United States Lawn Mowers Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Manual, Electric, Petrol, Robotics, and Others) and By End User (Residential and Commercial/Government), and United States Lawn Mowers Market Insights, Industry Trend, Forecasts to 2035.

Industry: AgricultureUnited States Lawn Mowers Market Insights Forecasts to 2035

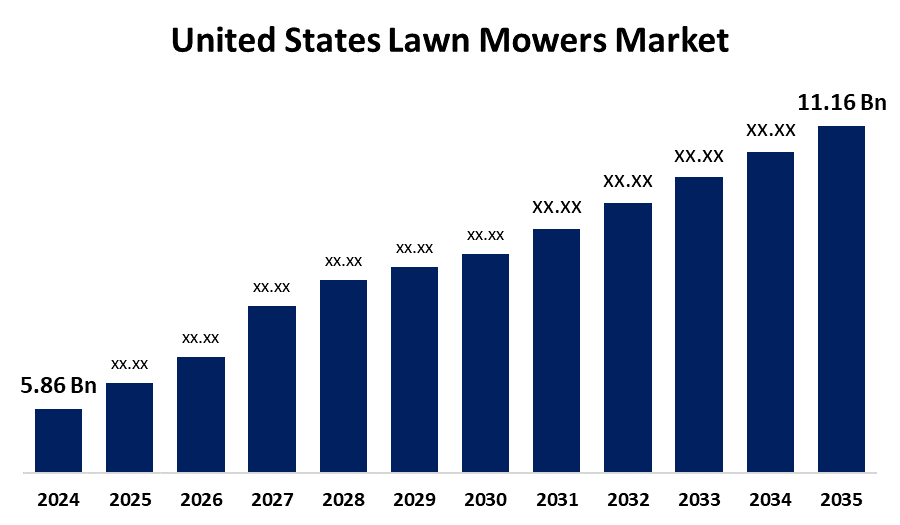

- The U.S. Lawn Mowers Market Size was estimated at USD 5.86 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.03% from 2025 to 2035a

- The USA Lawn Mowers Market Size is Expected to Reach USD 11.16 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The US Lawn Mowers Market Size is Anticipated to reach USD 11.16 Billion By 2035, Growing at a CAGR of 6.03% from 2025 to 2035. The U.S. lawn mowers market is thriving due to rising residential landscaping trends, smart mower innovations, and eco-friendly technologies, catering to both homeowners and commercial users seeking efficient lawn care solutions.

Market Overview

United States lawn mowers market includes manufacturing, distribution, and sales of equipment intended to cut grass within residential, commercial, and public areas. Such a market contains numerous types of mowers that are walk-behind, ride-on, or robotic and which operate through gas, electricity, or human labor. Moreover, factors driving growth in the U.S. lawn mowers market include rising lawn care subscription services, expanding adoption of battery-powered mowers for noise-sensitive zones, and expanding smart home integration. Furthermore, growing demand for DIY landscaping among millennials is driving persistent demand for easy-to-use, environmentally friendly mowing equipment. Furthermore, lading players are driving US lawn mower market growth with innovations such as autonomous robotic mowers, app-enabled systems, AI-driven terrain mapping, and quieter, more environment-friendly battery-powered variants. Such developments increase user convenience, lower emissions, and connect with technology-forward consumers, fueling adoption in both residential and commercial landscape segments.

Report Coverage

This research report categorizes the market for the U.S. lawn mowers market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States lawn mowers market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the USA lawn mowers market.

United States Lawn Mowers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.86 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.03% |

| 2035 Value Projection: | USD 11.16 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Deere & Company, The Toro Company, Husqvarna Group, Ariensco, American Honda Motor Co., Inc., Kubota Corporation, Makita Corporation, Stanley Black & Decker, Stihl Group, Yamabiko Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The drivers in the U.S. market for lawn mowers include mounting real estate activity with landscaped yard space, government spending in urban green coverages, growing consumer demand for outdoor beauty and residential improvement, and periodic seasonal maintenance of the lawn, primarily in suburban districts. Additionally, growing online shopper channels with diverse product offerings at accessible financing points fuel market penetration among various classes of consumers as well as regional locations.

Restraining Factors

High initial costs of advanced models, growing concerns over noise and emissions from gas-powered mowers, and limited battery life in electric variants are key factors restraining the U.S. lawn mowers market.

Market Segmentation

The United States lawn mowers market share is classified into product type and end user.

- The electric segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States lawn mowers market is segmented by product type into manual, electric, petrol, robotics, and others. Among these, the electric segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to rising environmental awareness, noise restrictions in urban areas, and advancements in battery technology. Their low maintenance, cost efficiency, and suitability for residential use make them increasingly popular, especially as consumers shift toward sustainable and convenient lawn care solutions.

- The residential segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States lawn mowers market is segmented by end user into residential and commercial/government. Among these, the residential segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This dominance is driven by homeowners' increasing interest in DIY lawn care, the growing popularity of smart and automated mowing solutions, and a strong cultural emphasis on maintaining attractive outdoor spaces.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the US lawn mowers market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Deere & Company

- The Toro Company

- Husqvarna Group

- Ariensco

- American Honda Motor Co., Inc.

- Kubota Corporation

- Makita Corporation

- Stanley Black & Decker

- Stihl Group

- Yamabiko Corporation

- Others

Recent Developments:

- In September 2023, John Deere disclosed a new strategic alliance with EGO and parent company Chervon, a top worldwide supplier to the Outdoor Power Equipment (OPE) and Power Tool markets. The partnership enables the brands to offer

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the USA lawn mowers market based on the below-mentioned segments

United States Lawn Mowers Market, By Product Type

- Manual

- Electric

- Petrol

- Robotics

- Others

United States Lawn Mowers Market, By End User

- Residential

- Commercial/Government

Need help to buy this report?