United States Locomotive Market Size, Share, and COVID-19 Impact Analysis, By Type (Diesel, Electric, and Others), By Technology (IGBT Module, GTO Thyristor, and SiC Power Module), and United States Locomotive Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited States Locomotive Market Insights Forecasts to 2035

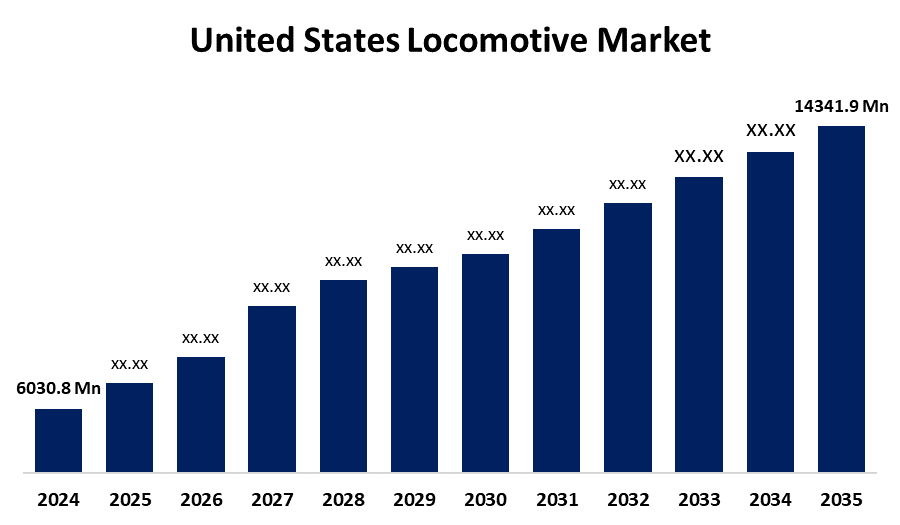

- The US Locomotive Market Size Was Estimated at USD 6030.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.19% from 2025 to 2035

- The US Locomotive Market Size is Expected to Reach USD 14341.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States Locomotive Market is anticipated to reach USD 14341.9 million by 2035, growing at a CAGR of 8.19% from 2025 to 2035. The expansion of the United States locomotive market is propelled by increasing governmental and private sector investments in rail network infrastructure.

Market Overview

A locomotive is an electric, diesel, or steam-powered self-propelled rail vehicle used exclusively to supply motive force for pushing or dragging one or more unpowered train carriages over railway rails. A salient feature of locomotive trends in the US is the increasing adoption of technologically advanced locomotives with a focus on lower emissions and energy efficiency. With the EPA and its strict enforcement of environmental standards, the industry is moving toward locomotives that use cleaner technologies. Adherence to regulations and increased consumer demand for environmentally responsible transit regimes are the principal drivers of this change. In addition, the industry is paying more attention to automation and digitalization of technologies, including both telematics and predictive maintenance. The outcomes are to enhance the reliability, safety, and operational effectiveness of rail transportation. In addition, changes to the US infrastructure bill are creating possibilities to fund rail projects that will modernize and enhance service. The anticipated resources and enhancements associated with such federal investment could create a stronger need for locomotives as a result of improvements and network expansions. The transition to urban transit systems also creates an opportunity to explore and capitalize on markets for commuter and transit rail solutions in large cities across the US, where population growth demands a solution for increased efficiencies in public transit.

Report Coverage

This research report categorizes the market for the United States locomotive market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States locomotive market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States locomotive market.

United States Locomotive Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6030.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.19% |

| 2035 Value Projection: | USD 14341.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Type, By Technology and COVID-19 Impact Analysis |

| Companies covered:: | Wabtc, Electro Motive diesel, Siemens Mobility, Alstom Inc, Stadler Rail, Kawasaki heavy Industries, CRRC MA Crop, and Trinity Industries Inc |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States locomotive market is boosted by the increase in demand for freight due to expansions in trade and e-commerce. Locomotives are a very attractive option for businesses because they are an economically and effective option for freight movements. Additionally, the overarching shift to sustainable transportation also benefits the market. Governments and transit authorities are placing importance on adopting low-emission and zero-emission rail systems, which is driving demand for hybrid, battery-electric, and hydrogen-powered locomotives. Rail operators are also facing pressure to move away from diesel-powered fleets and towards environmentally sustainable alternatives.

Restraining Factors

The United States locomotive market faces obstacles like the upfront costs associated with the purchase and maintenance of the locomotives. Significant investment is also required to transition to next-generation technologies such as electric propulsion systems and hydrogen.

Market Segmentation

The United States locomotive market share is classified into type and technology.

- The electric segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States locomotive market is segmented by type into diesel, electric, and Others. Among these, the electric segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because it has a lower output of emissions, which reduces greenhouse gas emissions and air pollution. Thus, expect this market to grow in the forecast period due to the increased interest in electric mobility and the use of renewable resources. The locomotive industry is also benefiting from government and regulatory organizations' increased concerns about climate change and their efforts to promote the use of electric locomotives.

- The IGBT module segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the technology, the United States locomotive market is segmented into IGBT module, GTO Thyristor, and SiC power module. Among these, the IGBT module segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the increased demand for efficient and reliable power electronics solutions for traction, propulsion, and control systems in modern rail transportation. The demand for IGBT modules is increasing for locomotives that span long distances.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States locomotive market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Wabtc

- Electro Motive diesel

- Siemens Mobility

- Alstom Inc

- Stadler Rail

- Kawasaki heavy Industries

- CRRC MA Crop

- Trinity Industries Inc

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States locomotive market based on the following segments:

United States Locomotive Market, By Type

- Diesel

- Electric

- Others

United States Locomotive Market, By Technology

- IGBT Module

- GTO Thyristor

- SiC Power Module

Need help to buy this report?