United States Lanolin Market Size, Share, and COVID-19 Impact Analysis, By Derivative (Lanolin Alcohol, Cholesterin, Isopropyl Lanolate, Laneth, Lanogene, Lanosterols, Quaternium 33, PEG-75, Lanolin Fatty Acid, and Other), By Application (Personal Care & Cosmetics, Baby Care Products, Pharmaceuticals, Industrial, and Other), and United States Lanolin Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited States Lanolin Market Insights Forecasts to 2035

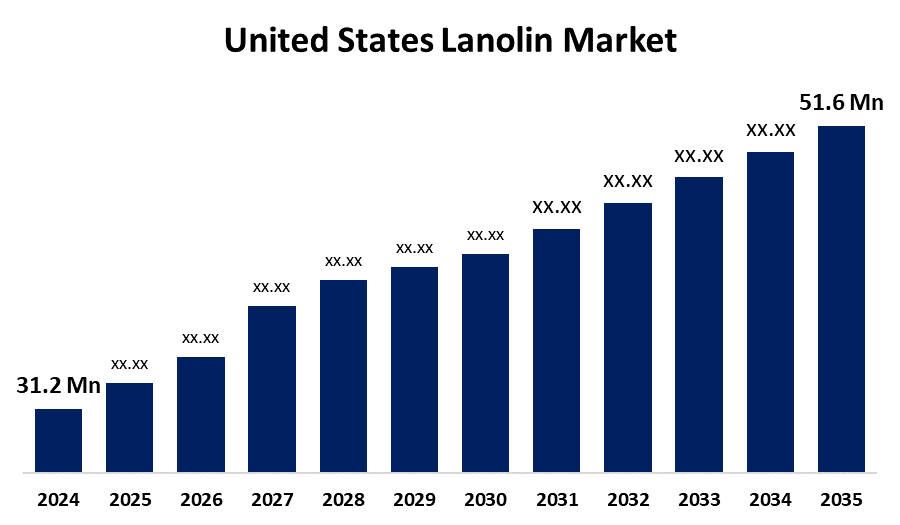

- The US Lanolin Market Size Was Estimated at USD 31.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.68% from 2025 to 2035

- The US Lanolin Market Size is Expected to Reach USD 51.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United States Lanolin Market Size is anticipated to reach USD 51.6 Million by 2035, growing at a CAGR of 4.68% from 2025 to 2035. The expansion of the United States lanolin market is propelled by the growing consumer preference for sustainable and natural components in personal care and cosmetic goods.

Market Overview

The lanolin is a naturally occurring wax-like substance secreted by sheep's sebaceous glands to keep their coats dry, is often referred to as wool wax, wool grease, or wool fat. Innovations in production and processing technology are improving the quality and efficiency of production and are opening new avenues for market development. The market is well-positioned for growth due to the increase in natural and organic product demand, advances in technology, and growing industrial applications of lanolin. Another important driver for the lanolin market is the increasing application of lanolin in the pharmaceutical industry and its wound healing properties. Lanolin is used to create therapeutic lotions and ointments because it is an emollient and assists in tissue healing. There is continued development in the use of lanolin for pharmaceuticals for wound care and dermatological applications, which is assisting in the development of market opportunities. As the interest in natural and effective healing agents increases, lanolin, pharmaceutical formulations, and its performance as an ingredient is being put into the spotlight.

In the US, lanolin is still considered a safe ingredient based on FDA oversight and cosmetic safety evaluations. The most recent re-evaluation of lanolin and its derivatives was conducted in April 2024 by the Cosmetic Ingredient Review, which acknowledged their status as weak possible sensitisers while also affirming their safety as a common ingredient in cosmetics, particularly when ultra-refined.

Report Coverage

This research report categorizes the market for the United States lanolin market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States lanolin market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States lanolin market.

United States Lanolin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 31.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.68% |

| 2035 Value Projection: | USD 51.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 216 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Derivative and By Application |

| Companies covered:: | Esperis, The Lubrizol Corp, Spectrum Chemical Mfg. Corp., Tannin Corp, Croda International, Whittemore Wright Co., McKinley Resources, Liberty Natural Products, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States lanolin market is boosted by its high usage in different end-user segments, including personal care and cosmetics, baby care products, and pharmaceuticals. In the last few years, lanolin application prospects have risen beyond pharmaceuticals and cosmetics because of its essential use in some industrial processes. Some cosmetics and personal care manufacturers are increasingly using Lanolin oils and waxes to improve the product value and sensations. Lanolin's unique properties, including superior biocompatibility, are gradually increasing because it is similar to the oils produced by human skin, which indicates high demand in a variety of industries. Further, the high incidence of bio-based lubricants from end-user segments is also essential to driving the market.

Restraining Factors

The United States lanolin market faces obstacles like the supply of raw materials because the quality of lanolin can be influenced by sheep husbandry methods, among other variables. There are also challenges with legal compliance, assurance of product quality, and environmental considerations during the extraction process.

Market Segmentation

The United States lanolin market share is classified into the derivative and application.

- The lanolin alcohol segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States lanolin market is segmented by derivative into lanolin alcohol, cholesterin, Isopropyl lanolate, laneth, lanogene, lanosterols, uaternium 33, PEG-75, lanolin fatty acid, and others. Among these, the lanolin alcohol segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven because cosmetic companies use it frequently. Lanolin alcohol is a fatty alcohol derived from the hydrogenation of lanolin. It is a common ingredient in cosmetic creations because of its excellent emollient and moisturizing properties. It is used in skincare for use in lotions, creams, ointments, and lip balms.

- The personal care & cosmetics segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States lanolin market is segmented into personal care & cosmetics, baby care products, pharmaceuticals, industrial, and other. Among these, the personal care & cosmetics segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by the consumer demand for lanolin in personal care and cosmetics. Factors driving demand include increased consumer interest in natural & organic skincare and cosmetic products, increased e-commerce and digital opportunities, and a heightened awareness of the damage of synthetic cosmetics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States lanolin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Esperis

- The Lubrizol Corp

- Spectrum Chemical Mfg. Corp.

- Tannin Corp

- Croda International

- Whittemore Wright Co.

- McKinley Resources

- Liberty Natural Products, Inc.

- Others

Recent Development

- In May 2024, Lansinoh Laboratories, a manufacturer of lanolin nipple cream, announced its decision to pursue acquisition opportunities in the maternal care sector. The company has partnered with Wellvest Capital, a specialist in the health and wellness segment, to identify potential targets for acquisition.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States lanolin market based on the following segments:

United States Lanolin Market, By Derivative

- Lanolin Alcohol

- Cholesterin

- Isopropyl Lanolate

- Laneth, Lanogene

- Lanosterols

- Quaternium 33

- PEG-75

- Lanolin Fatty Acid

- Other

United States Lanolin Market, By Application

- Personal Care & Cosmetics

- Baby Care Products

- Pharmaceuticals

- Industrial

- Other

Need help to buy this report?