United States LPG Tanker Market Size, Share, and COVID-19 Impact Analysis, By Vessel Size (Very Large Gas Carrier, Large Gas Carrier, Medium Gas Carrier, and Small Gas Carrier), By Refrigeration and Pressurization (Fully Pressurized, Semi-pressurized, Fully Refrigerated, and Extra Refrigerated), and United States LPG Tanker Market Insights Forecasts to 2033

Industry: Automotive & TransportationUnited States LPG Tanker Market Insights Forecasts to 2033

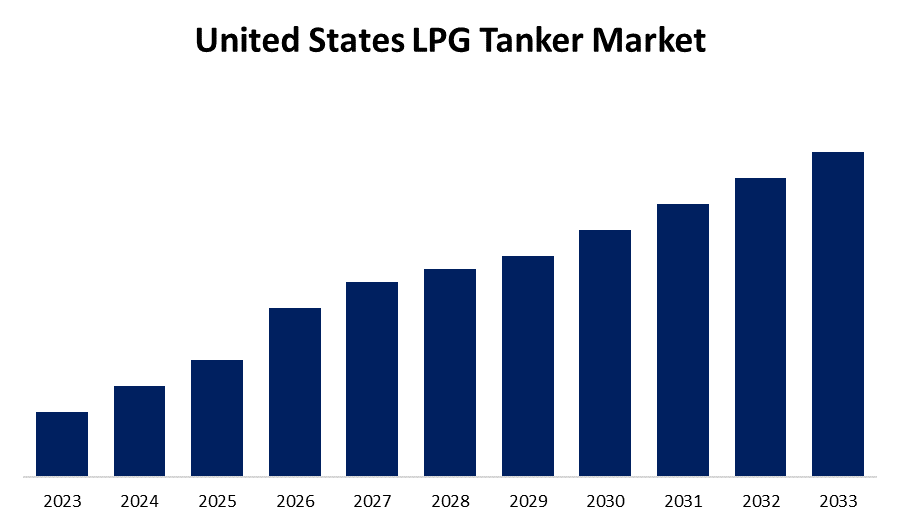

- The Market Size is Growing at a CAGR of 5.5% from 2023 to 2033.

- The United States LPG Tanker Market Size is Expected to Hold a Significant Share by 2033.

Get more details on this report -

The United States LPG Tanker Market Size is Expected to Hold a Significant Share by 2033, at a CAGR of 5.5% during the forecast period 2023 to 2033.

Market Overview

A liquefied petroleum gas (LPG) tanker is a gas carrier that transports petroleum gases in bulk, a by-product of natural gas processing and crude oil refining. It is made up of independent reservoirs arranged in cargo holds. Small-pressurized tanks, insulated or refrigerated seagoing tanks, and semi-pressurized tanks are among the most common types of LPG tankers. They have a controllable-pitch propeller and a geared-diesel engine and come in four sizes: very large, large, medium, and small. These tankers can also transport ammonia, propylene, and vinyl chloride. As a result, they find extensive use in a variety of industries, including oil and gas, chemical, automotive, and refinery. The market for LPG Tankers has grown significantly over the years, owing to a variety of factors including rising demand for cleaner-burning fuels, expansion in the petrochemical industry, and an increase in domestic LPG consumption.

Report Coverage

This research report categorizes the market for United States LPG tanker market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States LPG tanker market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the United States LPG tanker market.

United States LPG Tanker Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 5.5% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Vessel Size, By Refrigeration & Pressurization and COVID-19 Impact Analysis. |

| Companies covered:: | Kinder Morgan, Enterprise Products Partners, Phillips 66 Partners, Dorian LPG Ltd., Navigator Gas, BW LPG Limited, Avance Gas Holding Ltd., StealthGas Inc., Exmar, Nippon Yusen Kabushiki Kaisha and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United States LPG tanker market has been significantly impacted by rising demand for environmentally friendly energy alternatives. LPG, known for its cleaner combustion than traditional fossil fuels, has emerged as a popular choice in a variety of industries. Amid mounting environmental concerns and stringent emission regulations, various industries, residential enclaves, and commercial establishments are rapidly transitioning to LPG for a variety of applications such as heating, cooking, and energy generation. This notable shift towards cleaner energy sources has resulted in a significant increase in LPG consumption in the United States. This increased reliance necessitates an intricately structured and efficient supply chain to meet the growing demand for LPG tanker transportation services, allowing for the smooth movement of liquefied petroleum gas across the country. Moreover, the explosive growth of the United States LPG tanker market is driven by a significant increase in domestic LPG production within the country's borders. This meteoric rise can be directly attributed to revolutionary advances in extraction methods, most notably the introduction of shale gas technologies.

Restraining Factors

The inherent volatility of energy markets, as well as the susceptibility of LPG prices to fluctuations, present significant challenges for stakeholders in the United States LPG tanker industry. LPG prices are influenced by a variety of factors, including supply and demand dynamics, geopolitical tensions, currency fluctuations, and changes in crude oil prices, as LPG is frequently a byproduct of oil and gas production. Sharp price fluctuations can impact the profitability of LPG shipments by influencing investment decisions and trade patterns.

Market Segment

- In 2023, the large gas carrier segment accounted for the largest revenue share over the forecast period.

Based on the vessel size, the United States LPG tanker market is segmented into very large gas carrier, large gas carrier, medium gas carrier, and small gas carrier. Among these, the large gas carrier segment has the largest revenue share over the forecast period. large gas carriers, with capacities ranging from 35,000 to 85,000 cubic meters, have been at the forefront due to their versatility and ability to meet both regional and international LPG transportation requirements. These vessels strike a balance between size and flexibility, allowing them to navigate a variety of waterways while efficiently transporting large amounts of LPG. The LGC segment's dominance is attributed to several factors, including rising export demand for the United States.

- In 2023, the fully refrigerated segment accounted for the largest revenue share over the forecast period.

Based on the refrigeration and pressurization, the United States LPG tanker market is segmented into fully pressurized, semi-pressurized, fully refrigerated, and extra refrigerated. Among these, the fully refrigerated segment has the largest revenue share over the forecast period. Fully refrigerated vessels, which are outfitted with advanced refrigeration systems to keep LPG cargoes at low temperatures, have gained popularity for their ability to transport larger volumes of LPG over longer distances while maintaining cargo integrity. This segment's dominance can be attributed to several factors, including the growing demand for long-distance transportation of LPG.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States LPG tanker market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Kinder Morgan

- Enterprise Products Partners

- Phillips 66 Partners

- Dorian LPG Ltd.

- Navigator Gas

- BW LPG Limited

- Avance Gas Holding Ltd.

- StealthGas Inc.

- Exmar

- Nippon Yusen Kabushiki Kaisha

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2023, OceanTrans Logistics, a key player in the US LPG tanker market, has launched a game-changing digital platform to optimize LPG logistics. The platform combines advanced data analytics and AI-powered systems to streamline supply chain operations, increasing efficiency and transparency in LPG transportation. OceanTrans Logistics' emphasis on technological innovation is consistent with the industry's growing demand for digitization and operational efficiency in the dynamic LPG tanker market.

Market Segment

This study forecasts country revenue from 2022 to 2033. Spherical Insights has segmented the United States LPG tanker market based on the below-mentioned segments:

United States LPG Tanker Market, By Vessel Size

- Very Large Gas Carrier

- Large Gas Carrier

- Medium Gas Carrier

- Small Gas Carrier

United States LPG Tanker Market, By Refrigeration and Pressurization

- Fully Pressurized

- Semi-pressurized

- Fully Refrigerated

- Extra Refrigerated

Need help to buy this report?