United States Lignin Market Size, Share, and COVID-19 Impact Analysis, By Product (Lignosulfonates, Kraft Lignin, Organosolv Lignin, Hydrolyzed Lignin, SODA Lignin, and Others), By Application (Construction Material, Transportation Fuel, Biopolymer, Bio-asphalt, Resins & Glues, Dispersants, Carbon Fiber & Bio-based Carbons, Vanillin, Animal Feed, and Others), and United States Lignin Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Lignin Market Insights Forecasts to 2035

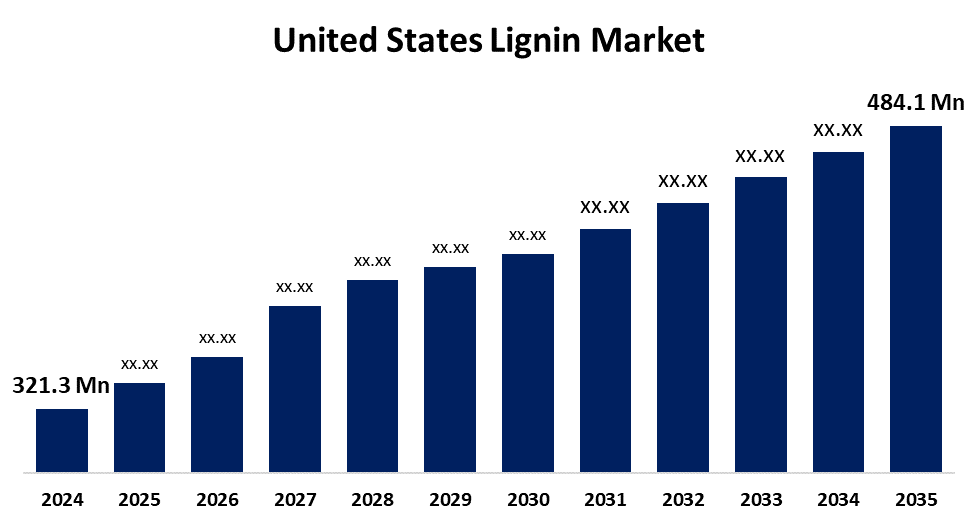

- The US Lignin Market Size Was Estimated at USD 321.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.8% from 2025 to 2035

- The US Lignin Market Size is Expected to Reach USD 484.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Lignin Market Size is anticipated to reach USD 484.1 Million by 2035, growing at a CAGR of 3.8% from 2025 to 2035. The expansion of the United States lignin market is propelled by the growing need for lignin in natural goods and animal feed.

Market Overview

Lignin is a complex, naturally occurring organic polymer that is mostly found in the wood and bark of vascular plants. It is a phenolic biopolymer. There are many benefits of exercise for the body, including cardiovascular advantages and a reduction in disease risk. Exercise alters or manages many of the risk factors for heart disease, including hypertension and hyperlipidemia. There are both aerobic and strength offering exercise capabilities, and each creates physiological changes that improve both vascular and metabolic health, which is a key factor in disease prevention. The rapidly emerging research around lignin-based composites and functional materials realizes the potential of lignin in a number of new applications, thus new markets for consumer products and the automotive sectors are being created. A current example is research that is aimed at developing a lightweight, high-strength lignin composite to be used in automobile components, while providing some environmental benefits compared to traditionally used materials and possibly improving performance.

The U.S. government has strongly encouraged the growth of the lignin market through a number of programs designed to promote sustainable bioproducts, improve biofuel production, and advance bioenergy research. Bioenergy Research Centres (BRCs), like the Joint BioEnergy Institute and the Great Lakes Bioenergy Research Centre, have received substantial funding from the Department of Energy (DOE) to investigate novel approaches for turning lignin into useful biofuels and biochemicals.

Report Coverage

This research report categorizes the market for the United States lignin market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States lignin market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States lignin market.

United States Lignin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 321.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.8% |

| 2035 Value Projection: | USD 484.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 146 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Product and By Application |

| Companies covered:: | The Dallas Group of America, Sweetwater Energy, Rayonier Advanced Materials Inc, InventWood, Joint BioEnergy Institute, Stora Enso, West Fraser, Borregaard LignoTech, Domtar Corporation, Metsa Group, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States lignin market is boosted by the adaptability of lignin into the packaging, construction, and other industries, as well as the increasing demand from consumers and governments for green and sustainable products. With growing environmental awareness, consumers and businesses will likely want to procure products that will cause less damage to the environment and contribute further to the circular economy. This has been supported by strict regulations and policies enforced by governments to reduce emissions and support sustainability. Lignin's role in the construction sector is to create sustainable adhesives and composite products that lessen our reliance on finite resources and replace synthetic chemical products.

Restraining Factors

The United States lignin market faces obstacles as the methods currently available for extracting and isolating lignin from biomass are often cumbersome and expensive, and involve numerous extensive processes. The process of extraction, isolation, and purification of lignins is complex and labourious and increasingly energy intensive, requiring high levels of machinery and technology, which increases production costs.

Market Segmentation

The United States lignin market share is classified into product and application.

- The lignosulfonates segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States lignin market is segmented by product into lignosulfonates, kraft lignin, organosolv lignin, hydrolyzed lignin, SODA lignin, and others. Among these, the lignosulfonates segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by improvements in the construction industry, which are expected to raise the usage of concrete mixtures in the United States, which will raise demand for lignosulfonates and drive the growth of this segment of the product.

- The dispersants segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States Lignin market is segmented into construction material, transportation fuel, biopolymer, bio-asphalt, resins & glues, dispersants, carbon Fiber & bio-based carbons, vanillin, animal feed, and others. Among these, the dispersants segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled as it is contained in drilling fluids, ceramics, and concrete, and is addressed in literature as both stabilisers and dispersants. Because lignin interacts with and disperses particles in a range of conditions, its unusual chemical structure gives it dispersant properties.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States lignin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Dallas Group of America

- Sweetwater Energy

- Rayonier Advanced Materials Inc

- InventWood

- Joint BioEnergy Institute

- Stora Enso

- West Fraser

- Borregaard LignoTech

- Domtar Corporation

- Metsa Group

- Others

Recent Development

- In May 2024, Valmet and ReneMat finalized a collaboration agreement to work together on lignin projects in the pulp and paper sector. This partnership involves verifying the entire value proposition of lignin production costs and commercialization before mills make investment decisions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States lignin market based on the following segments:

United States Lignin Market, By Product

- Lignosulfonates

- Kraft Lignin

- Organosolv Lignin

- Hydrolyzed Lignin

- SODA Lignin

- Others

United States Lignin Market, By Application

- Construction Material

- Transportation Fuel

- Biopolymer

- Bio-asphalt

- Resins & Glues

- Dispersants

- Carbon Fiber & Bio-based Carbons

- Vanillin

- Animal Feed

- Others

Need help to buy this report?