United States Lipid Disorder Therapeutics Market Size, Share, and COVID-19 Impact Analysis, By Drugs (Fluvastatin, Simvastatin, Atorvastatin, Pravastatin, Rosuvastatin, And Others), By Indications (Familial Hypertriglyceridemia, Familial Dysbetalipoproteinemia, Familial Combined Hyperlipidemia, Heterozygous Familial Hypercholesterolemia, Familial Defective Apolipoprotein B-100, and Others), By Distribution Channel (Hospital Pharmacies, Online Pharmacies, and Retail Pharmacies), and US Lipid Disorder Therapeutics Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUSA Lipid Disorder Therapeutics Market Insights Forecasts to 2035

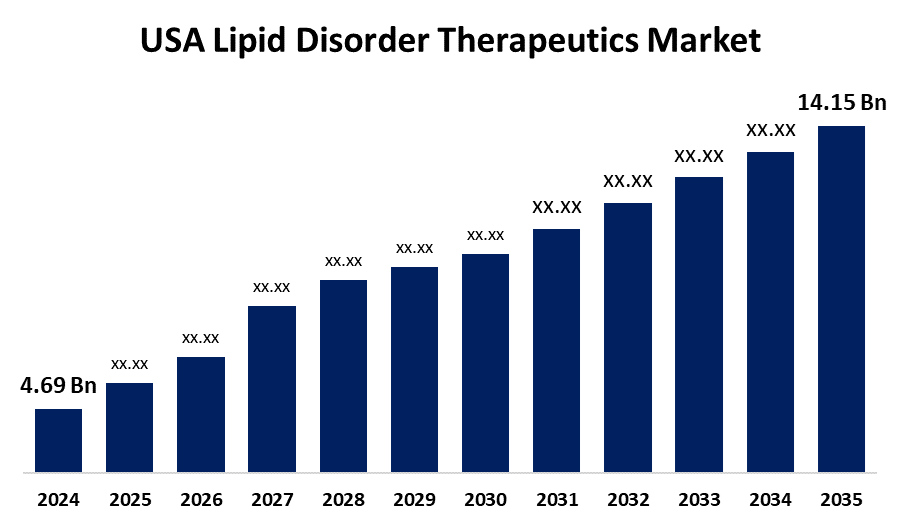

- The US Lipid Disorder Therapeutics Market Size Was Estimated at USD 4.69 Billion in 2024

- The Market Size is expected to grow at a CAGR of around 10.56% from 2025 to 2035

- The USA Lipid Disorder Therapeutics Market Size is Expected to reach USD 14.15 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the US Lipid Disorder Therapeutics Market is anticipated to reach USD 14.15 Billion by 2035, growing at a CAGR of 10.56% from 2025 to 2035. The market growth is attributed to the rising prevalence of lipid disorders such as hyperlipidemia and hypercholesterolemia, the rising proportion of the geriatric population, increasing research and development studies, and the growing focus on novel drug delivery systems.

Market Overview

The United States lipid disorder therapeutics market encompasses the development, production, and commercialization of medications used to manage and treat lipid disorders, such as hyperlipidemia. Lipid disorders hinder the body's ability to metabolize fats properly, leading to the accumulation of harmful fats in the bloodstream. Common risk factors include obesity, poor diet, smoking, high triglycerides, high cholesterol, diabetes, renal disease, and family history. Elevated triglycerides and cholesterol can result in plaque buildup in the arteries, increasing the risk of coronary artery disease, stroke, and other health issues. Sedentary lifestyles, smoking, diabetes, renal disease, obesity, and high intake of saturated and trans fats can further elevate these risks. The development of lipid diseases is influenced by hereditary factors, lifestyle choices, and other variables. Medications used for the management of lipid disorders include statins, fibrates, cholesterol absorption inhibitors, and bile acid sequestrants. Statins are the most commonly prescribed treatment for lipid disorders. They lower "bad" LDL cholesterol and slightly raise "good" HDL cholesterol by blocking an enzyme in the liver that produces cholesterol. Triglycerides can be reduced, arterial plaques can be stabilized, and plaque size can be diminished. Common examples of statins include atorvastatin, rosuvastatin, pitavastatin, and simvastatin. Ezetimibe and other cholesterol absorption inhibitors reduce the amount of cholesterol absorbed from the diet. Bile acid resins prevent bile from absorbing cholesterol in the gut. Fibrates increase HDL (the "good") cholesterol and reduce triglyceride synthesis.

The increasing prevalence of lipid disorders among the US population escalates the need for antihyperlipidemic treatment, which drives the market growth. Lipoprotein disorders affect approximately half of the adult population in the United States.

Report Coverage

This research report categorizes the market for the US lipid disorder therapeutics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the US lipid disorder therapeutics market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the US lipid disorder therapeutics market.

