United States Lecithin Market Size, Share, and COVID-19 Impact Analysis, By Source (Soy, Sunflower, Rapeseed, and Others), By End Use (Convenience Foods, Animal Feed, Industrial, Bakery, Confectionary, Pharmaceuticals & Personal Care, and Personal Care & Cosmetics), and United States Lecithin Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited States Lecithin Market Size Insights Forecasts to 2035

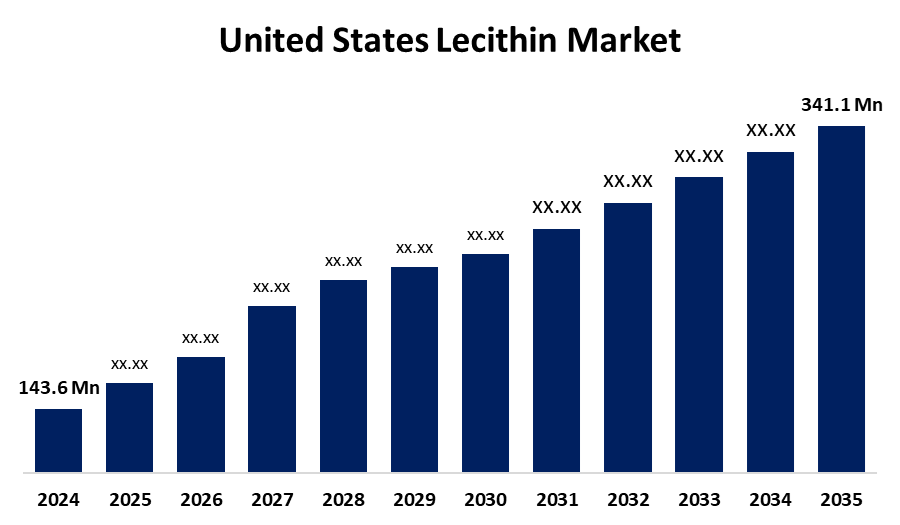

- The US Lecithin Market Size Was Estimated at USD 143.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.18% from 2025 to 2035

- The US Lecithin Market Size is Expected to Reach USD 341.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Lecithin Market Size is anticipated to reach USD 341.1 million by 2035, growing at a CAGR of 8.18% from 2025 to 2035. The expansion of the United States lecithin market is propelled by the growing desire for clean-label and natural ingredients in food and drink items.

Market Overview

Lecithin is a type of waxy, amphiphilic phospholipid that occurs naturally in plant and animal tissues, such as soybeans, egg yolks, and sunflower seeds. A few examples of these phospholipids are phosphatidylcholine and phosphatidylethanolamine. Lecithin is an all-natural emulsifier derived mainly from soybeans, sunflower, and egg yolks. As consumers become more health-conscious and knowledgeable about the ingredients in their foods, demand for lecithin has increased. Because of this, manufacturers are increasingly sourcing phospholipids as healthy substitutes for artificial preservatives, and thus following the larger trend in food production toward transparency and sustainability. Thus, technological advancements in lecithin extraction and processing have made it possible for the lecithin market to expand. Amongst a plethora of other developments, solventless and enzymatic extraction have immensely improved quality and yield with diminished negative effects on the environment. There are numerous organizations, across every sector, pointing to the importance of sustainability and environmentally friendly industrial practices, not only increasing lecithin manufacturers' ability to sell more product efficiently but also improving costs, thus potentially lowering consumer prices. Given its adaptability, the lecithin market will grow and continue satisfying the expanding demands of a variety of end users in the future.

Report Coverage

This research report categorizes the market for the United States lecithin market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States lecithin market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States lecithin market.

United States Lecithin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 143.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.18% |

| 2035 Value Projection: | USD 341.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 127 |

| Segments covered: | By Source, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | American Lecithin Company, NOW Foods, Cargill, DuPont de Nemours Inc, Archer-Daniels Midland Co, ADM, Lipoid GmbH, Bunge Limited, Stern-Wywiol Gruppe GmbH & Co. KG, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States lecithin market is boosted by consumer demand for natural and functional ingredients in food items, which has increased as a result of the increased emphasis on health and wellness. Preferred as a natural emulsifier and a source of vital nutrients, lecithin suits the tastes of health-conscious individuals. Its incorporation into more healthful food options has emerged as a key market driver. The food and beverage sector has widely used lecithin due to its emulsifying qualities. The pharmaceutical industry also benefits from lecithin's versatility, as it may be used as an excipient in a variety of formulations, particularly in drug delivery systems. Since lecithin helps to improve medication efficacy and patient adherence, the ongoing development of medications and drug delivery technology offers significant prospects.

Restraining Factors

The United States lecithin market faces obstacles like the fluctuations in the cost of raw materials, particularly eggs, soybeans, and sunflower seeds. These main sources are subject to a variety of influences, primarily supply chain interruptions, trade restrictions, weather, and geopolitical issues.

Market Segmentation

The United States lecithin market share is classified into source and end use.

- The soy segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States lecithin market is segmented by source into soy, sunflower, rapeseed, and others. Among these, the soy segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because substantial amounts of land are devoted to soybean production and agriculture, which, together with the expansion of the food industry, such as soybean consumption in food products like bread, margarine, infant formulae, ice creams, dairy products, supplements, and many convenience products.

- The animal feed segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the end use, the United States lecithin market is segmented into convenience foods, animal feed, industrial, bakery, confectionary, pharmaceuticals & personal care, and personal care & cosmetics. Among these, the animal feed segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by lecithin, which is an emulsifying agent that improves the digestibility of lipids and minerals in animal feed. It also has health benefits to animals by improving absorption. It also improves feed efficiency and is therefore a good ingredient of Mediterranean-type supplementation of animal nutrition.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States lecithin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- American Lecithin Company

- NOW Foods

- Cargill

- DuPont de Nemours Inc

- Archer-Daniels Midland Co

- ADM

- Lipoid GmbH

- Bunge Limited

- Stern-Wywiol Gruppe GmbH & Co. KG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States lecithin market based on the following segments:

United States Lecithin Market, By Source

- Soy

- Sunflower

- Rapeseed

- Others

United States Lecithin Market, By End Use

- Convenience Foods

- Animal Feed

- Industrial

- Bakery

- Confectionary

- Pharmaceuticals & Personal Care

- Personal Care & Cosmetics

Need help to buy this report?