United States Lipid Market Size, Share, and COVID-19 Impact Analysis, By Product (Triglycerides, Phospholipids, Ionizable Lipids, Sphingolipids, and Others), By Application (Pharmaceutical, Food & Beverage, Nutrition & Supplements, and Others), and United States Lipid Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Lipid Market Insights Forecasts to 2035

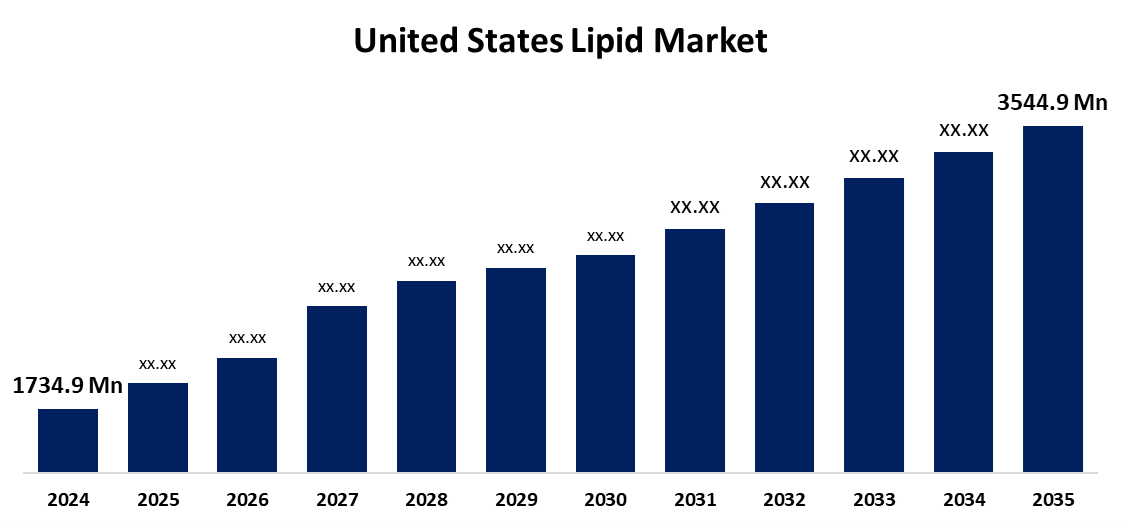

- The US Lipid Market Size Was Estimated at USD 1734.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.71% from 2025 to 2035

- The US Lipid Market Size is Expected to Reach USD 3544.9 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United States Lipid Market Size is anticipated to Reach USD 3544.9 Million by 2035, Growing at a CAGR of 6.71% from 2025 to 2035. The expansion of the United States lipid market is propelled by expanding use in sectors like nutrition supplements, food and beverage, and pharmaceuticals.

Market Overview

Lipids are a large class of organic compounds that are mostly identified by their insolubility in water and solubility in organic solvents such as ether and chloroform. Because of their growing role in drug development and many other pharmaceutical applications, lipids are expected to witness significant growth in demand over the forecast period. Lipids are considered essential active ingredients in the pharmaceutical industry for producing most pharmaceutical formulations. Growing health concerns and the need for medications are expected to increase demand for pharmaceuticals, which will present the lipids market with opportunities. Growth in public awareness of fitness and other health concerns has come with increased consumption of nutrition and supplements.

The US government has made significant financial investments to increase domestic production capacity for lipid systems utilised in innovative therapies, like mRNA vaccines. For instance, the Biomedical Advanced Research and Development Authority (BARDA), a branch of the U.S. Department of Health and Human Services, awarded up to $75 million to Croda International Plc. The goal of this funding is to build a new lipid factory in Lamar, Pennsylvania, to enhance the production of vital lipid components for drug delivery systems.

Report Coverage

This research report categorizes the market for the United States lipid market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States lipid market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States lipid market.

United States Lipid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1734.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.71% |

| 2035 Value Projection: | USD 3544.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Omega Protein, Cargill, Archer-Daniels Midland Co, Nordic Naturals, Danaher Corp, Croda International Plc, Lipoid GmbH, Gattefosse, Merck Group, and Other KeyCompanies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States lipid market is boosted because it contributed to a growing obesity epidemic and related health issues. The incidence is due to sedentary lifestyles, increased urbanisation, fast-food consumption, and availability. So, the requirement for nutritional lipids is increasing, and there is a growing health concern about foods. Many food production companies are also using lipids to substitute for synthetic flavouring carriers, to preserve the taste and smell of their products. Better functional qualities, including density, emulsifying, and hydrogenation, are responsible for this. There is also an increasing propensity to use lipids as a natural industrial ingredient in the personal care industry, which is now predicted to drive growth in the lipid market.

Restraining Factors

The United States lipid market faces obstacles as it is unsuitable for patients with specific medical concerns, competition among raw materials suppliers affects product supply, issues with sustainability or limits in fisheries, and reductions in catch quotas.

Market Segmentation

The United States lipid market share is classified into product and application.

- The triglycerides segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States lipid market is segmented by product into triglycerides, phospholipids, ionizable lipids, sphingolipids, and others. Among these, the triglycerides segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the increased demand from end-use industries, namely dietary supplements and functional beverages, for derivatives of triglycerides, which include medium-chain and long-chain triglycerides. Triglycerides and lipids are utilized extensively across many food and beverage functional foods, as they are an important energy source.

- The food & beverage segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States lipid market is segmented into pharmaceutical, food & beverage, nutrition & supplements, and others. Among these, the food & beverage segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled due to the population increase. Lipids are mostly used to prepare functional foods and beverages since they are excellent sources of vitamins and energy. The food and beverage sector will further increase in demand for the product due to excessive demand for nutrient-dense foods and healthy beverages.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States lipid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Omega Protein

- Cargill

- Archer-Daniels Midland Co

- Nordic Naturals

- Danaher Corp

- Croda International Plc

- Lipoid GmbH

- Gattefosse

- Merck Group

- Others

Recent Development

- In July 2023, Cytiva launched the NanoAssemblr System, a scalable mixing technology designed to support end-to-end clinical and commercial manufacturing of lipid nanoparticle (LNP) medicines. This system employs a single-use fluid path to minimize the risk of cross-contamination and facilitate efficient batch changeovers, enhancing reproducibility and scalability in the production of nanoparticle-based therapies.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States lipid market based on the following segments:

United States Lipid Market, By Product

- Triglycerides

- Phospholipids

- Ionizable Lipids

- Sphingolipids

- Others

United States Lipid Market, By Application

- Pharmaceutical

- Food & Beverage

- Nutrition & Supplements

- Others

Need help to buy this report?