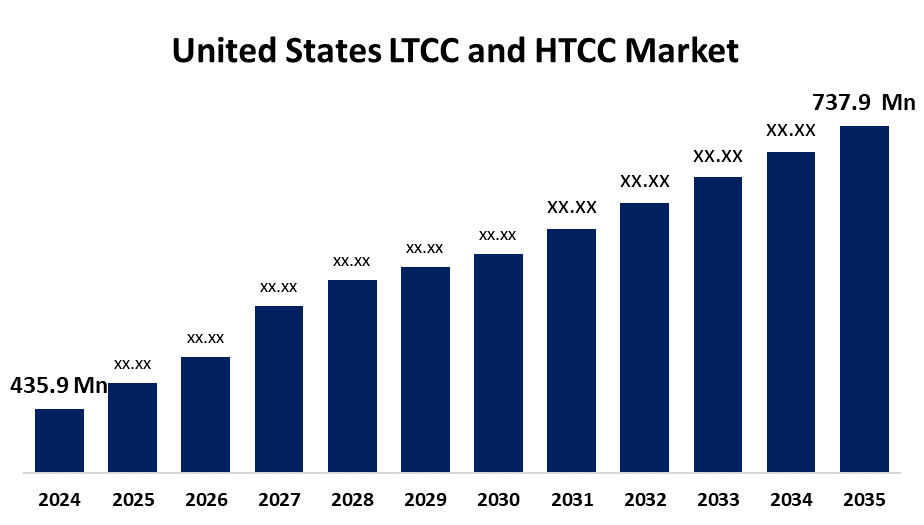

- The US LTCC and HTCC Market Size Was Estimated at USD 435.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.90% from 2025 to 2035

- The US LTCC and HTCC Market Size is Expected to Reach USD 737.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States LTCC and HTCC Market is anticipated to reach USD 737.9 million by 2035, growing at a CAGR of 4.90% from 2025 to 2035. The expansion of the United States LTCC and HTCC market is propelled by the increasing need for microelectronics in automobiles and aeroplanes to make travel safer.

Market Overview

Advanced ceramic packaging methods called Low-Temperature Co-Fired Ceramic (LTCC) and High-Temperature Co-Fired Ceramic (HTCC) are used in microelectronics to build multilayer substrates that incorporate passive parts like inductors, resistors, and capacitors. Because of the increasing popularity of new technologies like 5G and the Internet of Things (IoT), the U.S. is anticipated to continue to be the largest market for LTCC and HTCC during the projected period. It also anticipated that continued partnerships between various research institutes and rising research expenditures for creating next-generation wireless technologies would further propel market expansion. Additionally, it is projected that the growing use of electronic devices and sensors in automobiles will open up new potential opportunities for the industry in the upcoming years. For instance, HTCC technology can be used for next-generation automotive components, including the packaging of LED and LD headlights and DCB circuit substrates, while LTCC provides excellent performance in sophisticated automotive sensors. Market participants throughout the automotive electronics value chain are investing to take advantage of advancements in software and electronics as a result of the gradual movement from hardware to software-defined vehicles. Connectivity, electrification, autonomous driving, and diversified mobility are a few instances of software innovation. Although LTCC is an appealing option for microelectronic device packaging, a lot of research is being done to address issues that arise during LTCC's manufacture, processing, and use.

Report Coverage

This research report categorizes the market for the United States LTCC and HTCC market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States LTCC and HTCC market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States LTCC and HTCC market.

Driving Factors

The growth of the United States LTCC and HTCC market is being propelled by the growing demand for new electronic components across a variety of industries. Wearable technology, cell phones, and consumer electronics are driving the demand for high-performance components, and the growing trend of miniaturisation is leading to increased demand for high-temperature co-fired ceramic (HTCC) and low-temperature co-fired ceramic (LTCC). Due to the size of electronic devices decreasing, manufacturers are found to be able to make parts smaller and more effective using LTCC and HTCC materials without the compromise of a loss of functionality. In addition, both the LTCC and HTCC market demand is expected to increase with the advancement of 5G, artificial intelligence, and the Internet of Things (IoT). They are perfect for intricate electrical applications because of their high-frequency handling capabilities and superior heat control.

Restraining Factors

The United States LTCC and HTCC market faces obstacles like a large financial investment in cleanroom facilities, specialised machinery, and trained personnel. Small and medium-sized businesses (SMEs) may be discouraged from entering the market by this large upfront investment, which would restrict competition and innovation. Ongoing research and development (R&D) expenses also put further pressure on corporations and potential investors.

Market Segmentation

The United States LTCC and HTCC market share is classified into product and application.

- The LTCC segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States LTCC and HTCC market is segmented by product into LTCC and HTCC. Among these, the LTCC segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by rising investments in wireless technologies and RF modules due to the growing need for high-speed internet in urban and semi-urban areas. For example, Murata Manufacturing Co., Ltd. declared in October 2019 that it would be developing RF modules for Terragraph, Facebook's wireless technology. For consistent communication quality, the RF modules make use of LTCC products.

- The automotive segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States LTCC and HTCC market is segmented into automotive, telecommunication, aerospace & defense, consumer electronics, and others. Among these, the automotive segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is propelled by a safer and better driving experience, as car electronics use LTCC and HTCC. The main reasons propelling the need for automotive electronics are consumer preferences for car safety, telematics adoption, and government-mandated safety regulations. Advanced Driver Assistance Systems (ADAS), safety, powertrain, and infotainment are some of the main uses for car electronics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States LTCC and HTCC market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- DowDuPont Inc.

- AdTech Ceramics

- Micro Systems Technologies

- NEOTech

- API Technologies Corp

- Murata Manufacturing Co., Ltd.

- TDK Corporation

- Others

Recent Development

- In June 2023, at the International Microwave Symposium (IMS) in San Diego, Celanese introduced its Micromax LF Series conductive inks and the GreenTape LF95C LTCC material system. These innovations are designed to support the development of advanced electronic devices, particularly in the telecommunications and automotive sectors.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States LTCC and HTCC market based on the following segments:

United States LTCC and HTCC Market, By Product

- LTCC

- HTCC

United States LTCC and HTCC Market, By Application

- Automotive

- Telecommunication

- Aerospace & Defense

- Consumer Electronics

- Others

Need help to buy this report?