United States Lipid Disorder Therapeutics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.69 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 10.56% |

| 2035 Value Projection: | USD 14.15 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Drugs, By Indications, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Sun PharSun Pharmaceutical Industries Ltd., Viatris, Novartis G, Pfizer Inc., AbbVie, Inc., Sanofi, Takeda Pharmaceutical Company Limited, GlaxoSmithKline plc and others key players.maceutical Industries Ltd., Viatris, Novartis G, Pfizer Inc., AbbVie, Inc., Sanofi, Takeda Pharmaceutical Company Limited, GlaxoSmithKline plc and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising cases of lipid disorders drive the market growth:

In the USA, the prevalence of lipid disorders is rising, including hypercholesterolemia and hyperlipidemia, due to sedentary lifestyles, high intakes of fats and oils, and genetic predisposition. The rising intake of fats and oils leads to the deposition of the fatty acids and cholesterol in the inner lining of the arteries and increases the level of the LDL and triglycerides, which increases the risk of hyperlipidemia, which leads to the proliferation of the antihyperlipidemic treatment and results in to expansion of the market.

Rising awareness of lipid disorders and advancements in the lipid disorder medications:

The market for lipid disorder therapeutics is expanding significantly as a result of new treatment options, such as newer statins and PCSK9 inhibitors, as well as the emergence of combination therapy. The general public's and healthcare professionals' growing awareness of lipid diseases is another factor propelling the market, as it encourages proactive healthcare practices and more screening and diagnostic efforts. Public health campaigns make it easier for people to seek medical counsel by addressing the stigma associated with lipid diseases. Increased patient adherence to treatment plans as a result of this greater understanding propels market expansion.

Restraining Factors

The side effects derived from the continuous use of the medications, the presence of alternative lipid disorder medications, the high cost of the branded drugs, the stringent FDA approval framework, complexity in the drug discovery and development may impede the growth of the market.

Market Segmentation

The USA lipid disorder therapeutics market share is classified into drugs, indications, and distribution channel.

- The atorvastatin segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US lipid disorder therapeutics market is segmented by drugs into fluvastatin, simvastatin, atorvastatin, pravastatin, rosuvastatin, and others. Among these, the atorvastatin segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment growth is attributed to the rising cases of hyperlipidemia, effective statin class of drug, which decreases the risk of cardiovascular disease, normalizes the cholesterol level, lowers the LDL cholesterol, and inhibits the formation of cholesterol.

- The familial combined hyperlipidemia segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The US lipid disorder therapeutics market is segmented by indications into familial hypertriglyceridemia, familial dysbetalipoproteinemia, familial combined hyperlipidemia, heterozygous familial hypercholesterolemia, familial defective apolipoprotein B-100, and others. Among these, the familial combined hyperlipidemia segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the genetic mutation, lack of physical activity, presence of coronary artery disease, and history of high cholesterol.

- The retail pharmacies segment held a significant share in 2024 and is predicted to grow at a substantial CAGR during the forecast period.

The US lipid disorder therapeutics market is segmented by distribution channel into hospital pharmacies, online pharmacies, and retail pharmacies. Among these, the retail pharmacies segment held a significant share in 2024 and is predicted to grow at a substantial CAGR during the forecast period. The segmental expansion is attributed to the patient convenience, easy accessibility, provision of counselling & dispensing medications, and provides affordable discounts on the purchase of the medications.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US lipid disorder therapeutics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sun Pharmaceutical Industries Ltd.

- Viatris

- Novartis G

- Pfizer Inc.

- AbbVie, Inc.

- Sanofi

- Takeda Pharmaceutical Company Limited

- GlaxoSmithKline plc

- Others

Recent Developments:

- In April 2025, Verve Therapeutics reported positive initial data from the Heart-2 Phase 1b clinical trial of VERVE-102, a genetic medicine for cardiovascular disease. The trial is evaluating patients with HeFH and CAD who require significant reductions in low-density lipoprotein cholesterol (LDL-C) levels. The single infusion of VERVE-102 resulted in a mean reduction of 53% and a maximum reduction of 69% in the 0.6 mg/kg dose cohort.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the US lipid disorder therapeutics market based on the below-mentioned segments:

US Lipid Disorder Therapeutics Market, By Drugs

- Fluvastatin

- Simvastatin

- Atorvastatin

- Pravastatin

- Rosuvastatin

- Others

US Lipid Disorder Therapeutics Market, By Indications

- Familial Hypertriglyceridemia

- Familial Dysbetalipoproteinemia

- Familial Combined Hyperlipidemia

- Heterozygous Familial Hypercholesterolemia

- Familial Defective Apolipoprotein B-100

- Others

US Lipid Disorder Therapeutics, By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

Need help to buy this report?