United States Led Lighting Market Size, Share, and COVID-19 Impact Analysis, By Indoor Lighting (Agricultural Lighting, Commercial, Industrial and Warehouse, Residential), By Outdoor Lighting (Public Places, Streets and Roadways, Others, Alkyd Resin, Personal Care and Cosmetics, and Others), and United States Led Lighting Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsUnited States LED Lighting Market Insights Forecasts to 2035

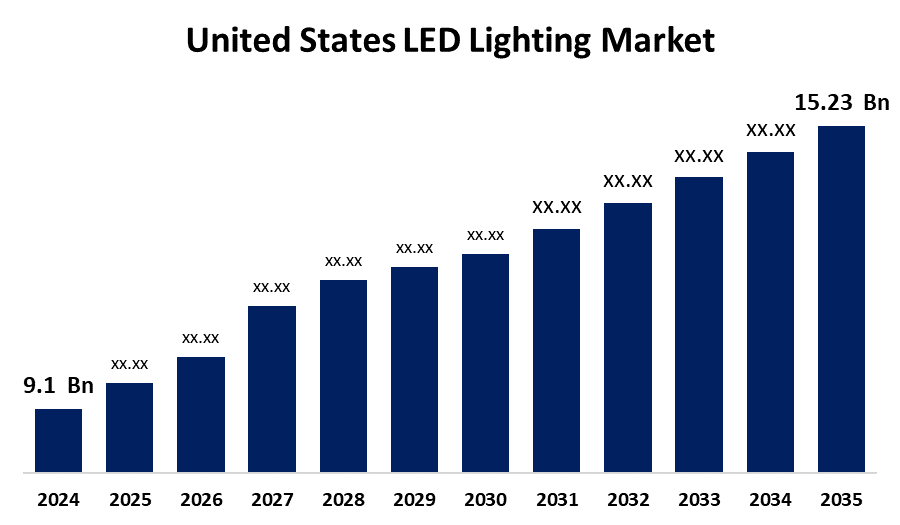

- The U.S. LED Lighting Market Size was estimated at USD 9.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.79% from 2025 to 2035

- The USA Led Lighting Market Size is Expected to Reach USD 15.23 Billion by 2035

Get more details on this report -

The US Led Lighting Market Size is anticipated to reach USD 15.23 Billion by 2035, Growing at a CAGR of 4.79% from 2025 to 2035. The U.S. LED lighting market is experiencing steady growth, driven by increasing demand for energy-efficient solutions and supportive government initiatives.

Market Overview

The United States LED lighting market involves the manufacturing, distribution, and use of light-emitting diode (LED) technology in residential, commercial, industrial, and external environments. LED lighting employs semiconductor diodes to produce light, which proves to be energy-efficient, with a longer lifetime and reduced maintenance compared to conventional lighting technologies. Moreover, market growth is driven by rising demand for energy-efficient lighting, government programs for sustainability, and smart lighting technology advancements. Usage varies from overall illumination and accent lighting to use with smart home systems and outdoor lighting systems such as streetlights and traffic signals. As technology advances, the U.S. LED lighting market continues to grow, leading to energy conservation and environmental sustainability initiatives. For Instance, in April 2023, Hydrel, a well-known innovator and manufacturer of landscape and architectural lighting systems for outdoor spaces, announced that the M9700 RGBW fixture has joined its family of M9000 ingrade luminaires.

Report Coverage

This research report categorizes the market for the U.S. led lighting market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States led lighting market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA LED Lighting market.

United States LED Lighting Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.1 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.79% |

| 2035 Value Projection: | USD 15.23 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 125 |

| Segments covered: | By Indoor Lighting, By Outdoor Lighting and COVID-19 Impact Analysis |

| Companies covered:: | Merck KGaA, Polynt SpA, Thirumalai Chemicals Ltd, Anmol Chemicals, NIPPON SHOKUBAI CO. LTD, Actylis, Changmao Biochemical Engineering Company Limited, Fuso Chemical Co. Ltd, and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Key drivers in the U.S. LED lighting market are the growing trend of adaptive lighting in healthcare and educational settings to improve well-being and productivity, integration of Li-Fi (Light Fidelity) for wireless high-speed communication, and growing demand for human-centric, customizable lighting solutions. Moreover, urban renewal projects involving smart infrastructure are promoting widespread adoption of LEDs in public and private sector lighting projects, enabling long-term energy and cost savings.

Restraining Factors

High initial investment costs, compatibility issues with older infrastructure, and limited awareness in rural areas restrain the U.S. LED lighting market, slowing adoption despite long-term energy and maintenance savings.

Market Segmentation

The United States LED lighting market share is classified into indoor lighting and outdoor lighting.

- The commercial segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States led lighting market is segmented by indoor lighting into agricultural lighting, commercial, industrial and warehouse, and residential. Among these, the commercial segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is driven by extensive adoption across offices, retail spaces, educational institutions, and healthcare facilities. Factors such as increasing commercial construction activities, renovations of existing buildings, and stringent energy efficiency regulations contribute to this significant market position.

- The public places segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States led lighting market is segmented by outdoor lighting into public places, streets and roadways, and others. Among these, the public places segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to extensive lighting needs in areas like airports, malls, and stadiums. Ongoing infrastructure developments, safety requirements, and the push for energy-efficient public environments further drive demand, making this segment dominant in both investment and implementation.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the US led lighting market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Merck KGaA

- Polynt SpA

- Thirumalai Chemicals Ltd

- Anmol Chemicals

- NIPPON SHOKUBAI CO. LTD

- Actylis

- Changmao Biochemical Engineering Company Limited

- Fuso Chemical Co. Ltd

- Others

Recent Developments:

- In May 2023, Dialight, a hazardous and industrial LED lighting technology company, has launched the ProSite High Mast, an addition to the company's highly popular ProSite Floodlight family. The new model is specifically designed to endure mount heights of up to 130 feet for a variety of outdoor industrial uses including airports, container terminals, rail yards, product inventory piles, transportation, perimeter security lighting, and parking installations. Having a total lumen output of up to 65,000, the ProSite High Mast enhances site security by delivering uniform, crisp, and clear lighting.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA led lighting market based on the below-mentioned segments:

United States LED Lighting Market, By Indoor Lighting

- Agricultural Lighting

- Commercial

- Industrial and Warehouse

- Residential

United States LED Lighting Market, By Outdoor Lighting

- Public Places

- Streets and Roadways

- Others

Need help to buy this report?