United States Lighting Market Size, Share, and COVID-19 Impact Analysis, By Type (CFL, Fluorescent Lighting, Halogen, HID, Incandescent, and LED Lighting), By Application (Indoor Lighting, Outdoor Lighting, and Smart Lighting), and United States Lighting Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsUnited States Lighting Market Insights Forecasts to 2035

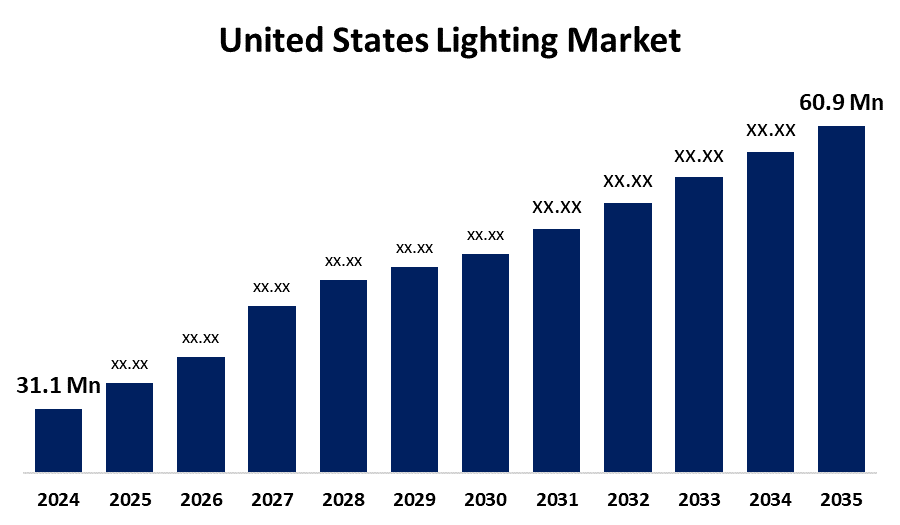

- The US Lighting Market Size Was Estimated at USD 31.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.30% from 2025 to 2035

- The US Lighting Market Size is Expected to Reach USD 60.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United States Lighting Market Size is anticipated to reach USD 60.9 Million by 2035, growing at a CAGR of 6.30% from 2025 to 2035. The expansion of the United States lighting market is propelled by smart lighting technology, urbanisation, and the rising need for energy-efficient solutions.

Market Overview

Lighting is the deliberate use of light to create functional and ornamental effects. Traditional lighting alternatives like incandescent and halogen bulbs are being replaced by LED lighting, which currently dominates the market, mainly due to its higher efficiency, longer lifespan, and lower cost. Governments are steering organizations in commercial, industrial, and residential areas to incorporate more LED and smart lighting. Whole governments are implementing policies that promote sustainable practices and energy efficiency. Many concurrent trends are impacting the industry’s future, including growth in infrastructure, smart city policies, and IoT-ready lighting solutions. Smart lighting solutions enable the use of IoT, AI, and automation to disrupt and transform the lighting industry through features such as remote control, adaptive lighting, and energy optimization. These systems offer enhanced efficiency and convenience for the user, which includes changing schedules, color temperature, and brightness using voice assistants and smartphone apps. Automation driven by AI can optimise energy utilisation by taking daylighting and occupancy into consideration in comparison to the system's lighting. In addition, the active demand for up-to-date lighting technology is increasing with the growth of new residential and commercial buildings, especially in urban areas.

The U.S. Department of Energy (DOE) sets energy efficiency standards for a range of lighting goods, including LED-based products, to phase out less efficient solutions and promote the use of newer, more efficient technologies.

Report Coverage

This research report categorizes the market for the United States lighting market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States lighting market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States lighting market.

United States Lighting Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 31.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.30% |

| 2035 Value Projection: | USD 60.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 289 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Type and By Application |

| Companies covered:: | GE Lighting, Cree, Inc., LEDtronics, Inc., Acuity Brands, Inc., Hubbell Incorporated, Eaton Corporation plc, Ideal Industries Inc., Leviton Manufacturing, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States lighting market is boosted by the growing need for smart lighting solutions that improve people's comfort and convenience. Additionally, because lighting systems incorporate artificial intelligence (AI) and the Internet of Things (IoT), users can change the lights to fit their needs. The market is growing because of the growing need for lighting products that are easy to connect to mobile devices. Furthermore, the market is expanding due to rising personal incomes and shifting living standards.

Restraining Factors

The United States lighting market faces obstacles as producers and investors deal with issues including high capital expenses, significant R&D expenditures, inefficient raw material supply, ineffective logistics, and a shortage of cutting-edge manufacturing equipment.

Market Segmentation

The United States Lighting Market share is classified into type and application.

- The LED lighting segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States lighting market is segmented by type into CFL, fluorescent lighting, halogen, HID, incandescent, and LED lighting. Among these, the LED lighting segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the expanding use of smart cities, smart offices, and smart households. IoT-enabled LED lighting has the potential to improve user experience in terms of energy optimization, automation, and remote control. In addition, LED lighting also makes communicating with voice assistants and smartphone apps easier for the end User.

- The indoor lighting segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States lighting market is segmented into indoor lighting, outdoor lighting, and smart lighting. Among these, the indoor lighting segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The need for high-quality, energy-efficient indoor lighting is being driven by rising urbanisation in the US. Due to the growing emphasis on sustainability and smart technology, as well as the need for improved illumination in new buildings, innovative indoor lighting solutions are becoming more and more popula.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States lighting market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GE Lighting

- Cree, Inc.

- LEDtronics, Inc.

- Acuity Brands, Inc.

- Hubbell Incorporated

- Eaton Corporation plc

- Ideal Industries Inc.

- Leviton Manufacturing

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States lighting market based on the following segments:

United States Lighting Market, By Type

- CFL

- Fluorescent Lighting

- Halogen

- HID

- Incandescent

- LED Lighting

United States Lighting Market, By Application

- Indoor Lighting

- Outdoor Lighting

- Smart Lighting

Need help to buy this report?